Binance Smart Chain (BSC) reached new milestones in NFT sales volume in February but the total number of sales was insignificant compared to the sales volume on the WAX blockchain.

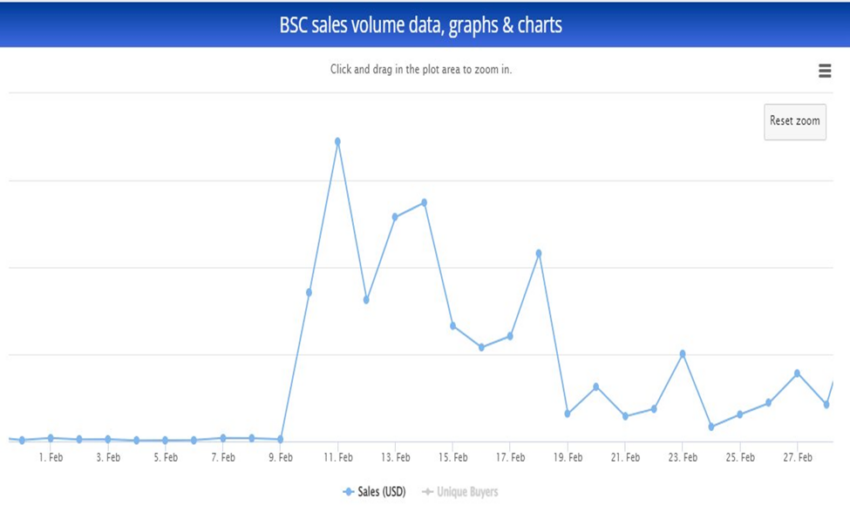

February proved to be a difficult month for several areas of the crypto finance space but Binance Smart Chain NFT sales volumes managed to reach new high highs. According to Be[In]Crypto Research, BSC was able to generate approximately $1.14 million in total sales volume during the second month of the year.

Although this statistic may not seem impressive due to the total number of transactions Binance Smart Chain records, total NFT sales volume increased by 1,109% from January 2022. At the close of Jan. 31, the total NFT sales volume of BSC was $94,325.

NFT sales volume increasing from 2021

BSC saw a 92% year-over-year monthly increase in NFT sales volume in February 2022. Total sales volume for February 2021 was $592,759.

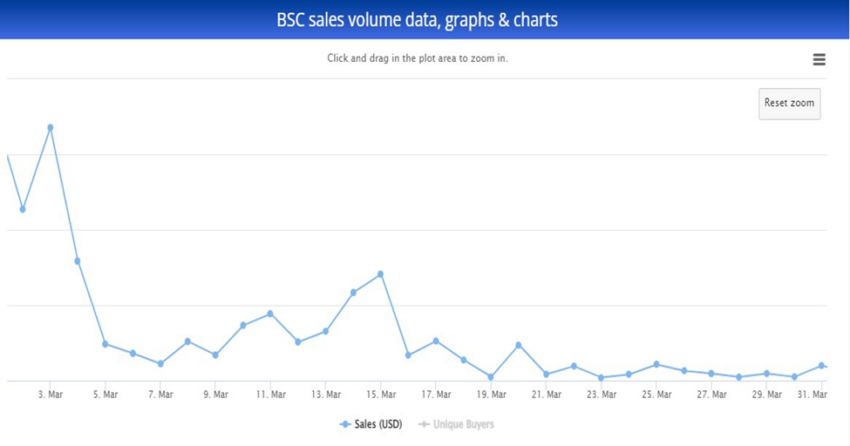

NFT mania took hold of the decentralized finance space in the first quarter of 2021. This saw Binance Smart Chain reach an all-time high in NFT sales volume in March 2021 after generating approximately $1.04 million.

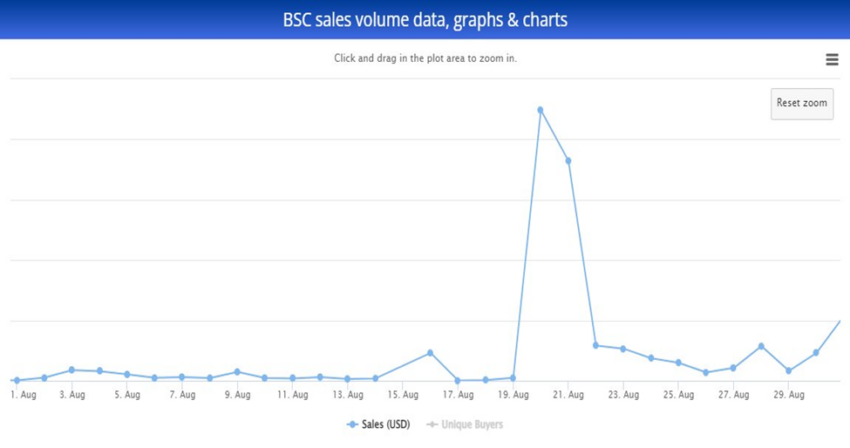

A bearish wave followed, causing a 32% plunge in sales volume to $704,384 on Aug. 31, 2021.

With the crash in the price of cryptocurrencies across the board towards the end of 2021, BSC NFT sales volume took a hit and shed 96% of its total sales volume in August when it recorded just $24,000.

WAX continues to surpass Binance Smart Chain

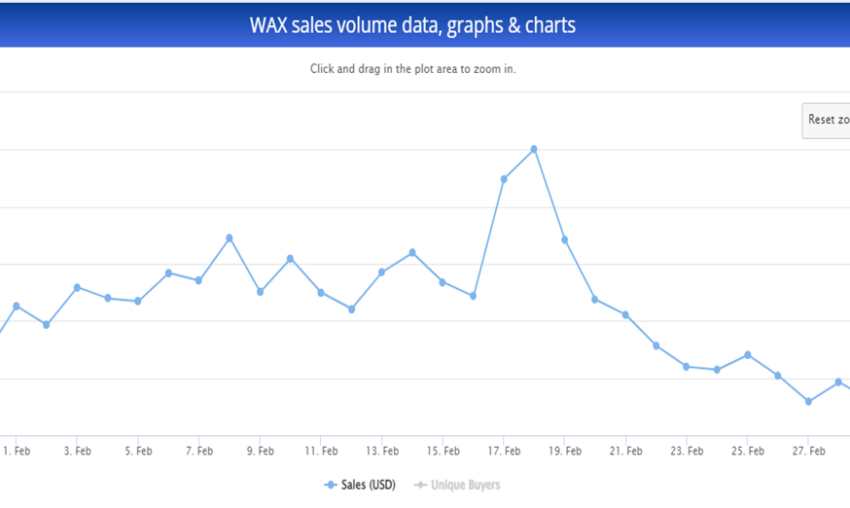

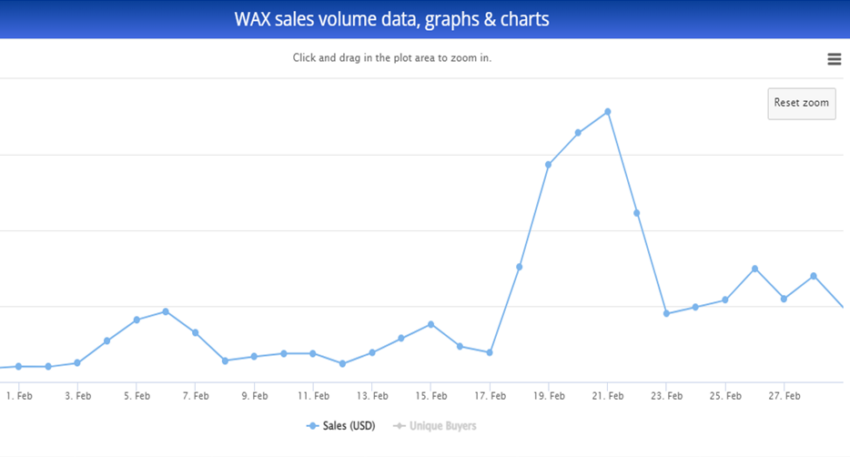

While BSC NFTs generated $1.14 million in sales volume in February, WAX NFTs generated a total sales volume of approximately $23.82 million.

Following in the footsteps of BSC, sales volumes on WAX soared by 14% from January 2022.

January 2022 saw WAX NFTs sales volume of approximately $20.87 million.

WAX NFTs also saw a year-over-year monthly increase for February. February 2021 brought in NFT total sales volume of $2.82 million, totaling a 744% increase in 12 months.

Buyers still prefer NFTs on the WAX blockchain

As of March 2022, Ethereum continues to dominate NFTs when total sales volume is considered. However, based on the statistics presented by Be[In]Crypto Research, WAX is among the favorites for buyers of digital collectibles that are indestructible, indivisible, verifiable, and interoperable.

Before the generation of sales volume in February, January 2022 saw WAX NFTs sales volume surpass BSC NFTs by 22,031%. In addition to this, WAX NFTs outpaced BSC NFTs by 99,292% in December 2021 as well as 13,351% when their respective all-time highs were assessed in November and March 2021 respectively.

In the second month of 2022, WAX remained the clear favorite as NFT sales volume surpassed BSC NFT by a staggering 1,987%.

What caused the increase in Binance Smart Chain and WAX NFT sales volumes?

The increase in sales volume can be attributed to a spike in the number of unique buyers which impacted the total number of transactions in February 2022.

For WAX, in February 2022, the single-day highest number of unique buyers was 6,409 on Feb. 17, compared to the single-day highest number of unique buyers in February 2021 which was 2,232 on Feb. 19. The single-day highest transaction count in February 2022 was 73,003 which was recorded on Feb. 2. The single-day highest transaction count in February 2021 was 36,715 which was recorded on Feb. 20.

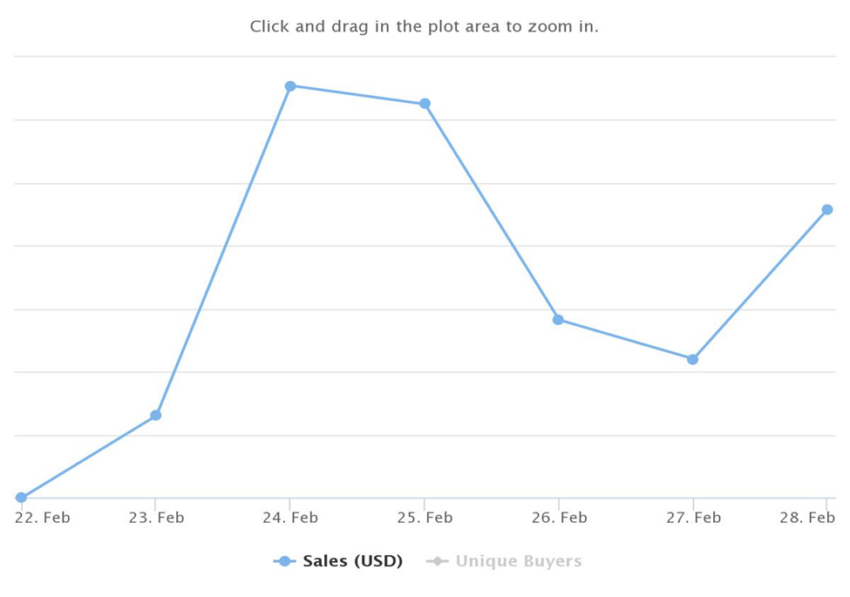

For BSC, in February 2022, the single-day highest number of unique buyers was 189 which was recorded on Feb. 23, compared to the single-day highest number of unique buyers in February 2021 which was 59 on Feb. 24. The single-day highest transaction count in February 2022 was 767 which was recorded on Feb. 23. The single-day highest transaction count in February 2021 was 290 which was recorded on Feb. 25.

The figures of WAX’s single-day highest number of unique buyers and single-day highest number of transactions in February 2022 was 187% and 98% more than that of February 2021.

Similarly, the figures of Binance Smart Chain’s single-day highest number of unique buyers and single-day highest number of transactions in February 2022 was 220% and 164% more than that of February 2021.

Aside from this, on the part of Binance Smart Chain, there was a huge spike in unique buyers and total transactions because of the longevity in the tracking of NFT data in 2022. While data for February 2022 covered the entire month (28 days), data for February 2021 covered just seven days (Feb. 22 to Feb. 28).

The total number of unique buyers and transaction counts on the buying of NFTs on the two chains is largely attributed to the difference in sales volume.

In February 2022, the total number of unique buyers of NFTs on WAX was 61,597, and the total number of unique buyers of NFTs on BSC was 1,163.

This resulted in total transactions of 1,790,884 for WAX and 5,790 for BSC.

Overall, the number of unique buyers on WAX was 52 times the statistic recorded by Binance Smart Chain. In addition to this, total transactions on WAX were 309 times the figure recorded by BSC in February 2022.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.