The golden cross is one of the most popular traditional technical indicators that signals the continuation of a long-term bull market. Today, it happens for the first time on the Bitcoin (BTC) chart in 2021.

However, historical analysis shows that sometimes the golden cross in the cryptocurrency market has been a false signal. It seems that it is impossible to understand the significance of this event well without referring to the broader context of the crypto market and other conditions for the continuation of the bull run on BTC.

What is a golden cross?

A golden cross is a pattern used in technical analysis in which a relatively short-term moving average crosses above a relatively long-term moving average (MA). Its opposite is the death cross, where the contrary process takes place. The former confirms an uptrend, while the latter indicates a downtrend.

In classical technical analysis, the most commonly used golden cross is the one that occurs between the 50 MA and 200 MA. Due to the high interval of these moving averages, this event indicates the potential for the start or continuation of a long-term bull market.

It is worth adding that the golden cross is a so-called lagging indicator, which usually confirms market events that have already taken place. Sometimes it also generates false signals and the price action goes in the opposite direction. An additional confirmation of the strength of this event is an increase in the volume of transactions for a given asset.

Interestingly, a golden cross is not an isolated event, but part of a larger process. It contains 3 stages:

- End of the downtrend and depletion of selling pressure.

- The actual golden cross, when the short-term MA crosses above the long-term MA.

- Continuation of the uptrend.

Golden cross for Bitcoin

Today we observe a classic golden cross on the daily chart of Bitcoin. The 50-day MA has made a cross above the 200-day MA (green circle). Moreover, the BTC price is trading above both moving averages today. This happened because a bullish engulfing candle was generated yesterday and BTC broke out above the 200 MA again.

On 19 June, we watched the death cross (red circle) that happened as a result of the cryptocurrency market crash in May. Measuring from that event to the macro bottom at $28,600, the Bitcoin price lost 20%.

If the upward momentum implied by the ongoing golden cross were to be sustained, an increase in volume is to be expected. So far, we see a gradual decline that has persisted since the May events (dashed line). However, if there is a break of the downtrend on volume and a clear breakout in the coming weeks, the golden cross will be confirmed, and the long-term bull run may find a continuation.

Three conditions for a bull market continuation

In a recent video, cryptocurrency macro analyst Benjamin Cowen provided his own interpretation of the ongoing golden cross. According to him, this event is one of the three conditions for the continuation of the bull run on BTC in the coming months. According to Cowen, the 3 conditions necessary, but not sufficient, for the resumption of long-term upside are:

- BTC price above the weekly 20 MA and 21 EMA, the so-called bull market support band.

- Golden cross.

- Bullish retest of the weekly 20 MA and 21 EMA and their validation as support.

According to the analyst, the meeting of these conditions is the most bullish and at the same time realistic scenario for Bitcoin in the perspective of the continuation of the bull market. Currently, the weekly 20 MA is located at $41,500 (yellow) and the 21 EMA at $43,500 (purple). The latter has been tested twice: last week and this week.

Thus, in the current situation, all three conditions presented by Cowen for the continuation of the bull run are fulfilled. However, this does not mean that the price of Bitcoin will immediately start rising to the ATH at $64,900 and above. Especially since historically the golden cross has not always heralded immediate increases and has sometimes been a false signal.

Golden cross in historical perspective

This is confirmed by several most recent instances of golden cross on the BTC chart, which sometimes turned out to be a false signal. During the period between April 2019 – April 2020 golden cross happened 3 times. Measured from the BTC price to the extremes:

- April 23, 2019, BTC increased by 155%,

- February 18, 2020, it dropped by 61%,

- May 20, 2020, it increased by 576%.

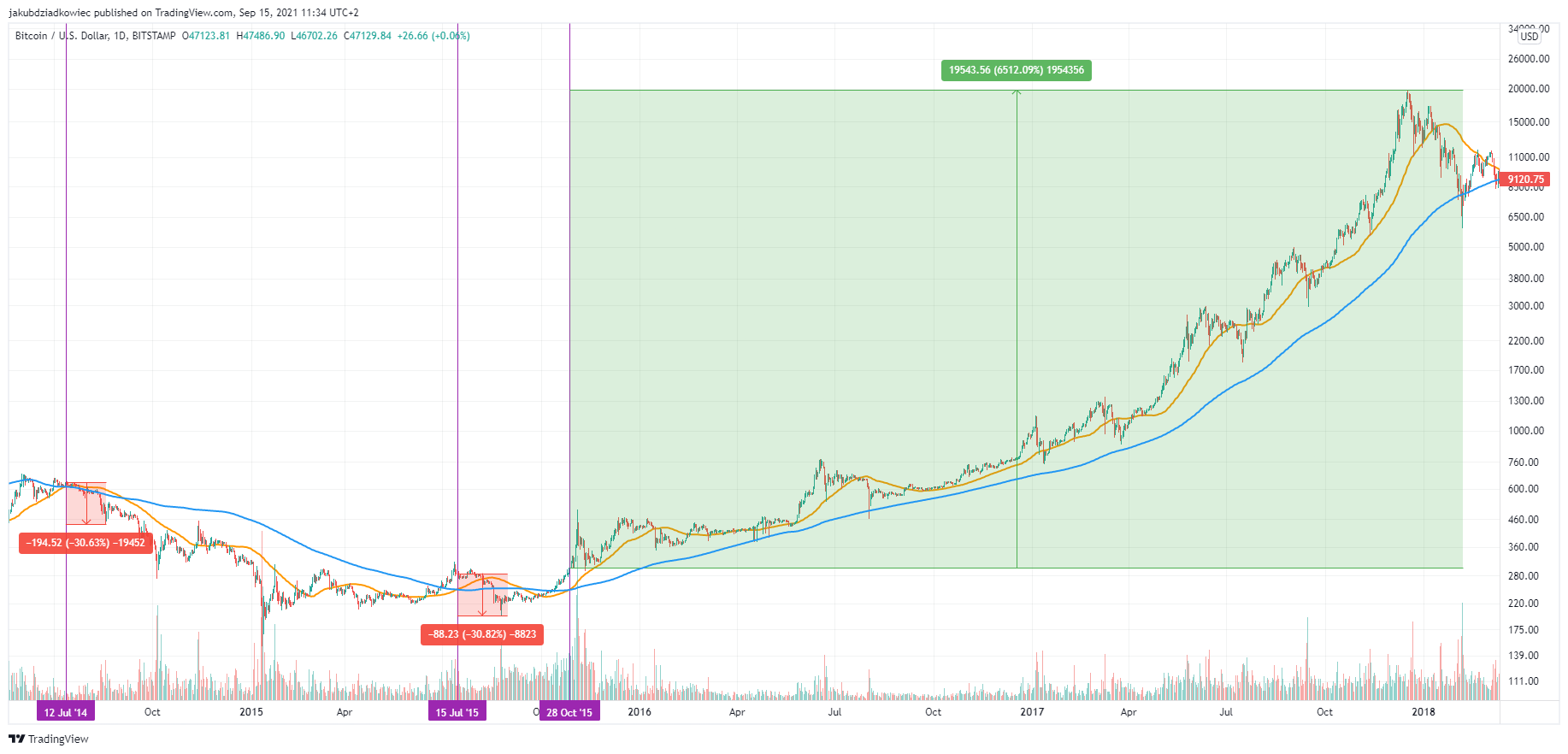

Moreover, in the previous cycle, between July 2014 and January 2018, we also find 3 such events. Their consequences were as follows:

- July 12, 2014, BTC dropped by 31%,

- July 15, 2015, it dropped by 31%,

- October 28, 2015, it increased by 6512%.

Thus, historical analysis shows that in half of the cases from the period between 2014-2020, the golden cross on the Bitcoin chart was a false signal. Nevertheless, it is worth noting that if it did lead to the continuation of the uptrend, there were impressive upward movements, which averaged an increase of 2414%. In contrast, the average declines were 41%.

Conclusion

The golden cross concept has gained popularity in the technical analysis of traditional financial markets. The cryptocurrency market is characterized by much higher volatility, and many traditional analytical instruments here completely fail or are much less effective.

However, regardless of this, today’s golden cross for Bitcoin is a bullish signal, which is one of the premises for the continuation of the long-term uptrend. If we add to it other indications, such as the aforementioned Cowen conditions or on-chain analysis indicators, we get a more complete picture of the health of the Bitcoin market and the entire cryptocurrency asset class.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.