After nine successive bearish weekly closes, bitcoin (BTC) finally had a bullish weekly close from May 30 to June 5.

BTC has been falling since reaching an all-time high price of $69,000 on Nov 8. The downward movement has been contained underneath a descending resistance line (dashed).

More recently, the line rejected the price in March (red icon), leading to nine successive bearish weekly candlestick closes and a low of $26,700. During the week of May 30 to June 5, BTC created the first bullish weekly candlestick since March.

There are three interesting developments based on the price action and technical indicator readings.

- BTC has bounced at the 0.618 Fib retracement support level at $28,700. The level is found when measuring the entire upward movement since March 2020.

- BTC is facing resistance at $31,500. This is a horizontal area that had previously acted as support throughout May to July 2021.

- The RSI reached a low of 33 in May 2022, the lowest value since March 2020.

Two out of three of these developments are bullish.

If the price moves upward and reclaims the $31,500 area, there would be strong resistance near $35,000 (red circle). The resistance is created from the aforementioned descending resistance line and an ascending parallel channel from where the price previously broke down.

Bullish daily RSI

The daily chart suggests that the ongoing bounce is expected to continue, meaning that BTC can reach the aforementioned confluence of resistance levels near $35,000.

The reason for this is the RSI reading in the daily time frame.

Firstly, the RSI has broken out from a descending resistance line that had previously been in place since April (dashed). Such an RSI breakout often precedes a price breakout.

Secondly, the RSI has generated a bullish divergence (green line), whose trendline is still intact.

Finally, the RSI is very close to moving above 50.

If the price breaks out from the current descending resistance line (solid), it would be expected to increase towards the $35,000 level.

Short-term BTC movement

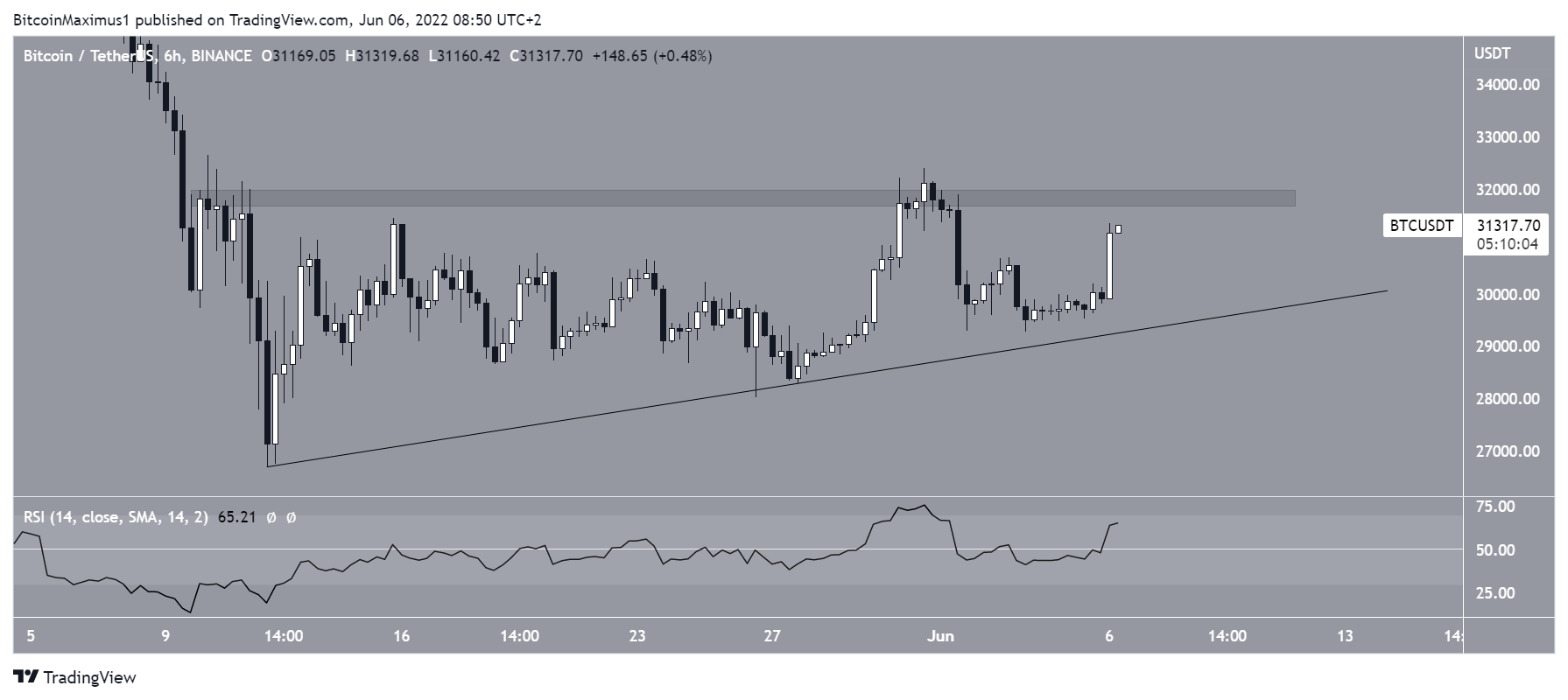

Finally, the shorter-term six-hour chart shows that the price could be following an ascending support line and potentially trading inside an ascending triangle.

Since the ascending triangle is considered a bullish pattern, it supports the possibility of a breakout from the channel.

For Be[in]Crypto’s previous bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.