Blockchain interoperability is becoming more standardized. This is great, as bundling different DeFi protocols within the same interface is the future of the space.

As a result, it was only a matter of time before a project like Furucombo would appear. After all, DeFi is all about dissembling financial activities to translate into smart contracts. Furucombo takes this principle to another level.

While still in the beta stage, Furucombo gives you a visualized, user-friendly toolset to combine various DeFi protocols. It allows users to harness their platform to produce a new effect for savvy yield farmers.

Furucombo’s purpose is to customize DeFi protocols with a drag-and-drop method, visualizing them as cube stacks. Correspondingly, users gain access to advanced yield-farm tuning without having smart contract coding knowledge.

Furucombo’s Mission

Furucombo is just over one year old, having launched in March 2020. Yet, without even exiting the beta stage of development, its community is more active than some larger DeFi projects.

So far, Furucombo transactions have accounted for over $4 billion in trading volume. They generated over a thousand new yield farming strategies, shared among 35,000 users across social media, YouTube, and Discord.

According to Furucombo developers, the main driver behind this project is to detach the complexity of back-end coding from leveraging smart contracts to their full extent, at least when it comes to yield-farming.

By giving the user the ability to combine multiple smart contract transactions in a seamless flow, they gain the building blocks for a whole new way of experiencing DeFi.

The name Furucombo comes from the Japanese gaming industry, which has pioneered chaining and combo-ing as an art form.

“The name Furucombo comes from a Japanese video game 太鼓達人, when you complete hitting all the drums in the game, it’ll say “Full combo” meaning you are all pass. So the drum and how people play the drum is like when we build a combo, when you execute all the cubes in a combo, it’s a full combo!”

Taking a step back to look at DeFi from an outsider’s perspective, it is clear that the amount of DeFi protocols and blockchains makes it an intimidating and overwhelming prospect.

With Furucombo in hand, one could easily see it catching just as much as eToro’s CopyTrader. When successful stacked DeFi flows rise to the top, others could easily copy them.

In the future, one could envision neatly organized libraries, each category serving different financial interests. However, for now, Furucombo’s Twitter feed demonstrates its capability.

A closer look at Furucombo’s mechanics

There are many ways one could describe how Furucombo improves DeFi yield-farming operations. The best way to understand Furucombo is as a toolkit for creating chained transactions, ending in a unique DeFi strategy.

Furucombo’s app is innovative. If you can picture a financial logic you can cobble up together based on your knowledge of DeFi protocols, Furucombo can make it happen.

In fact, this inherent puzzle-like feature can be gamified and is used as rewards, making it both educational and motivational.

Whether you want to make a new DeFi strategy for a flash loan, high-yielding passive income, save gas, or create an ETF fund, Furucombo can make the puzzle pieces click within its multi-step process.

It starts with the exploration of DeFi protocols that can be added. The final transaction chain is called a “combo,” with each step visualized as a cube. A cube represents a single action to be executed — adding liquidity, swapping, etc.

After selecting a protocol for each cube, the user can then set its output and input. Meaning, the user will send (input) tokens when executing the action or receive (output) them.

These two binary choices can either plug into a wallet or previous cubes. Once set up, at any time, cubes can be rearranged by dragging and dropping them.

The final step is connecting the chained transaction to a wallet to send it out. As seen in previous examples, Furucombo generates an emergent property when combining standard DeFi protocols.

Meanwhile, it simultaneously cutting short the time it would take to complete the transactions manually on each protocol.

Furucombo’s Adoption Hurdles

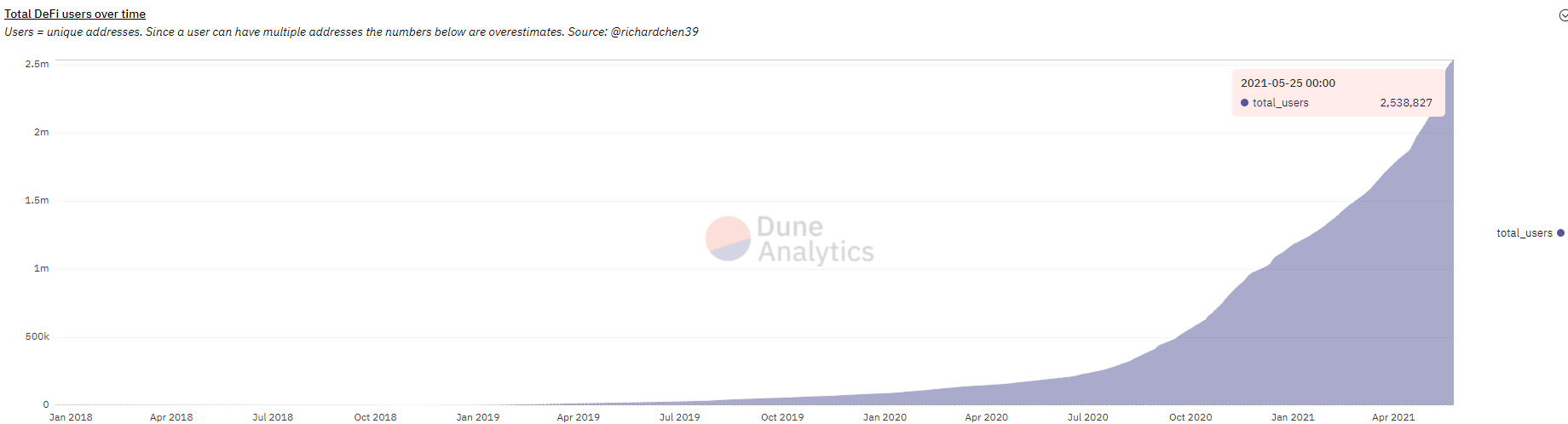

The DeFi space has now grown to about 2.5 million users, as shown by Dune analytics chart below.

This may seem a lot for a single year since DeFi really kick-started. However, this is still 11 times fewer addresses compared to bitcoin wallets, let alone to the traditional financial system as a whole.

In other words, Furucombo would tap into a sliver of market share. Although Furucombo is user-friendly enough, only those with advanced knowledge of dozens of protocols and tokens would be able to take advantage of it fully.

However, this may change if developers create a ranking system for DeFi strategies within the platform. Users can then easily copy with a few mouse clicks, just as one would with eToro’s CopyTrader. Moreover, there is the question of transaction fees.

Since Furucombo chains multiple transactions into a meta-transaction, the fee is multiplied by several orders of magnitude. Once again, this relegated Furucombo to a DeFi app best suited for heavily invested DeFi veterans.

Furucombo’s future relies on lowering the barrier to entry

It’s encouraging to see Furucombo developers understand that a big emphasis has to be placed on education. The app’s tutorial section already holds eight guides. They cover liquidity mining staking, flash loans, passive income, maker vault boosting, maker vault closing, token swaps, and even Synthetix cubes.

Completing those is as good a place as any to start mix-matching transactions with confidence. Furucombo will transition into v2 soon.

This upgrade should create an ecosystem on top of three pillars: builders, degens, and novice users. To make the platform more accessible for the latter, they plan to entice more builders into the Furucombo ecosystem.

“We are looking to expand to more blockchains to provide better user experience, add more protocol and expand our use cases, and start to collect fees (from partners and/or users).”

For this purpose, they have invited Sushiswap and B.Protocol developers to create their own cubes.

Both cubes — Sushiswap swapping/liquidity pools and B.Protocol vault management — should be released by the end of May.

If this trial run goes well, they will formalize this onboarding of builders with on-chain governance, prioritizing the most productive external builders.

Furucombo is an ambitious, original project that will likely attract many copycats. Its market share in the DeFi space may remain on the low side due to high-knowledge requirements, but this in itself presents a motivational driver to grasp the totality of DeFi protocols.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.