Despite increasing over the past three days, Curve DAO Token (CRV) is showing bearish signs in both short- and long-term time frames.

CRV has been falling since reaching a high of $6.98 on Jan 4. During the week of Jan 17-24, the price broke down from the $3.65 area and validated it as resistance two weeks later (red icon). So far, CRV reached a low of $1.86 on March 15.

While it has bounced slightly since, technical indicators are still bearish. This is visible in both the RSI and MACD since the former is below 50 and the latter is negative.

Due to the bearish price action and indicator readings, the trend cannot be considered bullish until CRV manages to reclaim the $3.65 area.

Ongoing upward movement

Cryptocurrency investor @real_moneylisa tweeted a chart of CRV, stating that it is one of the only tokens that is performing well today.

The daily chart provides mixed signs, which are leaning toward bullish.

Firstly, CRV has created a higher low green icon relative to the price on March 15. This is the first step toward the creation of a bullish structure.

Secondly, both the RSI and MACD are moving upwards. Furthermore, the RSI is already above 50, and is now considered to be in bullish territory.

The 0.382 and 0.5 Fib retracement resistance levels are at $3.85 and $4.45. The first one coincides with the previously outlined long-term resistance area. The second coincides with a horizontal resistance area.

For that reason, both are considered important resistance levels.

However, the six-hour chart is definitively bearish. CRV has broken out from a descending resistance line on April 19, initiating the current upward movement, which led to a high of $2.77 on April 24.

Afterward, the price was rejected by the $2.75 horizontal area, which had previously acted as resistance since the beginning of March.

So, it is possible that CRV will gradually decrease towards the $1.90 horizontal support area.

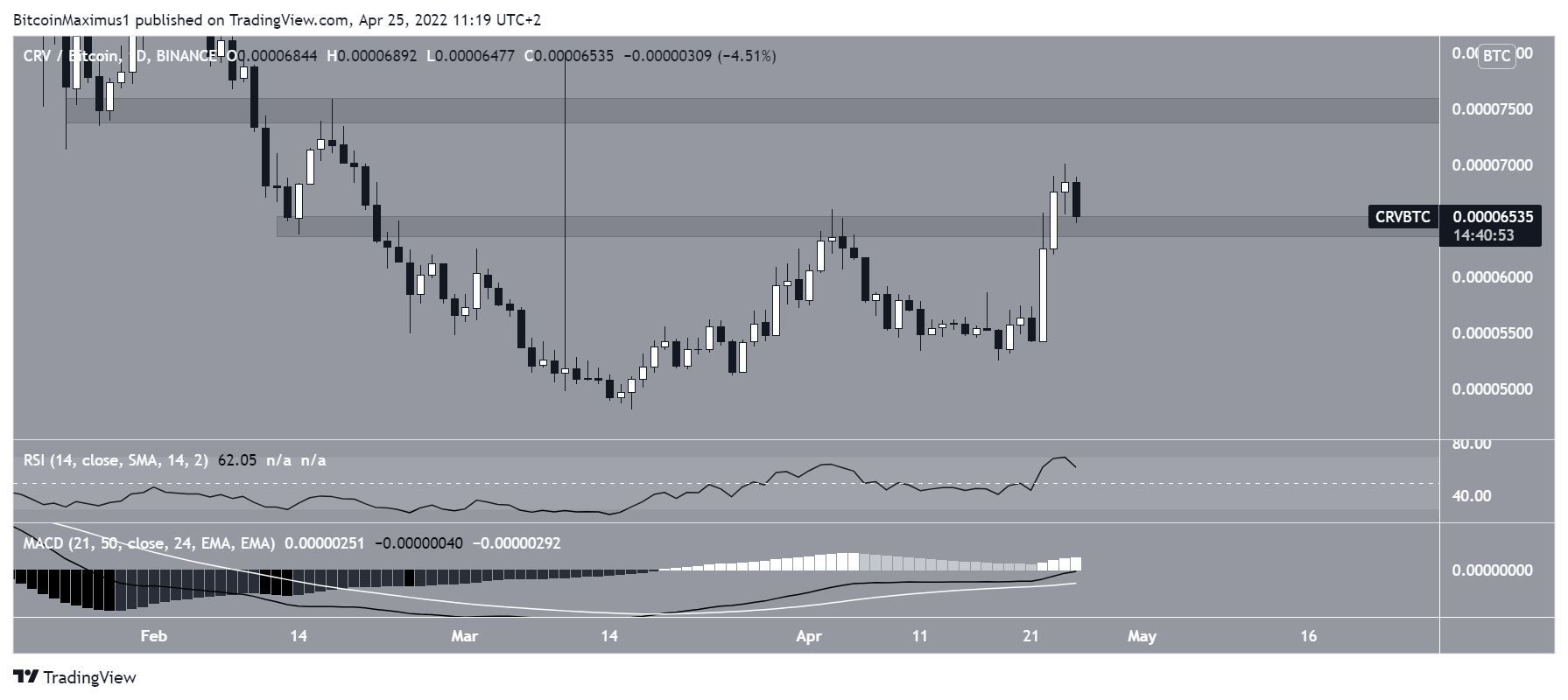

CRV/BTC

The CRV/BTC pair is more bullish than its USD counterpart. The main reason for this is that the price has already broken out from the 6,450 satoshi resistance area. The area had been acting as resistance since the beginning of April and has now seemingly turned to support.

In addition to this, technical indicators in the daily time frame are bullish. Both the RSI and MACD are increasing, the RSI is above 50 and the MACD is positive.

If the upward movement continues, the next closest resistance area would be at 7,500 satoshis.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.