Bitcoin (BTC) is in the process of breaking out from an important resistance area, a movement that is supported by both the weekly and daily RSI.

Bitcoin has been decreasing since reaching an all-time high price of $69,000 in November 2021. The downward move has so far led to a long-term low of $17,592 in June 2022. The price has been overall increasing since then.

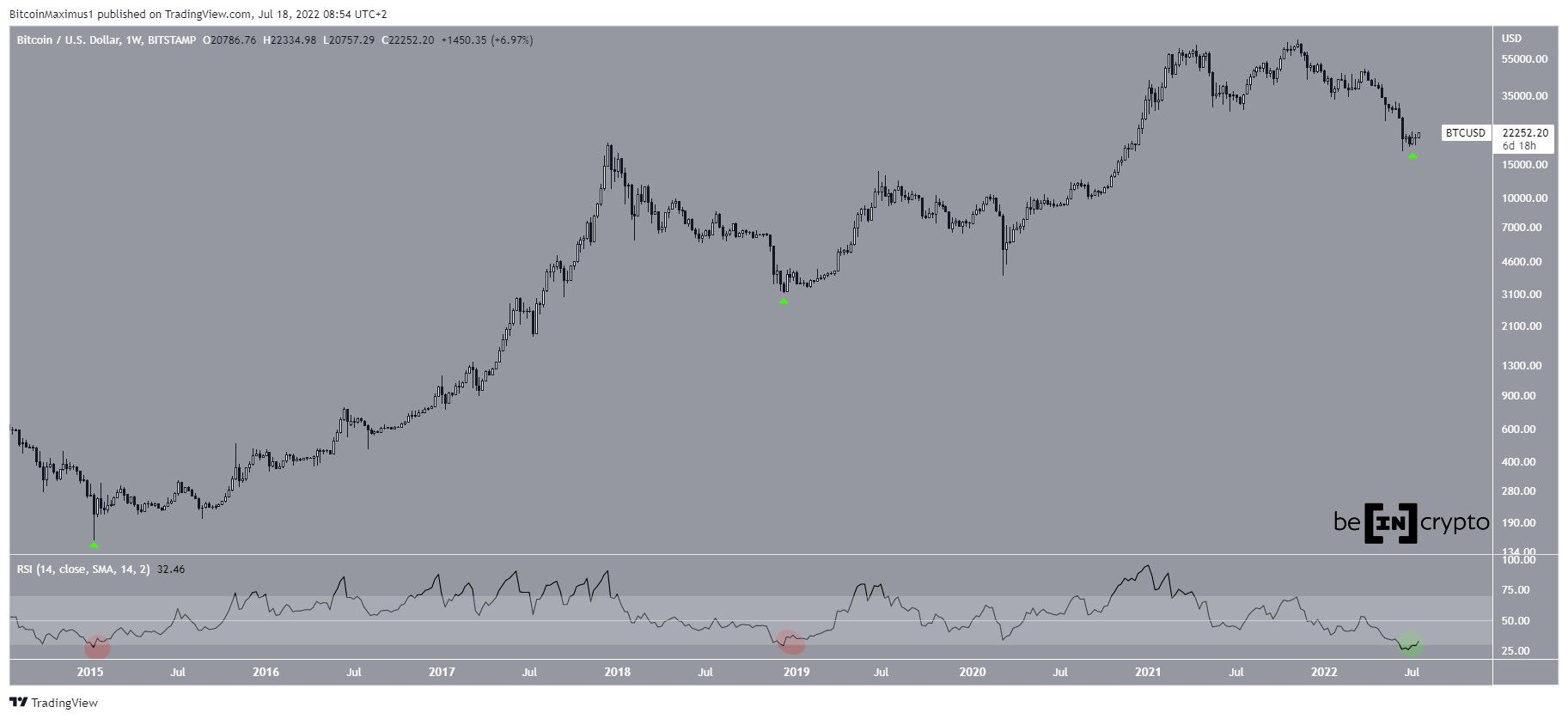

At the time of the low, the weekly RSI fell to the oversold territory (green circle). This was only the third time (green icons) this has occurred throughout the entire price history of BTC. Due to last week’s increase, the RSI has now moved outside of its oversold territory.

Historically, similar RSI movements have been a sign that the price bottom was in.

Current resistance

The daily chart shows that BTC had been trading under a descending resistance line since the beginning of April. This line caused a rejection on June 5, leading to the aforementioned low.

Currently, the price is in the process of breaking out above the resistance line, which currently also coincides with the $21,700 horizontal resistance area. If it’s successful in doing so, the next closest resistance would be found at $29,370, created by the 0.382 Fib retracement resistance level.

The daily RSI has already broken out from its resistance line, suggesting that the price could soon do the same. Additionally, it’s currently in the process of moving above 50.

BTC wave count analysis

The most likely wave count suggests that the price has already completed a five-wave downward move (yellow) when measuring from the beginning of April. Due to the extreme length of wave four, it seems that the fifth and final wave was truncated, hence its failure to move below the bottom of the third wave.

As for the longer-term wave count, it seems likely that the price has completed an A-B-C corrective structure (red) when measuring from the all-time high. This fits with the weekly RSI readings which indicate that a bottom has been reached.

For Be[in]Crypto’s previous bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.