Chainlink (LINK) is retracing after reaching a new all-time high price on April 16.

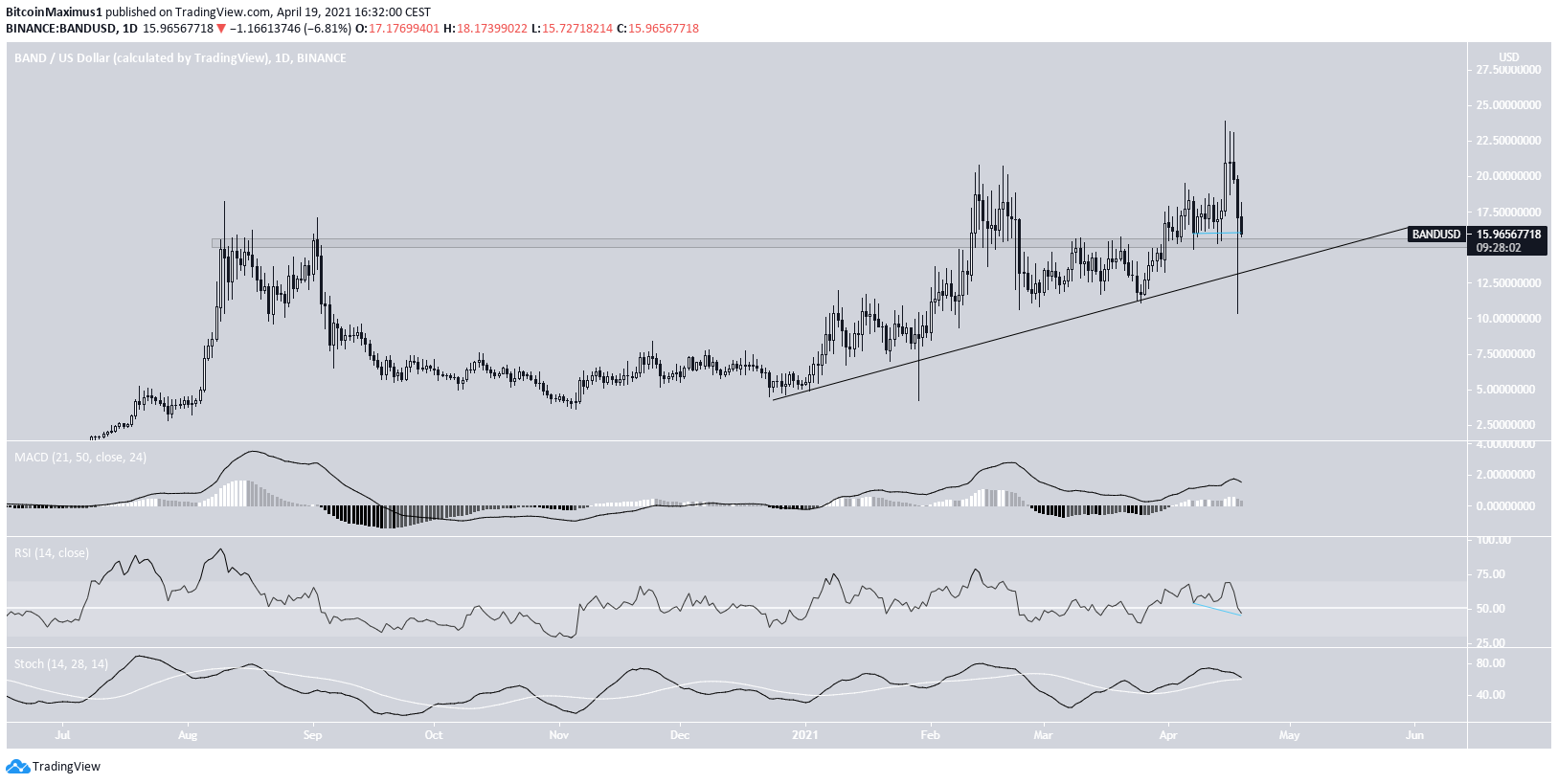

Band Protocol (BAND) is trading above long-term support at $15.30.

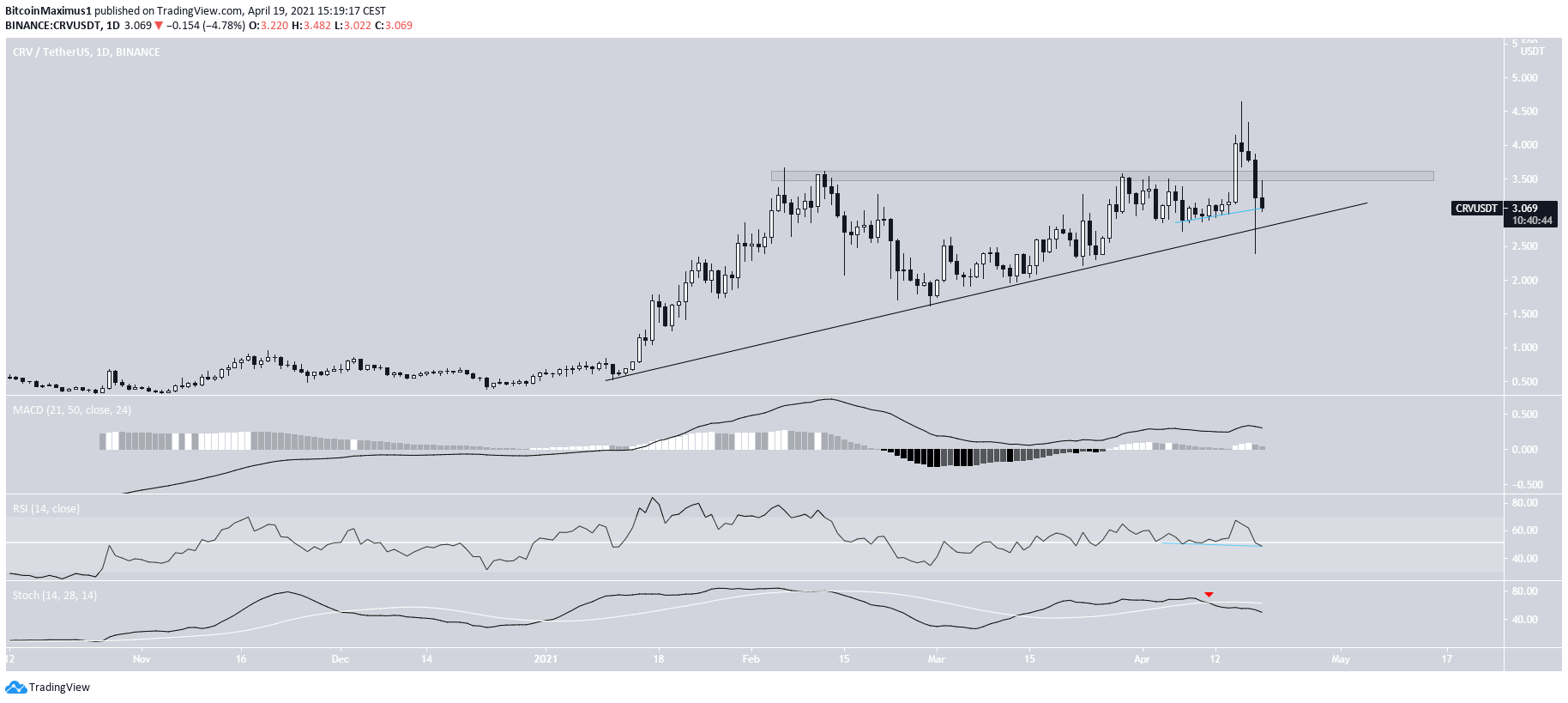

Curve Dao Token (CRV)

CRV has been following an ascending support line since Jan. 10. Throughout this line, it was facing resistance at $3.55.

It purportedly broke out on April 15, reaching a high of $4.65 the next day.

However, it fell below the horizontal $3.55 area shortly afterward and is currently trading just above this support line.

The wave count, however, is bullish. It suggests that CRV is in wave four of a bullish impulse (white) that began on Nov. 2020.

The increase since March looks very corrective. Therefore it is unlikely that wave five has ended.

To the contrary, it is more likely that wave four is a running flat correction.

Potential targets for the top of wave five are found at $5.74 and $7.77, respectively.

Highlights

- CRV is following an ascending support line.

- It has completed a running flat correction.

Chainlink (LINK)

On Feb. 20, LINK reached a then all-time high price of $36.93. It then decreased and struggled to move above this high until April 14.

The ensuing breakout took the token to a new all-time high price of $44.3 on April 15.

While LINK decreased afterward, it only served to validate the $35 level as support. The resulting bounce created a very long lower wick, a strong sign of buying pressure.

The next resistance levels are found at $46.88 and $63.11, respectively.

The shorter-term chart shows that the token is following a descending resistance line. So far, it has made three unsuccessful attempts at breaking out.

On the other hand, the ensuing bounce that followed the drop has been significant, measuring 46%. This is a sign of strength, indicating that the token is likely to move upwards once BTC stabilizes.

A breakout from the descending resistance line would confirm that the upward movement has begun.

The closest support levels are found at $36.90, $35.30 and $33.80.

- LINK reached an all-time high price on April 15.

- It is following a descending resistance line.

Band Protocol (BAND)

BAND has been moving downwards since April 15, when it reached an all-time high price of $23.30.

Despite the drop, it is still trading above the $15.30 long-term support area. Furthermore, the decrease created a long lower wick which validated a long-term ascending support line.

If BAND bounces, the ensuing upward movement could take it to the next resistance area of $26.82.

The short-term chart shows a significant bounce from yesterdays lows.

While BAND is currently retracing, there is minor support at $15.37, $14.54, and $13.72. The $15.37 level also coincides with the previously outlined long-term support area.

Therefore, the token is likely to find support at one of the levels outlined before moving upwards.

Highlights

- There is long-term support at $15.30.

- BAND is following an ascending support line.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.