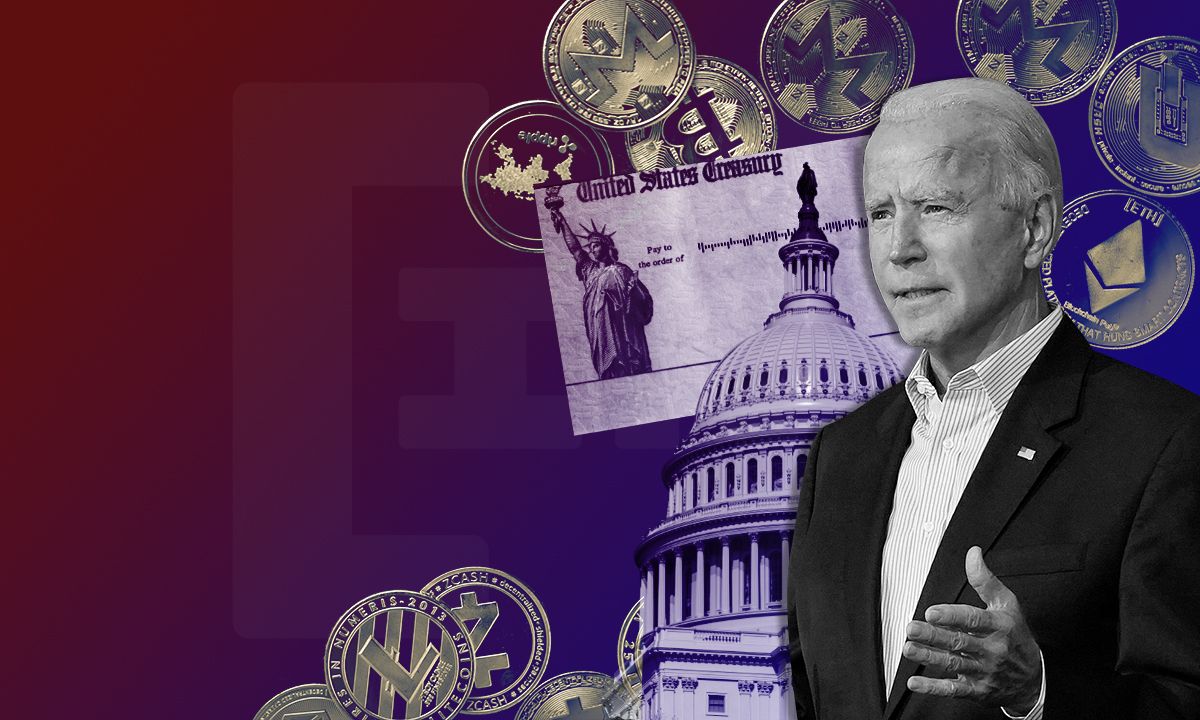

Reports from White House anchors revealed that U.S. President Joe Biden will sign a directive on cryptocurrencies this week. The executive order will demonstrate how the U.S. plans to deal with digital asset regulation.

The executive order, according to people knowledgeable about the topic, will assign the U.S. federal agencies to examine the risks and opportunities that come with digital currencies. The reports come while the U.S. and several major economies in the world are implementing more sanctions on Russia.

People who do not want to be named told Bloomberg, the U.S. is concerned with Russian people and organizations that could use cryptocurrency to evade international sanctions.

“The long-awaited Biden executive order on cryptocurrencies — outlining the admin’s view of digital assets and directing a further study of economic, regulatory, and national security issues is finally expected to be signed by the president this week,” said Jennifer Epstein, the White House reporter at Bloomberg.

Kayla Tausche who is the White House anchor at CNBC also confirmed the report. “Biden administration will release its long-awaited crypto EO by mid-week, aiming to coordinate policy-making for digital assets among various agencies, expected to report back over the next 3-6 months, an admin official says,” she said.

Any plans for a CBDC?

The U.S. Federal Reserve (Fed) has been analyzing the pros and cons of a U.S. dollar-pegged central bank digital currency (CBDC) since Sep last year. It released a report dubbed “Money and Payments: The U.S. Dollar in the Age of Digital Transformation,” on Jan 20 which listed some risks and potential benefits of a CBDC.

The Fed, however, is still listing possibilities and did not come to a conclusion yet.

Regulators including Senate Banking Committee Chairman Sherrod Brown and Senator Elizabeth Warren are scrutinizing diverse aspects of the asset class which could be used for dodging sanctions. “Although we have not seen widespread evasion of our sanctions using methods such as cryptocurrency, prompt reporting of suspicious activity contributes to our national security and our efforts to support Ukraine and its people,” said Him Das, acting director of Treasury’s Financial Crimes Enforcement Network, in a press release.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.