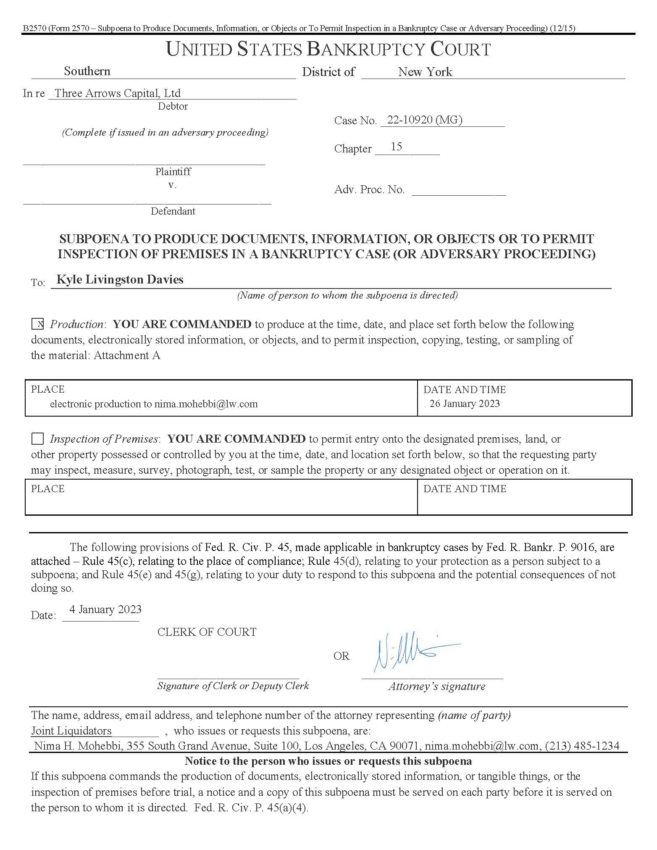

Liquidators have criticized 3AC co-founder Kyle L. Davies for failing to comply with a subpoena. They have requested a new order with a deadline of March 16.

Liquidators for bankrupt crypto hedge fund Three Arrows Capital (3AC) have called out co-founder Kyle L. Davies for failing to cooperate. The court filing, published on Feb. 7, notes that Davies was expected to comply with the subpoena by Jan. 26, 2023.

However, the liquidators state that the co-founder has not done so and has harshly criticized Davies’ behavior. The filing reads,

“… Mr. Davies has continued to post on his Twitter account, openly ignoring the Court’s directives and enjoying media attention while he continues to thwart efforts by the Foreign Representatives to gain access to documents and information. As such, the Foreign Representatives respectfully request entry of an order requiring Mr. Davies to comply with the subpoena within fourteen (14) days of the Hearing.”

The liquidators are now calling for a new order to push the compliance deadline to March 16. Davies has not yet commented on the development.

3AC owes about $3 billion to its creditors. It was one of the first companies in a long list to collapse last year. The company continues to be in the news for various reasons, with co-founder Zu Shu recently alleging that Digital Currency Group and FTX conspired to attack LUNA and stETH.

Davies Subpoenaed on Twitter

The liquidation case of 3AC remains at the center of attention, given the outstanding sum. Davies was subpoenaed on Twitter because of his activity on the platform.

Those in the crypto industry have called for the founders to accept responsibility instead of tweeting about crypto projects. The developments in the case don’t seem to deter them, however, as they are keen on other projects.

3AC Seeking $25M for a New Exchange

The founders are now working on a new crypto exchange called GTX. They are looking to raise $25 million and are collaborating with the founders of CoinFlex. It drew a lot of attention, given that 3AC is in the middle of a massive liquidation process.

Meanwhile, creditors are growing frustrated with the bankruptcy process. Liquidators have seized at least $35.6 million in fiat currencies and managed to obtain an account with over 60 crypto assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.