If you want to donate crypto and support some of the causes you believe in, then you can safely use The Giving Block, the most popular platform that aims to connect nonprofit organizations to their crypto donors.

Using The Giving Block is easy, and anyone can donate in just a few minutes and even receive a tax receipt to deduct it from their taxes.

In this guide:

Donate crypto to save taxes

Giving back to society used to be a task reserved for the rich and more mature segment of the population. But there is a new, generous segment of the population that wants to contribute and enhance their social connections. As cryptocurrency prices rise, so does the financial power of the youth owning it. This phenomenon has created a new layer of individuals that have disposable income to help the less fortunate. Many large worldwide charitable organizations — such as the Red Cross and United Way — accept cryptocurrency.

But giving back is not only a way to elevate your confidence and get to know the local community, but it’s also a way to foster your financial assets. Philanthropy is now expanding to include crypto. What’s more, by choosing to donate crypto directly, without transforming it to fiat first, it will help you save on capital gain taxes and claim the full donation as a charitable deduction.

Depending on the country you live in and the local cryptocurrency regulations, you might have to pay capital gain taxes on any profits you make from your cryptocurrency investments.

What is the capital gain? Simply put, capital gain refers to the difference between the purchase (the basis price) and the selling price. A taxpayer can donate bitcoin directly to charity instead of selling it first. This allows them to avoid capital gains tax, much like with appreciated securities.

A taxpayer who sells bitcoin — or any other cryptocurrency for fiat — will have to pay capital gains tax. That also depends on how long the cryptocurrency was held before they sold it. Each country will have its own regulations on how these taxes should be paid. For instance, the capital gain tax rates may vary between short-term and long-term crypto holdings.

Who can benefit from a tax deduction when donating crypto?

Different countries and jurisdictions can have entirely different approaches to how cryptocurrency traders are taxed. Each investor should be aware of the potential taxes that each transaction may attract. Countries like El Salvador, Singapore, or Malta maybe crypto tax havens. But regulators from the U.S. and the U.K., and others, will come knocking at your door to collect taxes.

A first step is to identify the applicable regulations to your location. That should give you a better understanding of what actions are taxable and how you should proceed with your crypto holdings. A good place to start is your local government’s tax authority website.

Regardless of where you live, if you must pay capital gain taxes, then donating cryptocurrency to charity is a way to lower your tax bill. However, please bear in mind that this is only an educational piece and not meant as tax advice. Remember that the best person to ask for tax advice is your accountant.

Tax benefits of donating crypto in the United States

For instance, in the U.S., the IRA has classified cryptocurrency as a property asset. This means that taxes on crypto are the same as taxes on stocks and other investments.

You will pay capital gains tax on any gains you make from cryptocurrency investments. The amount you pay and whether it falls under long-term gain or short-term gains will depend on the holding duration of the asset.

- You can consider the crypto asset short-term capital gain if you hold it for less than one year.

- You can consider the asset long-term if you have held it for longer than one year.

While the current federal long-term rate is set at 20%, you can end up owing 30% or more in tax jurisdictions such as New York and California. The short-term rates are higher and more in line with your tax bracket. If you’re a high earner, you could pay a huge 40% after state taxes.

In the U.S., if you want to donate crypto, and you have held bitcoin for at least one year, the taxpayer can claim a charitable deduction, if the taxpayer itemizes deductions. For donations exceeding $5,000, it is necessary to have qualified appraisals. The 30% limit on charitable deductions can be carried forward for up to five years. For bitcoin donations, the taxpayer might need to file IRS form 8283 (Here are the instructions on how to fill in that form).

How to donate crypto to a charity

If anyone wants to donate bitcoin and other cryptocurrencies to a nonprofit organization (NGO), they might discover that now a lot of these NGOs know how to accept crypto donations. The reason might be more complex than you think, due to the complexity of setting up a digital wallet and other legal considerations that they might not know how to tackle.

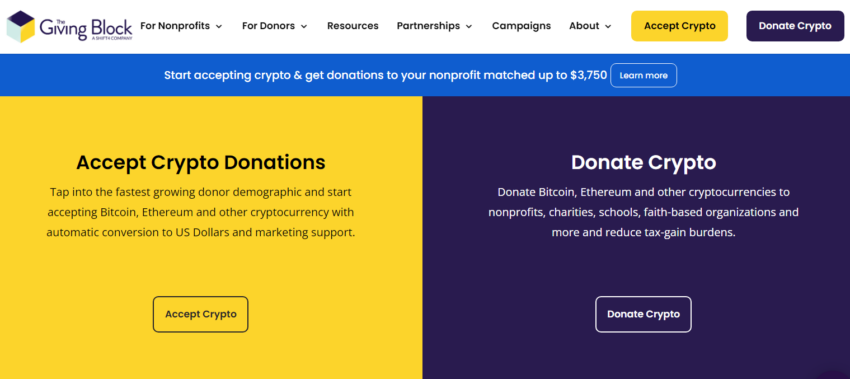

However, there are ways you can still donate to charity some of your bitcoin. More charities are starting to accept cryptocurrency donations through a third-party processor or through a donor-advised fund. Third-party processors such as The Giving Block facilitate cryptocurrency donations to charities. The processor converts the donation into cash for the charity. Using the platform, you can donate to nonprofit organizations or simply choose a specific charity cause such as education, children, or animals.

What is The Giving Block?

The Giving Block is the most popular crypto donation platform that aims to bring crypto philanthropy to our everyday lives. If you’ve ever donated to charity, then you already know that finding the right NGO for the cause you want to support.

Created in 2018, The Giving Block allows charities and nonprofits to raise bitcoin and other cryptocurrencies. They receive funds immediately and become a part of a community of crypto media partners that support their missions.

Only registered NGOs are present on the platform. You can donate crypto to any of them or even help register new organizations, thus amplifying the crypto philanthropy space.

After choosing the cause or NGO you want to donate crypto to, you can claim a charitable tax deduction, which can be used in your accounting for a tax deduction. These donations should be tracked to make sure you get a tax deduction, while also donating to the cause of your choice. The Giving Block platform recommends using one of its trusted partners for tracking tax deductions, tax receipts, and cryptocurrency donations.

The Giving Block is matching your donations

In Mar. 2022, Shift4, a leading provider of integrated payment and commerce technology, announced the acquisition of The Giving Back. The company also mentioned that it will invest in the strategy of the donation platform, and it will aim at a $45+ billion embedded cross-sell opportunity by uniting traditional card acceptance with crypto donation capabilities.

As the first campaign since its acquisition, Shift4 launched the “Caring with Crypto” campaign. The goal is to raise $20 million for NGOs present on the donation platform. Shift4 CEO Jared Isaacman will match donations to a total of $10 million, according to an announcement. This campaign aims to be the largest crypto philanthropy event up to date. By donating to this campaign, donors can support all of the platform’s NGOs with a single donation.

How does The Giving Block work?

If you’re looking to donate crypto for the first time, the amount of information you will find online will probably overwhelm and confuse you at the same time. Which of these organizations are legit, and which can provide you with a tax receipt?

Donating cryptocurrency is the preferred method of giving back by Millennial and Gen-Z donors, and The Giving Block wants to help connect all these organizations that support different causes to their potential donors.

Luckily, there are accessible platforms — such as The Giving Block — that offer a comprehensive UI for donors. They are constantly looking for new organizations to add to their platform and offer support for over 70 cryptos, including bitcoin, ethereum, and stablecoins.

As of writing, The Giving Block works with over 1000 nonprofits, universities, and faith-based organizations.

To start donating cryptocurrency with The Giving Block, you have to follow five simple steps:

- Select the organization or cause to donate to: You can decide where your donation goes, and it can be anything from mental health to environment and education.

- Select the crypto and the amount you want to donate.

- Enter your details or choose to donate anonymously.

- Enter your email if you want to receive a tax receipt (you can receive one even if you choose to donate anonymously).

- Use the given crypto address to make the donation from your wallet.

If you choose to donate to a particular cause, then the fund for the cause will be evenly distributed among the NGOs participating in that fund (cause) once per month. You can also donate more if you like.

Here are some of the individuals and companies that have taken The Giving Block pledge to donate 1% or more of their yearly cryptocurrency holdings.

Have you ever considered donating crypto?

In the past, donating crypto was a hassle, and finding a registered organization to support a cause you believe in was a struggle. But you can now donate crypto much easier than ever before and directly choose the cause or NGO that will benefit from your donation. It’s easy, safe, and you can even use it as a tax-deductible.

You can use The Giving Block to donate crypto to the cause of your choice or participate in their campaigns that aim to help all organizations on the platform. What’s more, you can even register a new organization on the platform and enable them to accept crypto donations from others. The world is more connected than ever thanks to blockchain and cryptocurrencies, and The Giving Block is the proof.

Frequently asked questions

Can I donate crypto to charity?

Can I give away my crypto?

Do people donate crypto?

Can you donate crypto to a DAF?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.