Share prices of MicroStrategy (MSTR) fell by approximately 15% at the start of the week following an SEC ruling. The decision made by the SEC had to do with the accounting principles used by MicroStrategy in the third quarter financial report of 2021.

MicroStrategy’s shares fell by nearly 15% at the start of the week as the United States Securities and Exchange Commission (SEC) ruled against an accounting choice used in its quarterly reports. The company had used non-GAAP measures for a report for Q3 2021 to showcase its income if it didn’t have to impair the asset.

MicroStrategy gets pushback from SEC

The SEC objected to the usage of that accounting standard, which sent the share price down as the market’s top asset itself experienced a six-month low. The SEC’s objection was published on Jan 20.

The next quarterly report, for Q4 2021, will be related on Feb 1 and will show how much of an impact the change will have. The ruling by the SEC seemed to have a tremendous impact on shares, resulting in a 30% drop at one point, though it has since recovered.

It’s unlikely that MicroStrategy will be fazed by the decision, as it has generally given the impression of being in for the long haul. Chairman and CEO Michael Saylor has touted it being an important asset going into the future, and also holds bitcoin in his personal portfolio.

The crypto market and public crypto companies are both facing a rough time, while the global market itself is in a bit of a difficult phase. The SEC is currently working hard on oversight of the crypto market, so current slumps may not be at their end.

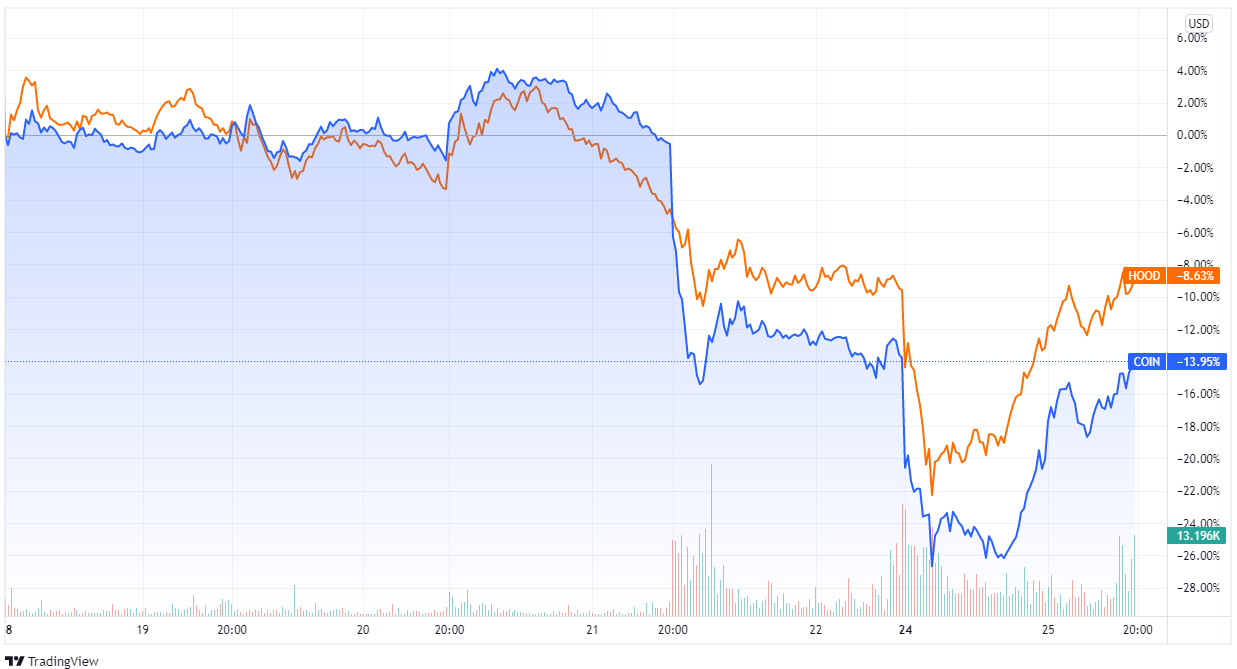

Coinbase and Robinhood shares also tank

The recent crypto market crash has not been kind to public crypto companies. Coinbase shares dropped by a whopping 13% to $191 on Jan 21, which puts it well below its $250 IPO price. Robinhood also experienced a drop of 15% the same week, down 60% from its IPO price of $35.

The drop in share prices is not surprising, given how global markets are faring, but it will come as a blow to investors. Coinbase is attempting to offer more services. It includes an NFT marketplace, which should help in its bid to grow, but the price drop is a reflection of market sentiment, though the exchange seems to be taking it in its stride.

With more regulation incoming, the market could be set for more strong price changes in the months to come. The SEC is at the center of regulatory decisions, and there have even been reports that the Biden Administration will release an executive order relating to cryptocurrencies in the near future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.