Bitcoin (BTC) and the global crypto market cap have moved in tandem over the last few months as the top cryptocurrency leads larger market momentum.

The global crypto market has been in a long-drawn downtrend for over 11 months now as Bitcoin, Ethereum (ETH), and most of the top altcoins undergo massive correction.

After Bitcoin’s price made the $69,000 all-time high in Nov. 2021, the larger crypto market has declined in price in tandem with BTC.

The historic pullback has affected HODLers, traders, and investors as top crypto assets continue to oscillate in proximity with the lower price range.

October unlikely to offer relief for crypto

Bitcoin, the oldest cryptocurrency with the largest market capitalization of over $368 billion, is often called the king coin of the market, and rightly so. Being a first mover and the top coin, BTC price typically directs the larger market flow unless in an altcoin season, or altseason.

At press time, BTC price stood at $19,153.35, still oscillating in a tight range below the $20,000 mark. With no major short-term bullish catalysts in sight, Bitcoin price has little to no support in case of a bearish turn.

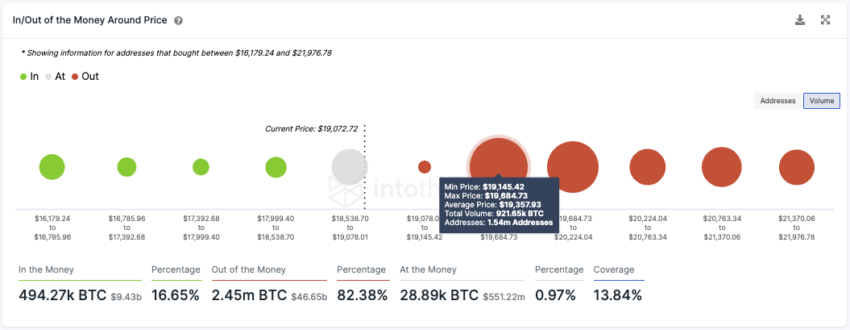

BTC price recently dipped below a crucial demand wall around the average price of $19,357 based on Into The Block’s In and Out of Money around the price Indicator.

Notably, if BTC price continues to dip, the addresses that are now underwater may be forced to sell, further pushing BTC price lower.

For now, the next significant support for BTC would be at the $16,000 mark. However, a revisit to that lower level could also trigger significant losses for the larger crypto market.

It’s Bitcoin season, for the time being

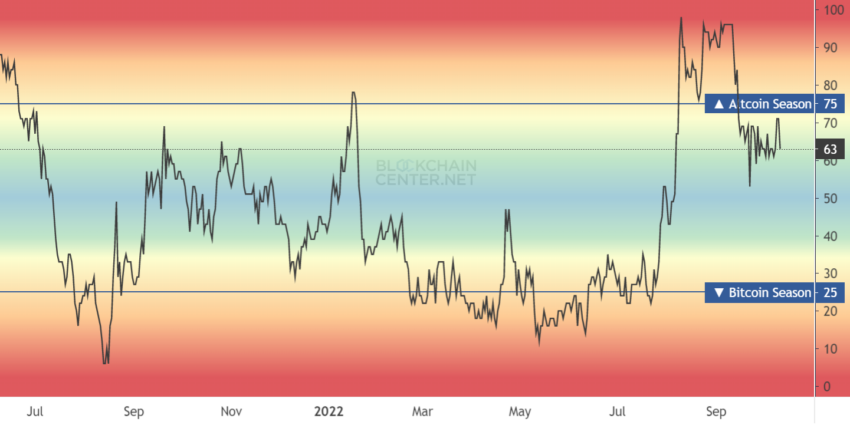

In an altseason, investors often expect decent gains from the massive rallies that altcoins present as BTC maintains a calm yet bullish tone. Over the last few weeks, the market has been strongly BTC-led, and an altseason doesn’t seem to be on the cards for crypto investors, according to altseason index.

Moreover, with the BTC volatility index dropping to its lowest since Dec. 2020, the exciting volatility that aids sudden price momentum, often fueling short-term gains for altcoins, is also missing in action.

All in all, with Bitcoin governing larger market momentum as most of the top altcoins presented a high correlation with Bitcoin price, seemingly more sell-offs could await investors.

Additionally, sell-off warnings in the Bitcoin market by analysts are still surfacing, as reported in a previous article.

Thus, Oct. could play out at the mercy of BTC, and with Bitcoin price at crucial crossroads, that could have a cascade effect on top cryptos.

Disclaimer: Be[in]Crypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.