As Bitcoin hovers around $69,000, the crypto community buzzes with speculation about a potential market peak. Notable indicators suggest the market may be nearing a climax.

The crypto market has been choppy since Bitcoin hit an all-time high of around $73,500 in March. Since then, many have speculated if the market top is near.

Celebrity-Endorsed Meme Coins: A Double-Edged Sword

A pseudonymous crypto investor, ‘Gold,’ talks about three top signals:

- Celebrities began to create and endorse meme coins.

- The crypto community and developers are creating millions of new meme coins.

- The social media has been flooded with PnL screenshots.

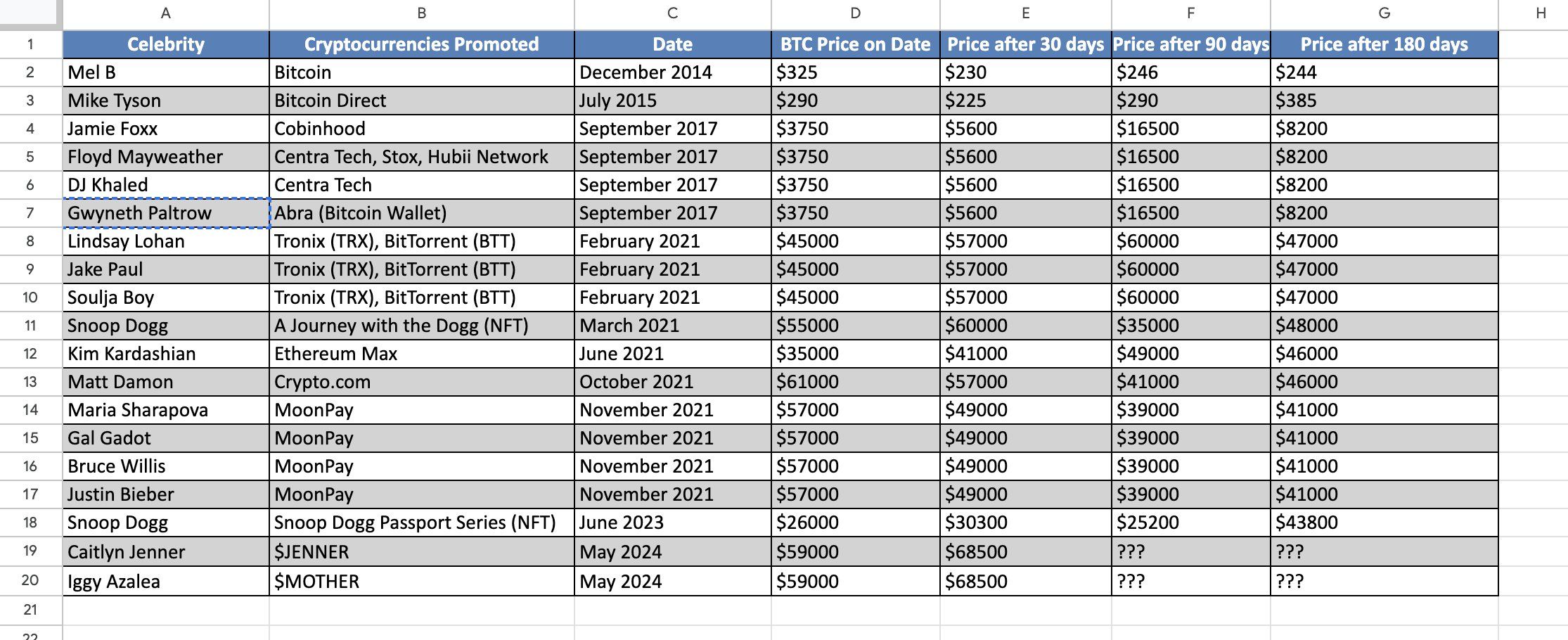

The crypto space has recently seen an increase in celebrity involvement, with figures like Caitlyn Jenner and Iggy Azalea launching their meme coins. This resurgence mirrors past cycles, where celebrity endorsements often preceded significant market corrections.

Renowned crypto analyst Miles Deutscher discusses the nuanced impact of these endorsements.

“Celebrities (love or hate them) clearly command one thing: Attention. And this attention is vital for the health of the crypto economy. With much of this attention being directed to meme coins, this sector is the standout beneficiary. However, this comes with a trade-off – as not all attention is created equal,” Deutscher said.

This trend raises questions about the real value celebrities add to the crypto ecosystem versus the potential for quick profits at the expense of uninformed followers. Historical data suggests that the involvement of celebrities in crypto, while initially boosting market activity and coin liquidity, could also signal approaching market tops, as seen in the cycles of 2017 and 2021.

“Based on this, we can conclude that when celebrities start promoting cryptocurrencies, the market usually experiences a final leg up before reaching a local top. In any case, the sample size is small, and therefore the edge is limited. Nonetheless, it is interesting,” crypto influencer – Capo of Crypto said.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

Meme Coin Mania: Indicator of Market Euphoria

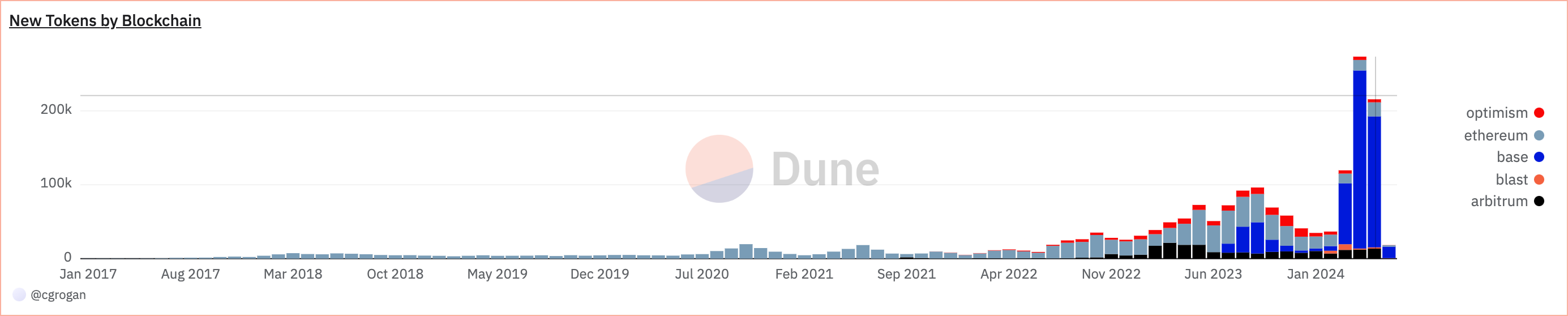

Furthermore, the explosion of meme coins might be another red flag. A staggering increase in new meme coins, as reported by a Dune dashboard from Coinbase executive Conor Grogan, highlights the frenzy.

Over one million meme coins were created in April alone, surpassing the total number of tokens created on the Ethereum blockchain since its inception. This spike reflects extreme market greed, a classic sign of a market top.

This is because many developers try to make quick profits by creating meme coins. Moreover, some bad actors also conduct rug pulls through meme coin launches.

Crypto investor Andrew Kang offers a counter perspective, suggesting that meme coins now represent a mature sector that leads rather than follows the market. However, the general consensus remains that such exponential growth in meme coin production is a precursor to a market downturn.

“Meme coins pumping are no longer indicators of local tops because memecoins are no longer the last rung of desirability as a sector. In fact, they are the sector that new capital allocators believe in the most. Memes have and will lead the market,” Kang argued.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

PnL Screenshot Flood: A Symptom of Overconfidence

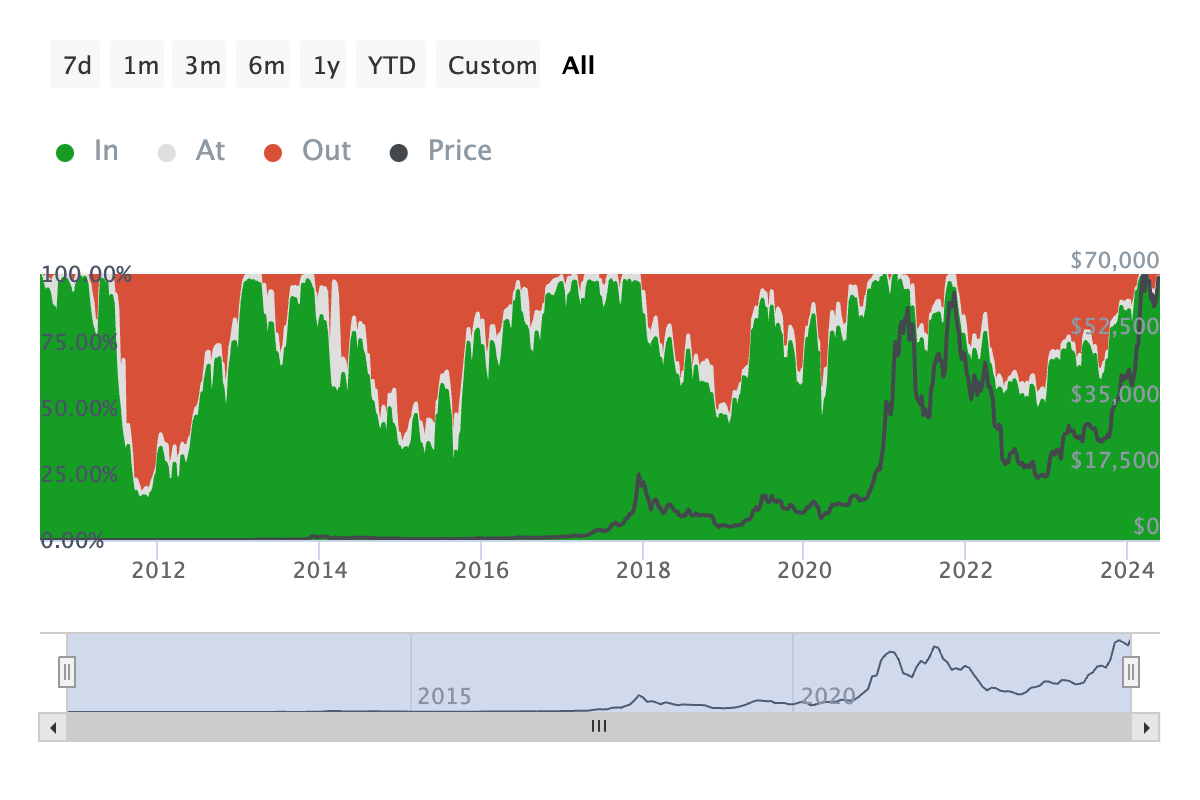

Additionally, the third indicator is the prevalence of PnL screenshots across social media platforms, illustrating widespread profitability among traders. While this might seem positive, historically, markets tend to reverse when such euphoria reaches its zenith.

The ease of securing profits during these periods often doesn’t last, and the overwhelming display of gains could well be the setup for a subsequent fall.

For instance, year-to-date, over 90% of Bitcoin investors are ‘In the Money,’ meaning they are profiting from their holdings. Historically, the market has reversed after a considerable period of such massive profitability.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Each of these signals—celebrity-driven meme coins, the proliferation of meme tokens, and the public display of financial gains—might not alone dictate market behavior. However, their simultaneous occurrence should give both retail and institutional investors pause.

Past patterns have shown that celebrity involvement and meme coin mania correlate with peak market phases followed by sharp declines. Observing these indicators in conjunction might help investors anticipate and potentially mitigate risks associated with an impending market top.

However, Gold also notes that some significant bullish catalysts could invalidate the speculations of a market top. Hence, investors should consider these nuances and make their investment decisions accordingly.