When subreddit r/WSBs started to buy GameStop stock (GME) to punish short sellers, they had no idea it would bring global attention to cryptocurrencies.

It all began with cat food

Chewy.com co-founder Ryan Cohen started buying GameStop shares last August. By the time he became GameStop’s largest stockholder, he was warning America’s largest videogame retailer to shutter brick and mortar stores in favor of an online model.

The move was ambitious, intelligent, and in retrospect, worth almost $3 billion.

While GameStop shares rose in value, not everyone was so optimistic the retailer could turn things around. A hedge fund called Melvin Capital Management decided to short the stock. But Redditors had other plans.

A group of retail investors led by a user named DeepF*ckingValue decided to teach the hedge funds a lesson. On Jan. 22, 2021, GME jumped to $150, then to $339, and on Jan. 28, 2021, briefly reached a high of $483.

“Bankrupting institutional investors for dummies”

With the stock outlandishly overpriced, short sellers doubled down, increasing the short positions. As the price rode up to past $400, Melvin Capital sold its short positions, essentially giving in.

The source of this unbridled upward pressure appeared to come form a subreddit called r/Wallstreetbets (WSB). A number of posts revealed that users were intentionally trying to short squeeze GameStop’s short sellers.

A short squeeze is when short-sellers suddenly buy up a stock to cut their losses as a stock price goes up. This injection of funds results in sharp price hikes.

Thus, individual retail investors came together and “rekt” the hedge fund short sellers as GameStop’s price held. On Jan. 28, 2021, Reuters reported that the short sellers had already lost $70 billion.

Soon after GameStop’s massive rise, the wall street bettors began looking for other highly-shorted stocks to sell. The AMC theaters seemed ripe. Weakened from coronavirus, the movie theater conglomerate saw its stock price quadruple to nearly $20 overnight. Some leveraged traders made, and lost, large sums on AMC.

Playing the long GameStop

Interestingly, the plan to bankrupt hedge funds was already months in the making. Four months prior to the incident, a detailed post on r/wallstreetbets made the case for the GameStop-fueled destruction of institutional investors. The post was called “Bankrupting Institutional Investors for Dummies.”

While the high stock price resulted from a kind of manipulation, it appears to fall into a legal gray area in the United States. Misrepresenting the value of a stock seems to be the US Securities and Exchange Commission’s (SEC) definition of price manipulation.

The Washington Post reported that finding manipulators would be difficult because of their lack of official association and the anonymity of the internet.

Organized pump and dump schemes are also illegal, but as the r/WSB subreddit itself organized nothing, this looked a lot more like bubble euphoria and hype.

Is Wall Street the real fraud?

Then again, traditional Wall Street firms manipulate markets all the time, argues journalist Doug Henwood. The idea that stocks actually “represent” the value of companies is ridiculous. Companies’ market caps are generally much larger than their earnings warrant.

Large corporations will also buy back company stock when they become flush with cash (though this action was curbed in 2020’s stimulus package). Stock buybacks decrease market supply leading to a higher stock prices.

Stockholders are happy because they make money, and company executives are happy because their salaries, often paid in stocks, also grow. But new value in the actual company does not change.

The idea that redditors misrepresented GME’s value is a double standard, since the intrinsic value of any publicly traded company is not dictated by stock price, Henwood argues.

Short squeeze: an honest living

On the other hand, some believe that WSB’s GameStop pump was indeed about the company’s true value. Eddie Koo, a Business Analyst involved in some of the recent trading, told BeInCrypto that WSB was fully in the right:

“We’re all trading on publicly available information within the bounds of the trading rules and a good understanding market dynamics. Hedge funds were overleveraged, did lazy research, and managed their risk poorly. We did our due diligence.”

Moreover, Wall Street companies have the ears of regulators and large corporations. Koo explained what he sees as unfair Hedge Fund (HF) tactics:

“When the HFs are facing liquidation, they advise brokerages to halt retail from buying on tickers they have a short position in, then trade with other HFs at low bid/ask ping ponging back to each other at lower prices each time to cover their positions on the cheap and manipulate the price for their put contracts.”

Wall Street did flex its muscles, and the reaction was a revolt.

Two rules, one system

It appears the short sellers who lost billions used their influence to try and stop r/Wallstreetbets. The WSB subreddit was closed. Many stock brokers including the millennial-loved Robinhood froze trading of certain stocks, citing volatility, but apparently at the behest of hedge funds. Soon enough, Robinhood, which was a major onramp for crypto, froze some crypto purchases as well.

What’s more, a blacklash against Robinhood in the form of bad Google Play Store reviews resulted with Google unjudiciously removing those negative comments.

Discord chat servers originally said they would also ban WallStreetBets, but backtracked following a backlash.

Maria Stankevich, Chief Busines Development Officer of EXMO UK, blamed these shutdowns on the influence of instutional investors. She said that hedge fund managers were shaking in their boots:

“One thing has become clear — the big guys are really afraid, and they close the trading of those shares that are pumped thanks to the WSB. Ordinary people make money, hedge fund managers lose.”

The SEC even released a statement on Jan. 29, 2021 regarding the recent price volatility. The statement, signed by several high-ranking SEC officials including “Crypto Mom” Hester Pierce, said the regulator would review actions taken over the last week. The statement claimed to have retail investors’ best interests in mind.

Even Reddit froze the r/Wallstreetbets page, though this only led to the rise of r/satoshistreetbets. And WSB’s red-headed step brother had a pet dog named DOGE.

Crypto takes note

While crypto lovers have been watching the story closely and pointing out the hypocrisy of Wall Street, they had their own plans.

Following the r/wallstreetbets freeze, a new subreddit gained popularity called r/satoshistreetbets. This new band of retail investors rallied to pump the meme-fueled DOGE coin into the top 10 crypto assets. The now “homeless” r/wallstreetbets members appeared to have joined in as well, but maybe it was Elon Musk (who cheered-on r/WSB) who gave crypto an extra boost.

The world’s richest man changed his Twitter bio to read simply “Bitcoin,” and BTC pumped 15% within hours on Jan. 29, 2021. This sent a surge of new users into crypto.

Disgruntled Robinhood and r/WSB users appeared to have flooded major crypto exchanges to such an extent that several, including Binance, Kraken, and Coinbase, all had difficulties with their websites. Demand was so great, Binance had to freeze some trading, according to their CEO CZ.

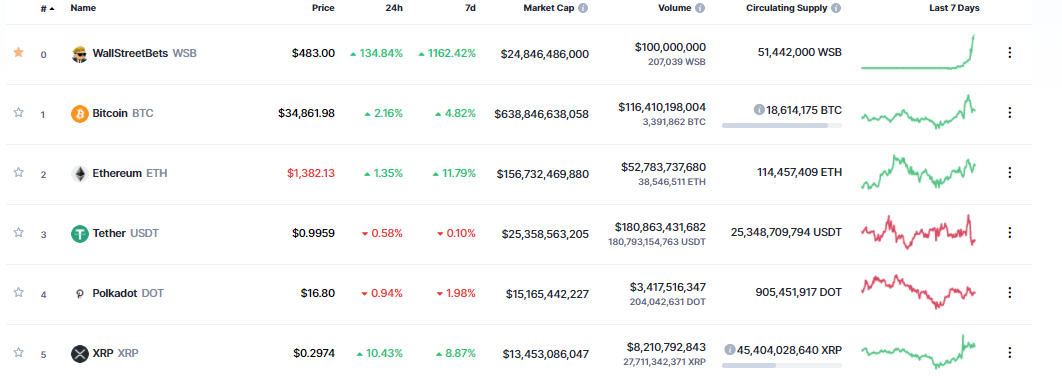

Coinmarketcap even honored WSB with a fake meme coin at a rank higher than bitcoin at #0.

In classic crypto style, many in the community are attracting newcomers with calls for an unregulatble market. DeFi and AMMs like Uniswap have proven that a trustless exchange system is possible.

Likewise, a decentralized system would remove barriers to investing like not being an accreddited investor or meeting the criteria to trade options (for better or worse).

With such systems, there is no regulator or central authority, like the SEC or Robinhood, that can give preference to certain customers above others. Talk on Reddit even began about creating fully decentralized stock markets.

Revenge for 2008, served cold?

The recent fall in major American stock indices was blamed by CNBC on the volatility of these pumps. But then again, the markets were bloated, at all time highs, and ex Grayscale CEO Gary Silbert predicted these levels as the top.

But some are seeing the shakedown of Wall Street as the average Jane’s revenge for government bailouts of the rich in 2008 and 2020. At the time, complex derivatives led to a market bloated with bad credit and doomed to fail.

When things collapsed, the US government lent incredible amount of money to coporations that were, “too big to fail,” while leaving the little guy in a rut. Some of the mistakes were repeated in 2020.

A number of op-eds and tweets called out Wall Street for their double standard. They point out hat regulators did little to stop the 2008 economic crisis when big banks were taking huge risks to manipulate the market into gains.

When retail traders tried the same thing this week, they were shut down from the very top within days (though some are happy to just have the money).

America comes together

If nothing else, the GameStop fiasco has shown the power a large group of individual strangers can have when they come together, and American’s politicans have taken note.

Arizona Congressman Paul Gosar wrote a letter to the US Attorney General castigating Robinhood for its one-sided shutdown of certain stocks. While Gosar is a Republican and strong Trump ally, it is quite a surprise that some Democratic politicians were echoing his concerns.

Alexandria Ocasio-Cortez, who is often seen as one the most left-leaning members of congress, also expressed concern for special treatment of Wall Street intuitions. Her quote was retweeted by Republican rival Ted Cruz.

In fact, few in politics are taking the sides of the hedge funds. This is likely because both parties want to appeal to “the little guy” who sympathizes with the retail investors.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.