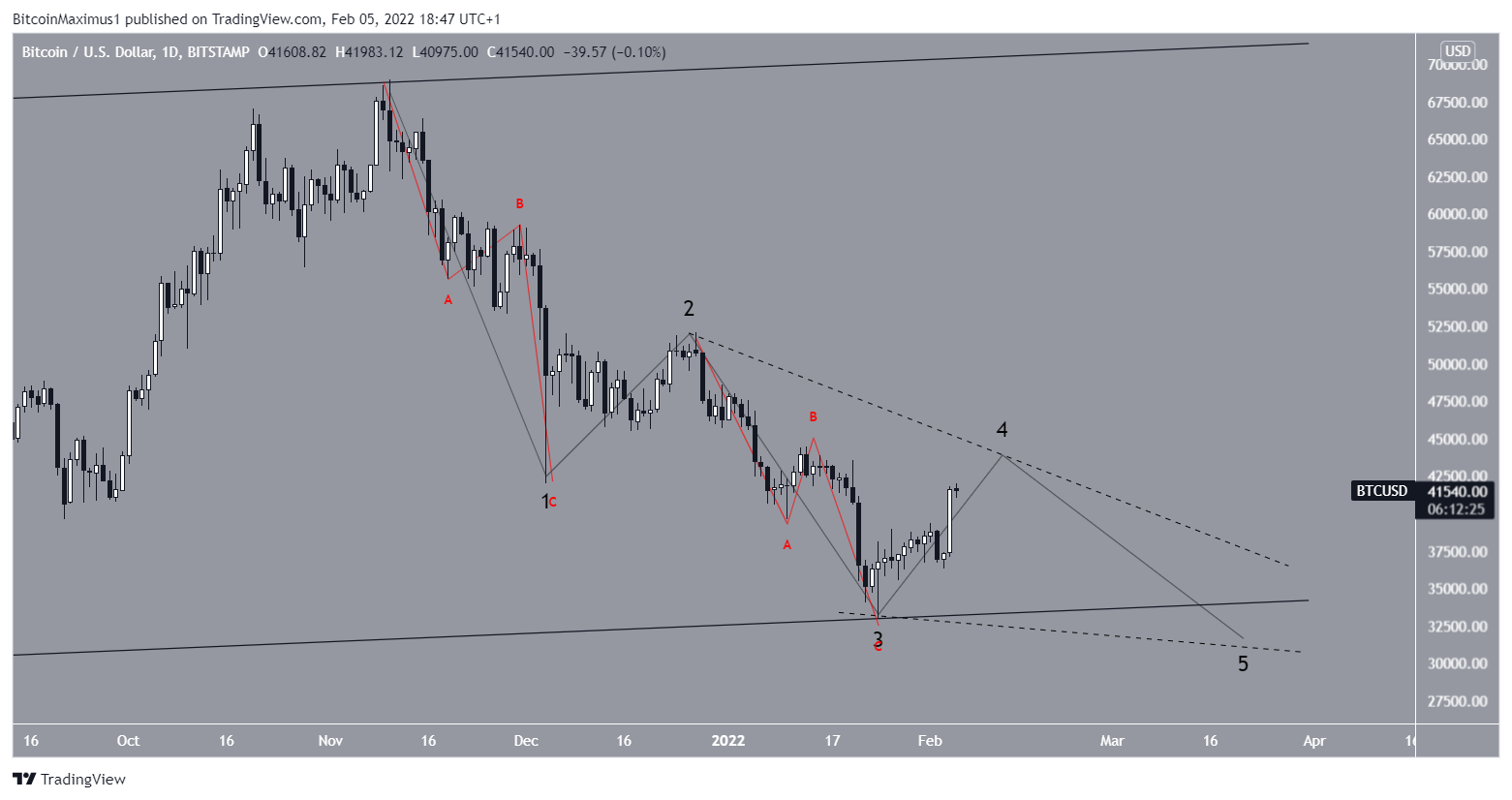

Bitcoin (BTC) has been increasing since Jan 24 and is showing strong signs that it has completed its long-term correction, which began on April 2021.

Bitcoin most likely began a five-wave upward pattern (white) in December 2018. If true, the April 14, 2021 high of $64,895 marked the top of wave three. In this case, BTC has likely been correcting inside wave four since then, as BeInCrypto outlined in the previous wave count analysis.

The most likely count suggests that wave four ended with the $32,950 local low on Jan 24, 2022. The sub-wave count is shown in red. In it, waves A and C have a 1:1 ratio, which is quite common in similar corrective structures.

As a result, it’s possible that BTC has now begun the fifth and final wave of its bullish impulse.

The first potential target for the top of this upward move is between $71,600-$73,600. This target range was found using the 0.618 length of waves 1-3 (white) and the 1.27 external retracement on wave four (black). Beyond this, the next targets would be $84,450 (1.61 external Fib) and $95,325 (entire length of waves 1-3).

Completed BTC correction

As for the shorter-term movement, the most likely possibility indicates that wave four is a complete running flat correction. The sub-wave count is shown in black as a completed bearish impulse.

In this scenario, BTC has now begun a new bullish impulse as part of the previously outlined wave five, which could potentially take it to a new all-time high price and beyond.

Triangle correction

The second likeliest possibility suggests that BTC is still in wave four, which will take the shape of a symmetrical triangle.

In this scenario, BTC could increase toward the 0.618 fib retracement resistance level at $55,250 before falling once more and completing sub-wave E (red).

The movement since Jan 24 would be the same in both scenarios. At the current time, we cannot determine which of these wave counts is at play.

Ending diagonal

The third, and least likely scenario, suggests that BTC is completing the C wave in an ending diagonal pattern that could take the shape of a descending wedge.

If true, BTC could increase towards $44,600 before falling once more and completing the diagonal somewhere in the neighborhood of $31,000.

This would also cause the price to break down from the ascending parallel channel that BTC is currently trading in.

Furthermore, in an ending diagonal, each wave has to be an A-B-C structure. Due to the very small length of the sub-wave B (red), neither wave one nor wave three look to have formed an A-B-C structure.

The short-term price action should help in determining whether or not this is the correct wave count.

Short-term Bitcoin price movement

Since Jan 24, BTC has been trading inside an ascending parallel channel. Currently, it’s trading slightly above the resistance line of this channel.

If the entire movement is a correction, waves A and C already have more than a 1:1 ratio.

Therefore, if the proposed diagonal scenario is to play out, BTC must get rejected and begin a downward move from the current level.

Conversely, the most likely scenario suggests that the upward movement is part of a bullish impulse. This is supported by the increasing volumes.

If Bitcoin were to break out from the channel with high volume and then validate it as support (green circle), it would almost certainly confirm that a new upward trend has begun.

This would support the possibility that the correction is complete. However, it would not invalidate the triangle scenario, since the entire movement could still be part of an A wave that would eventually take BTC to $55,300 to complete the triangle structure.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.