With different incentive systems and programming languages, only time will tell which one will prevail — Ethereum or Cardano.

Mathematician and co-founder of Ethereum Charles Hoskinson launched Cardano in 2017. His goal was to create a fast and scalable blockchain. Thanks to its proof of stake (POS) consensus mechanism, this has been the case.

It provided much faster transactions at negligible fees compared to Ethereum. However, it lacked a key ingredient — smart contract capability.

Smart contracts — dApps — is what propelled Ethereum to its second rank next to the juggernaut that is bitcoin (BTC).

A saving grace for Cardano was that Ethereum’s transition into POS has been postponed many times, leaving the space wide open for competition.

This year, we are seeing the direct competitors clashing. Ethereum has made great strides to make it scalable and affordable, with the Berlin fork already finalized and London hard fork scheduled for July.

In the meantime, Cardano smart contracts should be entering the Cardano testnet by the end of this month. Here is a brief recap of Cardano’s roadmap progress.

Alonzo anticipation boosts ADA price

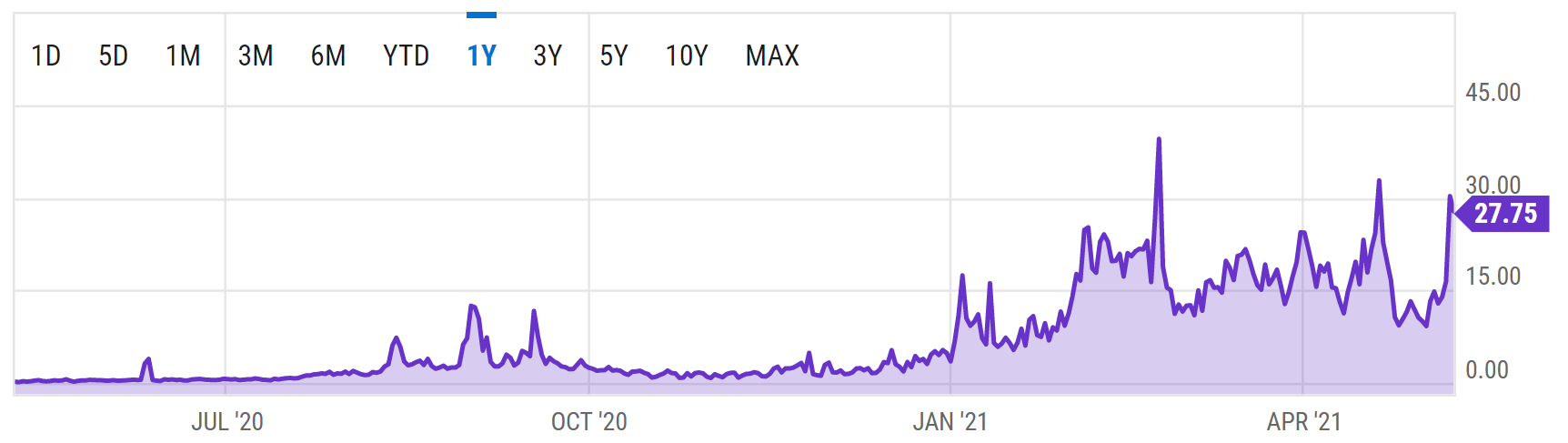

Codenamed Alonzo, the smart contract implementation into Cardano’s blockchain has had a positive impact on its native token ADA, to say the least. Last week, ADA cryptocurrency achieved its ATH at $1.77.

The initial boost of 270% came in February in anticipation of March’s Mary hard fork. This successful upgrade brought multi-asset native tokens to the Cardano blockchain, alongside the foundation to transact different types of fungible tokens and non-fungible tokens (NFTs).

Within the framework of Cardano’s roadmap, the upcoming Alonzo hard fork is somewhere in the middle, marking the departure from the Shelley era with Allegra hard fork at the end of 2020 and entrance into the Goguen era.

- Byron era – wallet implementation

- Shelley – staking, multi-asset capability, and decentralization

- Goguen – smart contracts

- Basho – optimization, and scalability

- Voltaire – governance

Therefore, Alonzo will be the first hard fork to bring in the Goguen era. The most recent update happened on April 1, codenamed Daedalus. It made it possible for users to access their ADA tokens within a streamlined interface, alongside having the ability to hold all Cardano-native tokens.

Alonzo hard fork origins

The smart contract platform is called Plutus after a character in Greek mythology. Zeus blinded him so that he could distribute his gifts without prejudice.

On the other hand, the name Alonzo comes from the American mathematician Alonzo Church who lived for almost a century (1903–1995). He was responsible for Lambda Calculus, a universal computational logic composed of three elements: variables, abstractions, and applications.

Given that Hoskinson himself is a mathematician, Church’s Lambda Calculus is no coincidence. Cardano’s smart contracts use the Haskell programming language, which itself derives from Lambda Calculus principles.

Plutus smart contracts are much more secure than Ethereum’s, according to the platform. This alone should give Cardano a new wave of investors.

After all, since 2019, DeFi exploits have cost investors at least $284 million. Likewise, the interface for creating smart contracts will give developers little room for ambiguity.

According to Hoskinson,

“Alonzo takes the Extended UTXO Model, some of which is already in the code base, adds everything to it, and then puts this beautiful Plutus platform on top of Cardano.”

Cardano’s impact on the DeFi ecosystem

As demonstrated by the exodus from Ethereum to Binance Smart Chain, with PancakeSwap supplanting Uniswap, there is a high demand for DeFi dApps. As of press time, Ethereum’s average transaction fee is still uncomfortably high.

If Cardano had implemented smart contracts at the beginning of the year, it would now be in a drastically better position. As it stands, both Cardano and Ethereum are working on their upgrades only a few months apart.

However, Cardano already made its blockchain inroads in undeveloped markets, such as Africa, South America, and Southeast Asia. It is primarily used for tracking goods. These include logistics in agricultural and trading sectors. One of its biggest partners making that happen is Emurgo.

Just last week, the global consultancy company helped the Cardano Foundation reach a deal with the government of Ethiopia.

The future of ADA

IOHK, the research organization building Cardano blockchain, is set to service 5 million Ethiopian students. It aims to track their performance in a non-fungible manner via Cardano blockchain ID.

While such projects are bound to expand Cardano’s usage and increase ADA’s price, it may falter compared to Ethereum in the end.

After all, unlike Ethereum, Cardano has a system in which ADA holders vote on transaction fees instead of leaving it to dynamic market forces.

As such, Cardano may become less flexible because voters won’t be able to keep track of the shifting demand for new dApps.

Lastly, despite getting up to 7th rank, Cardano (ADA) is not likely to catch up with Ethereum’s much larger dev pool and network effect.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.