- Blockstack (STX)

- TROY (TROY)

- Ravencoin (RVN)

- Chiliz (CHZ)

- Origin Protocol (OGN)

In this article, we will take a look at each of them and determine their potential for increasing.Have you noticed what's happening?

— TraderLenny (@TraderLenny1) February 6, 2020

-> Majors have pumped for a month ( $EOS, $XRP, $ETH, $ADA, $LTC, $XTZ,…)

-> Mid caps are now starting to pop ( $STX, $TROY, $RVN, $CHZ, $OGN,…)

-> After this: small caps.

These are the usual cycles within an #altseason.

It's here. 🚀

Blockstack (STX)

The main STX resistance area is found at 1800 satoshis. The price has made three attempts at breaking out, but all have been unsuccessful. More recently, the price has been trying to break out above this area since beginning a rapid upward move on February 6 — but has created long upper wicks and decreased each time. The RSI supports a breakout. It has been generating a bullish divergence since December 13, 2019, and has moved clearly above the 50-line — indicating that the price is in an upward trend. The next resistance area is found at 2600 satoshis. In the short-term, the price is trading inside a symmetrical triangle. Since this pattern has been created after an upward move, we believe it will act as a continuation and cause the price to finally break out from this resistance area.

A breakout that travels the entire height of the pattern would take the price to 2300 satoshis (solid line). The most likely movement afterward would be a retest of the current resistance area as support followed by an increase to 2600 satoshis. Measuring from the current price, this is an increase of 64 percent. A breakout above this area would constitute an all-time high and take STX into price discovery mode.

The breakout is supported by the bullish cross of the 50- and 200-period moving averages (MAs), which have just transpired.

In the short-term, the price is trading inside a symmetrical triangle. Since this pattern has been created after an upward move, we believe it will act as a continuation and cause the price to finally break out from this resistance area.

A breakout that travels the entire height of the pattern would take the price to 2300 satoshis (solid line). The most likely movement afterward would be a retest of the current resistance area as support followed by an increase to 2600 satoshis. Measuring from the current price, this is an increase of 64 percent. A breakout above this area would constitute an all-time high and take STX into price discovery mode.

The breakout is supported by the bullish cross of the 50- and 200-period moving averages (MAs), which have just transpired.

STX Price Conclusions

- The STX price is trading inside a symmetrical triangle.

- There is resistance at 1800 and 2600 satoshis.

- Technical indicators support a price increase.

TROY (TROY)

The main resistance areas for TROY are found at 64, 93 and 130 satoshis. The price has been trading below the 68 satoshi resistance area since January 14. In addition, the price made an upward move on February 6 and reached this resistance area, but created a long upper wick and decreased. While the RSI has been generating bullish divergence, it has yet to move above the 50-line. Combining this with the fact that the price has yet to move above the first resistance area, we can state that the price has not begun an upward trend yet — even though there are several reversal signs present. In the short-term, the TROY price broke out from a descending resistance line on February 4. The line had been in place for 44 days.

However, the price has yet to initiate an upward move and has made a double bottom near 50 satoshis instead. A move to the all-time high of 130 satoshis would be an increase of 125 percent from the current price level.

In the short-term, the TROY price broke out from a descending resistance line on February 4. The line had been in place for 44 days.

However, the price has yet to initiate an upward move and has made a double bottom near 50 satoshis instead. A move to the all-time high of 130 satoshis would be an increase of 125 percent from the current price level.

TROY Price Conclusions

- There is resistance at 64, 93 and 130 satoshis.

- The TROY price has broken out from a descending resistance line.

- It has yet to initiate a significant upward move.

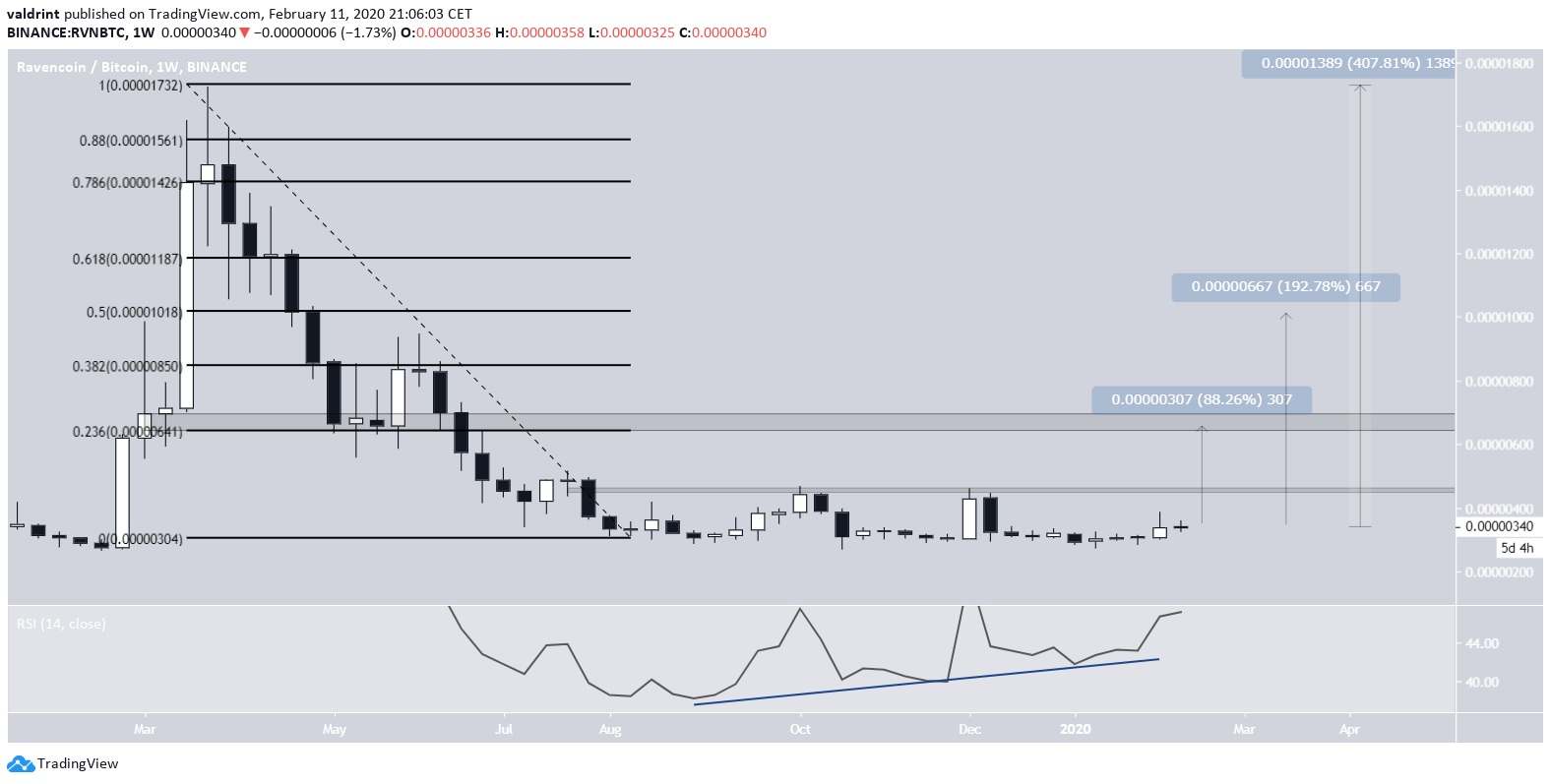

Ravencoin (RVN)

On February 3, the RVN price broke out from a descending wedge and has been increasing since. This increase caused the price to move above the 200-day moving average (MA). In addition, the 50-day MA is moving upwards — setting itself up for a bullish cross with the longer-term 200-day one. There is almost no resistance all the way to 455 satoshis, so the price could get there relatively quickly. We can use a Fibonacci retracement since the all-time high of 1724 satoshis to find long-term targets for the future price movement. The first one is found at 660 satoshis, acting as both a previous support level and the 0.382 Fib level of the entire decrease.

Afterward, the 1000 satoshi area is likely to provide resistance prior to the all-time high of 1700 satoshis. Measuring from the current price level, these areas represent increases of 88, 192 and 407 percent. This makes RVN the coin with the highest increase potential out of the five coins we are analyzing.

The bullish divergence developing in the weekly RSI since September 2019 suggests that the price will eventually break out.

We can use a Fibonacci retracement since the all-time high of 1724 satoshis to find long-term targets for the future price movement. The first one is found at 660 satoshis, acting as both a previous support level and the 0.382 Fib level of the entire decrease.

Afterward, the 1000 satoshi area is likely to provide resistance prior to the all-time high of 1700 satoshis. Measuring from the current price level, these areas represent increases of 88, 192 and 407 percent. This makes RVN the coin with the highest increase potential out of the five coins we are analyzing.

The bullish divergence developing in the weekly RSI since September 2019 suggests that the price will eventually break out.

RVN Price Conclusions

- The RVN price broke out from a descending wedge.

- There is resistance at 455 and 660 satoshis.

- Long-term targets at 1000 and 1700 satoshis.

- The long-term RSI supports a price increase.

Chiliz (CHZ)

The most important area for the CHZ price is found at 76 satoshis. This area has intermittently acted as resistance and support. The price bounced on the 76 satoshi support area on February 1 and has been increasing since. The RSI moved above 50, something it has not done since December 3, 2019. Therefore, the RSI movement has captured the direction of the trend perfectly until now, since an RSI value below 50 has indicated that the price is in a downward trend and vice versa. Based on this, we can assume that the price is in an upward trend. In the short-term, the CHZ price is following an ascending support line. The closest resistance areas are found at 145, 175 and 200 satoshis.

The final resistance area of 200 satoshis is 82 percent higher than the current price.

In the short-term, the CHZ price is following an ascending support line. The closest resistance areas are found at 145, 175 and 200 satoshis.

The final resistance area of 200 satoshis is 82 percent higher than the current price.

CHZ Price Conclusions

- There is support at 76 satoshis.

- There is resistance at 145, 175 and 200 satoshis.

- The RSI suggests the price is in a bullish trend.

- CHZ is following a short-term ascending support line.

Origin Protocol (OGN)

The OGN price began an upward move on February 5 and increased by 300 percent in only three days. However, the price generated bearish divergence and has been decreasing since February 9. It has almost reached the 3000 satoshi area, which is likely to act as support in the future. The all-time high area of 4500 satoshis is likely to act as resistance. A price increase from the current level to the all-time high is an increase of 36 percent. Whether the OGN price decreases below the 3000 satoshi support area will determine if the upward trend will continue or OGN will correct. Since there is a lack of data for OGN, we cannot confidently make a prediction for the long-term price.

OGN Price Conclusions

- There is support at 3000 satoshis

- There is resistance at 4500 satoshis.

Conclusions

If all the coins were to return to their all-time highs, the price increases would be as follows- RVN: 407 percent

- TROY: 125 percent

- CHZ: 83 percent

- STX: 62 percent

- OGN: 36 percent

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.