The third annual Bitcoin Investor Study report from Grayscale shows signs of growth for bitcoin. Older investors, as well as female investors, are showing more interest in the asset as the perception of bitcoin grows more positive.

Grayscale Investments has released its third annual Bitcoin Investor Study report, which covers perspectives and sentiment surrounding the asset. The annual report showcases several interesting insights into investment of the asset. The study was conducted by Grayscale and financial market research firm 8 Acre Perspective.

Specifically, the report covers the profile of bitcoin investors, familiarity with the asset, motivations behind investor interest, barriers to investing, and the impact of bitcoin ETFs, among other things. The two firms note a few key themes that emerged in 2021, including the idea of bitcoin as a store-of-value — as worries of inflation increase — and increasing interest from older investors.

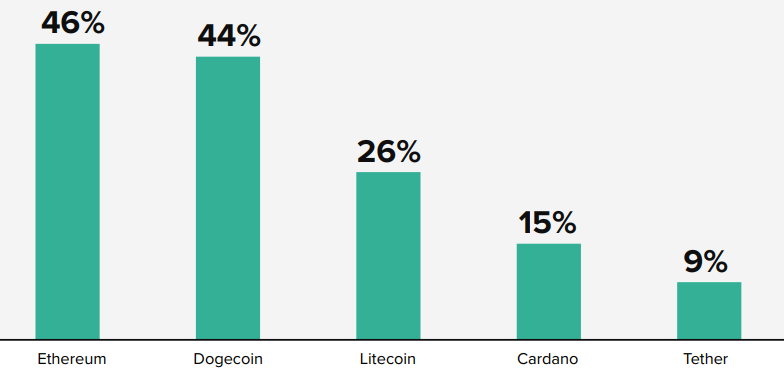

The survey involved 1,000 U.S. consumers, who were questioned in mid-Aug. 2021. One of the key findings from the report was that 59% of investors are interested in bitcoin as an investment, which is a jump from 2020 and 2019, when it was 55% and 36%, respectively. 87% of bitcoin investors also owned more than one digital currency.

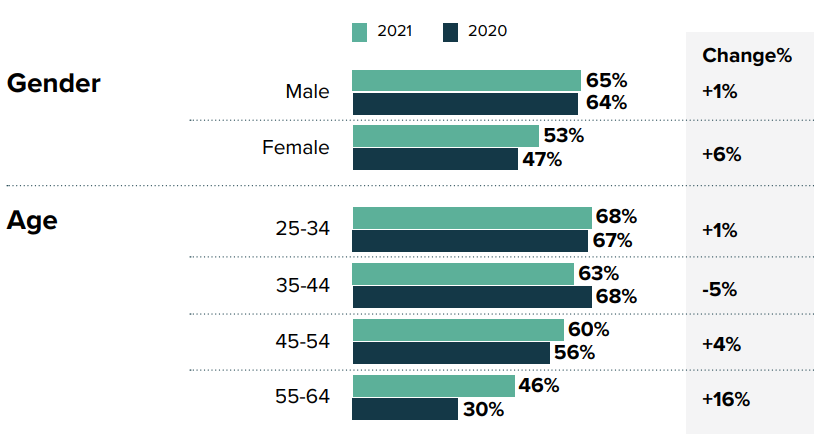

Perhaps even more significant is the fact that older investors showed a growing interest in bitcoin investment products. 46% of those between 55 and 64 were willing to consider these products, compared to a much lower 30% in 2020. Interest among female investors also grew to 53% in 2021 from 47% in 2020.

Michael Sonnenshein, CEO of Grayscale Investments, said that while the attitude around crypto is changing, it is still early in the days of the industry,

“While it is encouraging to see attitudes towards crypto continue to evolve, it’s still early days for this industry. It’s incumbent on all of us to remain focused on educating the investing public, so investors — across generations and demographics — can access this once in a generation opportunity.”

Other highlights include the fact that 42% of investors want to know more about bitcoin and that more than 30% of investors want bitcoin offered at more financial institutions. These signs are good omens for bitcoin, which has had a strong year overall.

Perception of bitcoin as a legitimate asset growing

If there’s one overall takeaway from the Grayscale report, it’s that the attitude towards bitcoin is changing quickly. The cryptocurrency is increasingly becoming seen as a legitimate asset. The report corroborates this, with 29% of those surveyed saying that they had a more favorable view of the asset.

In the past two years, the number of companies investing in bitcoin as a hedge against inflation has increased considerably. MicroStrategy is spearheading this pack and started a wave of new companies doing the same.

Even governments are opening up to the idea of cryptocurrencies. El Salvador is obviously the most notable of these, having made bitcoin legal tender. While many are concerned about stablecoins and investor protection, they are still open to allowing investment in the asset class.

What do you think about this subject? Write to us and tell us!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.