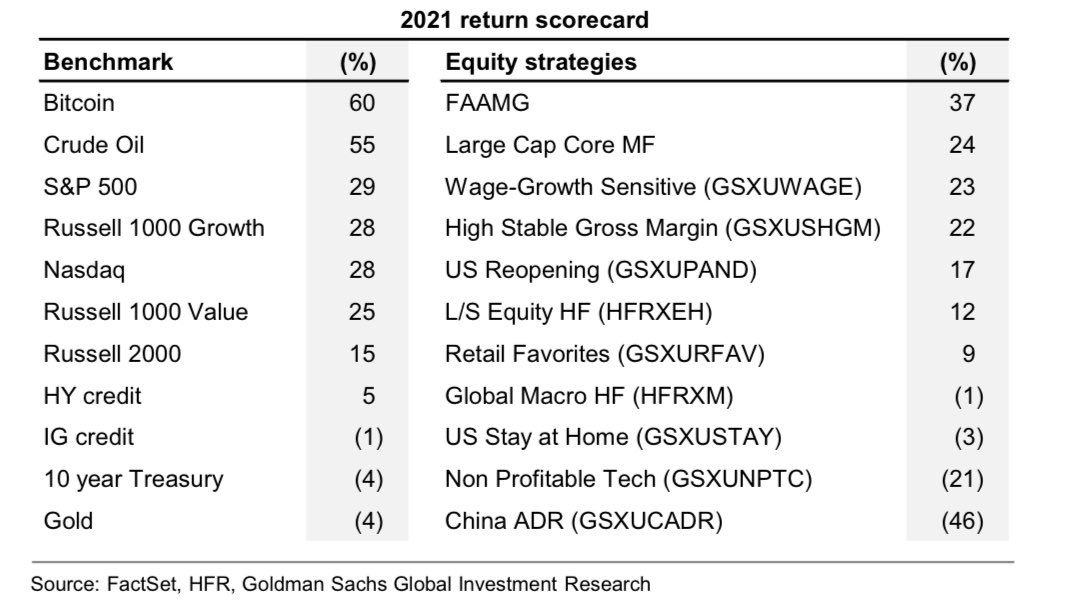

Data from a Goldman Sachs report shows that bitcoin outperformed all capital markets in 2021. Bitcoin saw a 60% return over the year, with crude oil coming in next at 55%.

Bitcoin has been the best performing asset for yet another year, as pointed out by a Goldman Sachs report. The data shows that the cryptocurrency returned a strong 60% over the year, while the next top performer was crude oil at 55%. The S&P 500, often compared with bitcoin, saw a 29% increase, while the top 5 was completed by Russell 1000 Growth and Nasdaq, both at 28%.

The performance is another feather in the cap for bitcoin, which for many years was dismissed by critics. 2020 and 2021 have been quite a change from that sentiment, with many established companies and investors jumping into the market. Bitcoin’s performance in 2021 seems to reflect that change.

The performance of the biggest tech stocks — Facebook, Apple, Amazon, Microsoft, and Google — saw a 37% return. This is strong, but still pales in comparison to bitcoin.

Gold, meanwhile, seems to be losing some of its sheen. The precious metal saw a return of only 4% in 2021, which probably upset prominent bitcoin critic Peter Schiff. Younger generations especially seem to be moving away from gold and into bitcoin, which is often called digital gold.

What does 2022 have in store for bitcoin?

The next few years could be even more momentous for bitcoin, as adoption rates grow and countries form regulation. 2022 is set to be an exciting one for the asset class in general, which has entrenched itself in the public consciousness through NFTs and DeFi.

As the market leader, bitcoin will likely be the first of the assets that most people invest in. Exchanges and institutions are working on extensive solutions to make investment easier, and that may have a strong positive effect on bitcoin.

Government regulation will be a hurdle for bitcoin, but it seems like most countries will allow the asset — though not as legal tender, like El Salvador did. With regulatory uncertainty removed, bitcoin could experience much stronger growth in 2022, resulting in yet another year of the cryptocurrency outperforming other capital markets.

What do you think about this subject? Write to us and tell us!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.