Tokens powering Decentralized Physical Infrastructure Networks (DePIN) are emerging as assets to watch in the current market. These cryptocurrencies incentivize the creation and maintenance of physical infrastructure on decentralized platforms.

Lumerin (LMR), Destra Network (DSYNC), AIOZ Network (AIOZ), StorX Network (SRX), and Storj (STORJ) are some of the DePIN coins that promise gains in the coming month.

Destra Network (DSYNC) Sees Double Digit Surge, Eyes More Gains

Destra Network offers a decentralized cloud solution. The value of its native token, DSYNC, has risen by 33% in the past seven days. It currently ranks among DePin coins with the most gains during that period.

As assessed on a daily chart, its price movements show that the recent rally has been backed by actual demand for the altcoin. This is evidenced by its rising Relative Strength Index (RSI). As of this writing, the key momentum indicator is in an uptrend at 65.14.

RSI measures an asset’s overbought and oversold market conditions. At 65.14, DSYNC’s buying pressure significantly outweighs selling pressure.

If DSYNC continues to enjoy demand for market participants, its next price target is $0.36, a high it last traded at in May.

Lumerin (LMR) Trades Above Key Moving Average

Lumeric (LMR) is a foundational layer technology that uses smart contracts to control how peer-to-peer (P2P) data streams are routed, accessed, and transacted. Its native token, LMR, has enjoyed significant attention in the last week, with its price rising by 28% over the past seven days.

The uptick in the demand for the token has pushed its price above its 20-day exponential moving average (EMA), which measures its average price over the past 20 days.

When an asset’s price rallies past this key moving average, it signals a hike in buying pressure and is often an indicator of a continued price rally.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

If LMR maintains its uptrend, its price will climb to $0.033.

AIOZ Network (AIOZ) Trends Within an Ascending Channel

AIOZ Network operates as a decentralized platform that leverages a global network of nodes to deliver content cheaper, faster, and more securely. It is powered by the AIOZ token, the price of which has risen by 22% in the past week. As of this writing, the token trades at $0.58.

The asset’s price has formed an ascending channel on a one-day price chart. This bullish pattern occurs when the price moves between two upward-sloping parallel lines. The upper line acts as resistance, while the lower line serves as support.

At press time, AIOZ’s Aroon Up Line shows an uptrend, indicating strong market momentum. The Aroon indicator measures trend strength and identifies potential reversal points. When the Up Line is at or near 100, it suggests a strong uptrend, and the most recent high was reached recently.

If this DePin token maintains its uptrend within the ascending channel, its price will rally toward resistance to exchange hands at $0.63.

However, if the current trend changes course and AIOZ initiates a downtrend, its price will fall to $0.53.

Storj (STORJ) Flashes Buy Signal

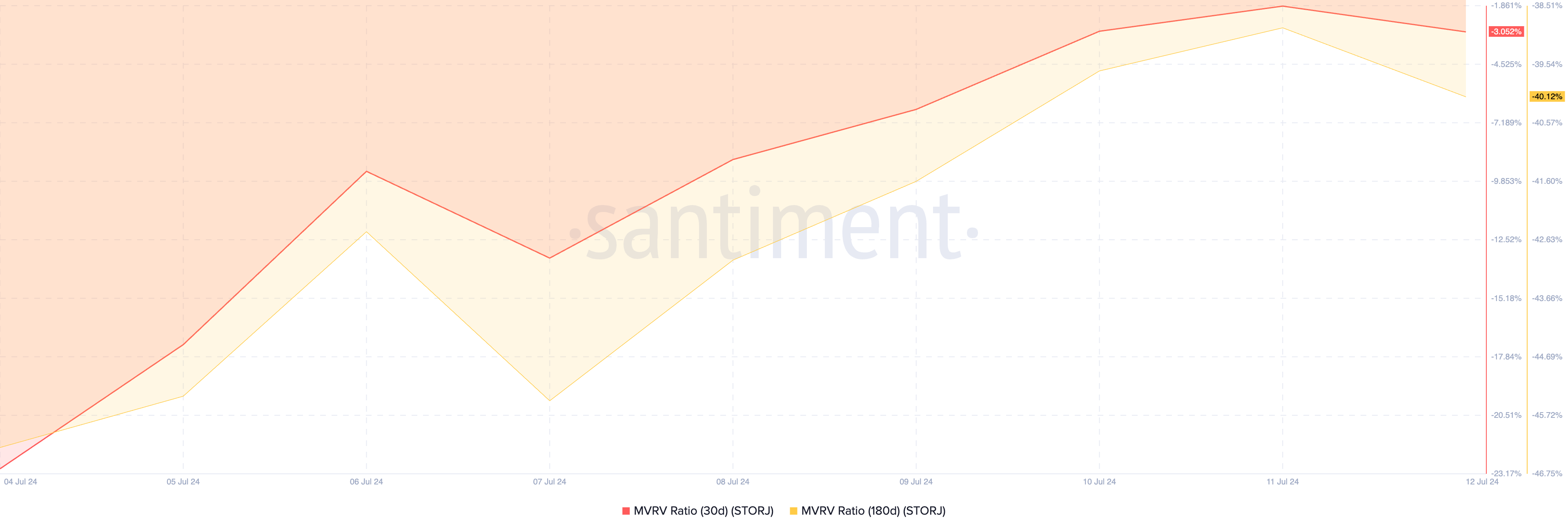

STORJ, the native token of the open-source cloud storage platform STORJ, has flashed a buy signal. This reading is based on the negative values of the altcoin’s Market Value to Realised Value (MVRV) ratio when assessed over different moving averages.

An asset’s MVRV measures the ratio between its current price and the average price at which all its coins or tokens were acquired. When it is below zero, the asset’s current market value is less than the price at which most investors acquire their holdings. The asset is deemed undervalued and offers a good buying opportunity.

According to Santiment, STORJ’s MVRV ratios for the 30-day and 365-day moving averages at press time are -3.05% and -40.12%, respectively.

A surge in STORJ’s demand at its current price level might kickstart an uptrend. Should this happen, the token’s next price target is $0.50.

Read more: Top 9 Web3 Projects That Are Revolutionizing the Industry

For context, the altcoin currently trades at $0.43, meaning a potential 16% price surge is in the books.

StorX Network (SRX) Climbs to a Monthly High, Gears For More

StorX Network is also a decentralized cloud storage network. Its native token, SRX, has seen its value climb by 10% in the past week. It currently trades at

Exchanging hands at $0.60 as of this writing, the altcoin trades at a monthly high. The token enjoys a significant bullish bias, evidenced by its positive Elder-Ray Index. At press time, the indicator’s value is 0.0081.

This indicator measures the relationship between the strength of buyers and sellers in the market. When its value is positive, it means that bull power is dominant in the market.

Read more: The Economics of Decentralized Storage Protocols

If the bulls remain dominant, SRX’s next price target is $0.062, a high it last traded at in October 2023.