Polkadot (DOT) has followed a descending resistance line since reaching an all-time high price on Feb. 20.

DAO Maker (DAO) has reclaimed the previous all-time high resistance.

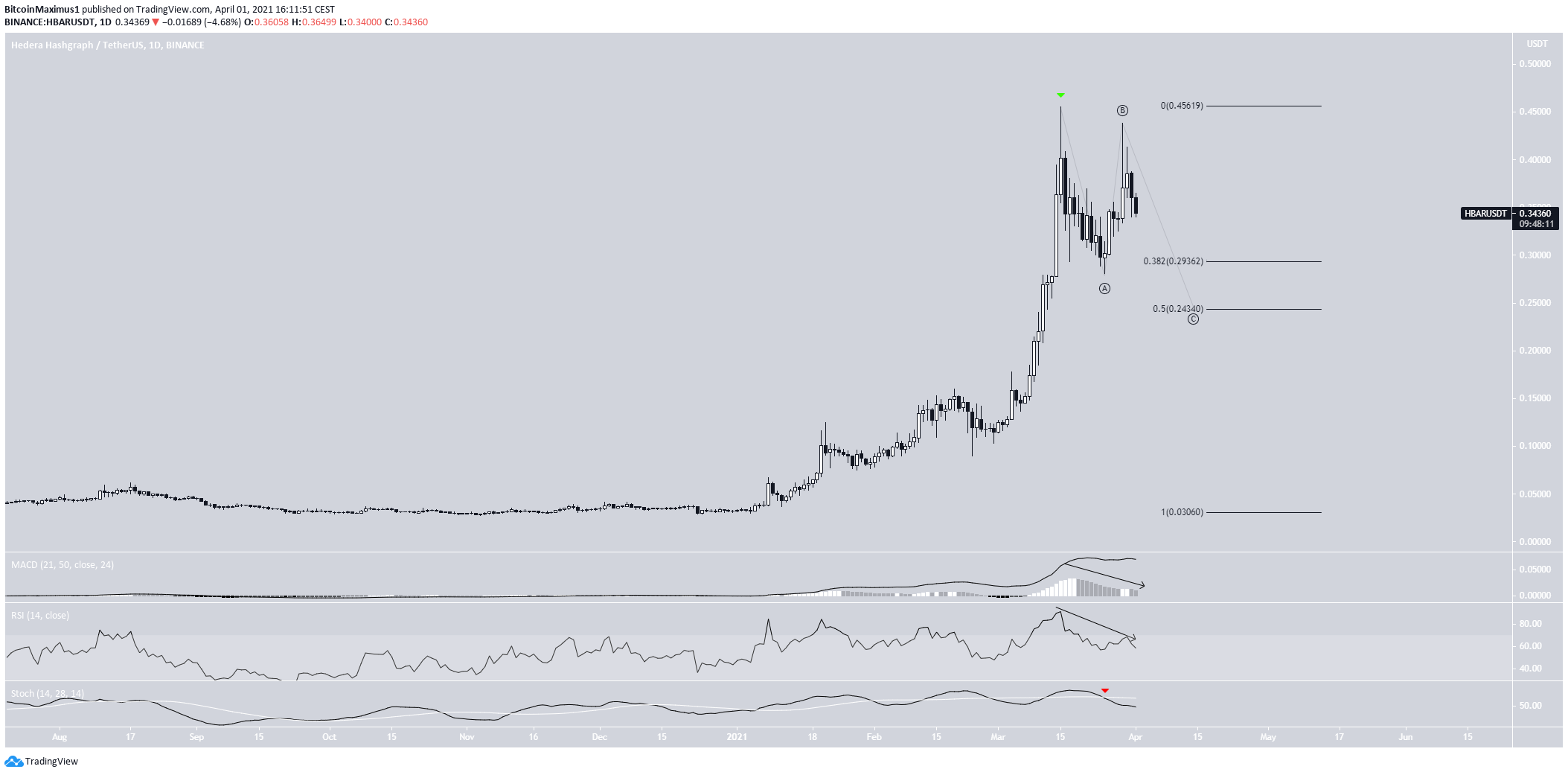

Hedera Hashgraph (HBAR) is potentially in the C wave of an A-B-C corrective structure.

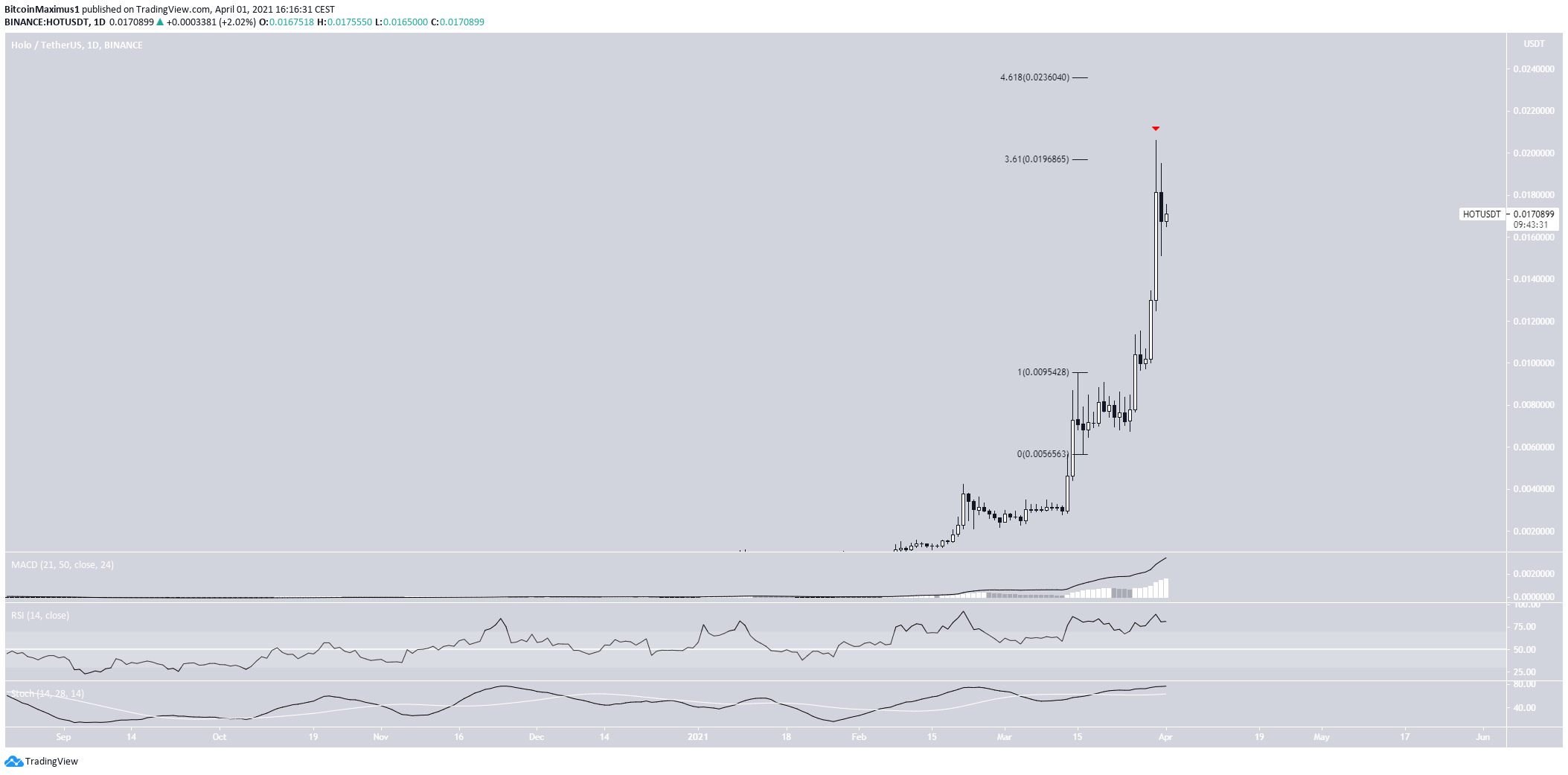

Holo (HOT) is increasing at a parabolic rate and has reached the 3.61 external Fib retracement resistance.

Polkadot (DOT)

DOT has been moving downwards since reaching an all-time high price of $42.28 on Feb. 20.

Since then, it has made two unsuccessful breakout attempts and is currently making its third one.

In addition, the line is strengthened by the $39.50 resistance area.

Nevertheless, technical indicators in the daily time-frame are bullish. The MACD has given a bullish reversal signal, and the RSI has crossed above 50.

Therefore, an eventual breakout is expected, though a rejection in the short-term could occur.

If DOT breaks out, the next major resistance area would be at $51.80, found using an external retracement on the most recent drop.

Highlights

- DOT is following a descending resistance line.

- It is trading close to resistance at $39.50.

DAO Maker (DAO)

DAO has been decreasing since March 22, when it reached an all-time high price of $8.56. Throughout the decrease, it followed a descending resistance line.

On March 31, it broke out from this line and is currently validating it as support. The breakout transpired after DAO bounced at the $6.50 area, validating it as support.

Technical indicators are neutral, failing to confirm the direction of the trend.

The closest resistance area is found at $8.40.

Highlights

- DAO is trading above support at $6.50.

- It has broken out from a descending resistance line.

Hedera Hashgraph (HBAR)

HBAR has been increasing in a completely parabolic movement for the entirety of 2021. It reached an all-time high price of $0.455 on March 15 but created a long upper wick afterward.

Several days later, it made another attempt at moving upwards but created another long upper wick.

Technical indicators are bearish. The MACD & RSI are decreasing while the Stochastic oscillator has made a bearish cross.

HBAR may be in the C wave of an A-B-C corrective structure. If so, it could decrease all the way to the 0.5 Fib retracement support level at $0.243.

Highlights

- HBAR has been decreasing since March 15.

- Technical indicators are bearish.

Holo (HOT)

HOT has been increasing parabolically since March 16. On March 30, it reached an all-time high price of $0.021 and decreased slightly.

The rejection occurred right at the 3.61 external Fib retracement of the previous drop, a likely resistance area.

While technical indicators have not yet shown any weakness, the parabolic rate of increase is likely unsustainable.

If HOT makes another upward move, it will find the next resistance at $0.236.

Highlights

- HOLO is increasing at a parabolic rate.

- There is resistance at $0.0197 and $0.0236.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.