The Monero (XMR) price has been decreasing since it was rejected by the long-term $250 resistance area on Feb. 20.

Despite the rejection, XMR seems to be holding up above the minor $185 support area and should continue increasing.

XMR Long-Term Levels

XMR has been decreasing since reaching a high of $287 on Feb. 20. The rejection occurred right at the 0.5 Fib retracement level measuring from the all-time high price of $476.

Technical indicators are mixed. While the MACD is increasing, the Stochastic oscillator has made a bearish cross. The RSI has formed bearish divergence, but a drop has already occurred as a result.

If successful in breaking out, the next resistance area would be at $380.

Current Movement

The daily chart shows that XMR has bounced at the $185 minor support area, a level that previously acted as resistance, creating a long lower wick in the process.

While this is a sign of buying pressure, technical indicators are neutral since both the Stochastic oscillator and the RSI are at critical junctures as to whether the trend is bullish or bearish.

A breakdown from this level would confirm the bearish trend, while a significant bounce would do the opposite.

The shorter-term two-hour chart is more bullish since it shows a breakout from a descending resistance line. In addition, both the MACD and the RSI are increasing.

If XMR manages to clear the $230 resistance area, it would confirm the bullish trend.

Wave Count

The wave count suggests that XMR is in an extended wave five of a bullish impulse (white) that began on Mar. 2020. The sub-wave count is in orange.

A potential target for the top of this move is near $360, using an external retracement on sub-wave four (orange) and a Fib projection on waves 1-3 (white).

This would also align with the long-term resistance area outlined in the first section.

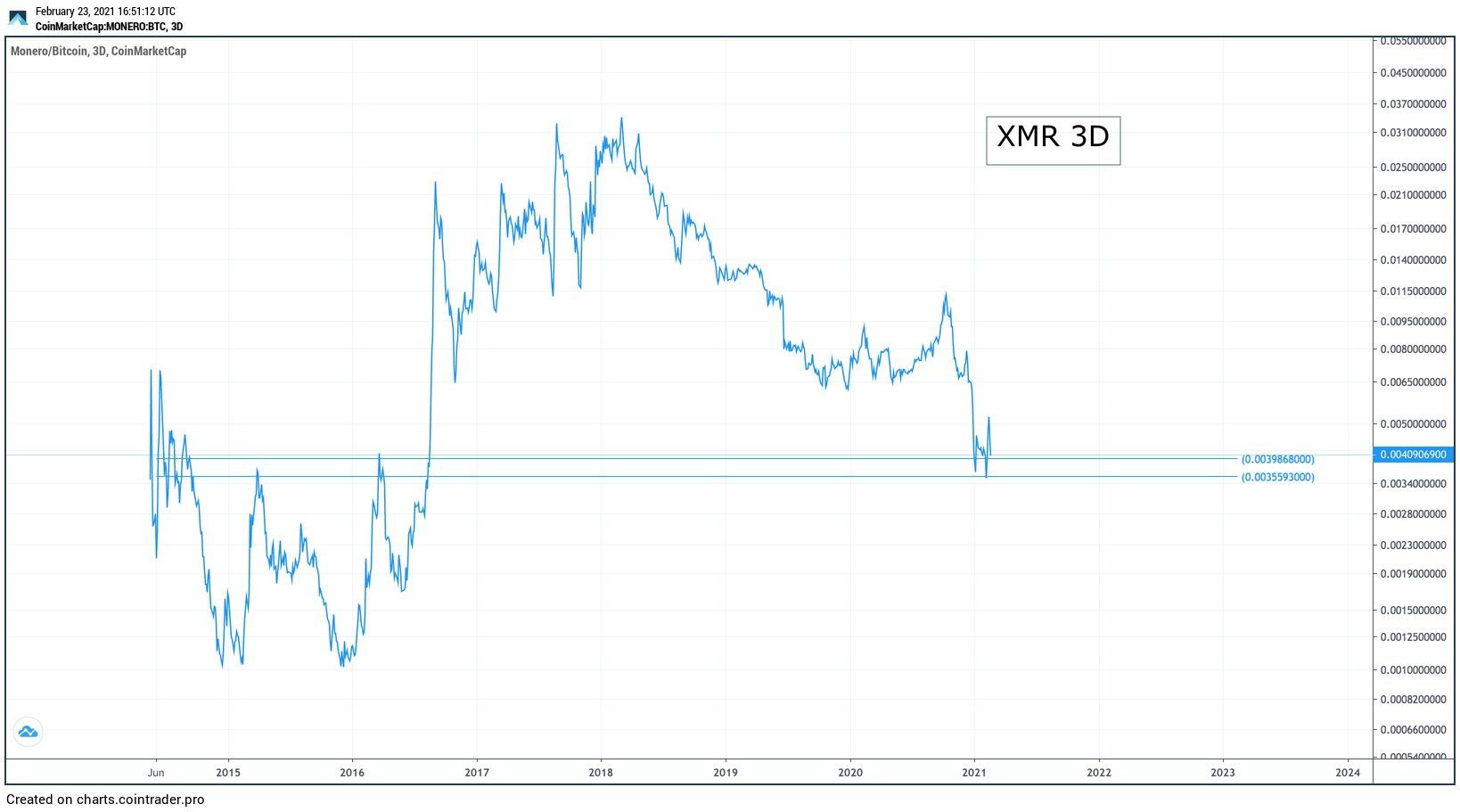

XMR/BTC

Cryptocurrency trader @Elliotwavefrog outlined an XMR/BTC chart, stating that the Jan. low is likely to be a local low since it validated a breakout level from 2016.

On Jan. 8, XMR reached a low of ₿0.0034 and has been increasing since. In addition, the RSI has formed significant bullish divergence.

Nevertheless, until the previous breakdown area at ₿0.0063 area is reclaimed, the trend is bearish.

Conclusion

To conclude, while XMR’s trend direction is unclear, it’s likely to be bullish as long as it doesn’t close below $185.

While XMR/BTC has been showing potential bullish reversal signs, the reclaim of the ₿0.006 area is required to confirm the bullish trend.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.