Bitcoin (BTC) has once again energized the crypto community by surpassing the $111,000 mark, setting a new all-time high. However, this price surge appears to differ significantly from previous cycles.

Based on market indicators and on-chain data, three notable differences stand out compared to past Bitcoin peaks. These differences suggest a more mature and less speculative market. Let’s examine them in detail.

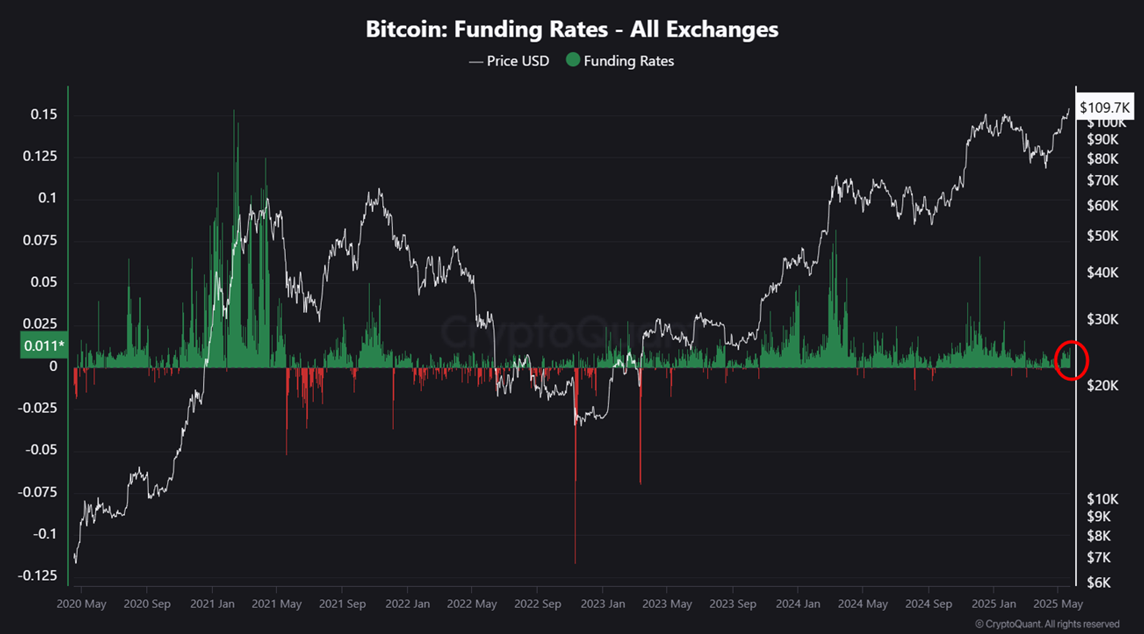

#1. Low Funding Rate: The Futures Market Shows Less Overheating

One key indicator of market overheating is the funding rate in the perpetual futures market. This rate reflects the cost traders pay to maintain long or short positions and reveals overall market sentiment.

According to data from CryptoQuant, when Bitcoin peaked in March and December 2024, the funding rate spiked. This signaled excessively long positions and an overheated market. Such conditions often led to sharp price corrections afterward.

However, in May 2025, even though long positions increased, the funding rate stayed significantly lower than during previous peaks. This suggests that the current rally is less driven by excessive speculation in the futures market.

“Compared to March & December last year, perp funding rates are much lower now than they were then. This means the recent rally was spot driven and a lot less overheated. Violent pullbacks are unlikely,” Nic, CEO and Co-founder of Coin Bureau, said.

This level of stability is a positive sign. It shows that the market is developing in a more sustainable direction.

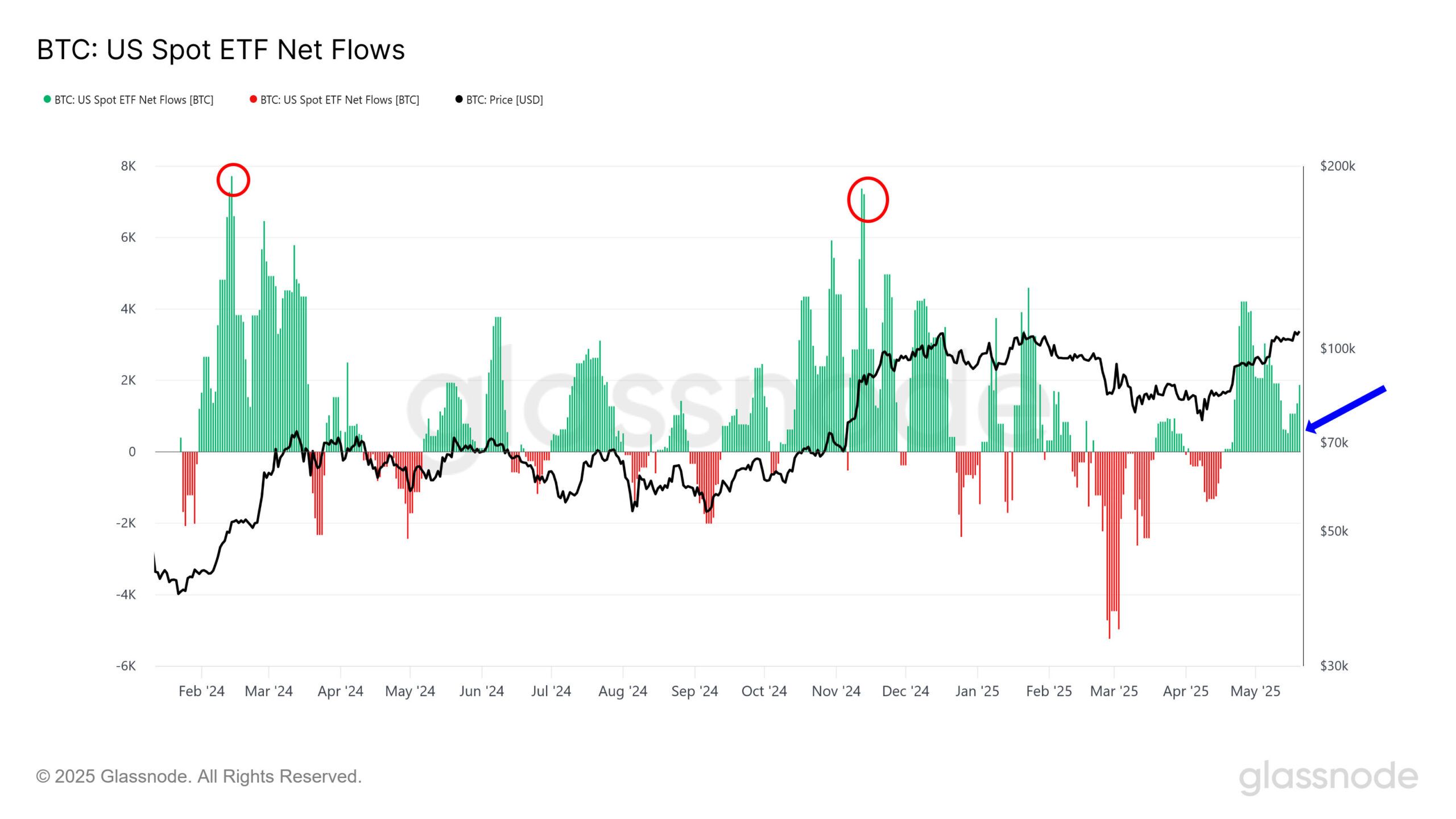

#2. Weaker ETF Inflows: Where Is the Buying Pressure Coming From?

In previous bull runs—especially in March and December 2024—spot Bitcoin ETFs in the US played a major role in driving prices upward. Data from Glassnode shows that these ETFs recorded billions of dollars in inflows during those periods.

However, ETF inflows have been relatively modest during this new peak in May 2025.

A recent report from BeInCrypto noted that spot Bitcoin ETFs saw $608.99 million in inflows, marking six consecutive days of increased investor confidence.

Glassnode charts show that while Bitcoin’s price rose from $70,000 to over $100,000 recently, ETF inflows remained far lower than during previous peaks. According to Nic, this means ETF investors—retail and institutional—are not the main drivers of the current rally.

“Recent ETF flows are much more subdued than they were in previous breaks through the all-time-highs. This means ETF buyers (retail & institutions) aren’t the biggest contributors of this rally,” Nic added.

This raises the question: If not ETFs, who buys Bitcoin?

Some speculate that large firms like MicroStrategy (MSTR) or other funds may quietly accumulate BTC. However, detailed data remains unclear. This allows for even greater upside if institutional investors return to the market more aggressively.

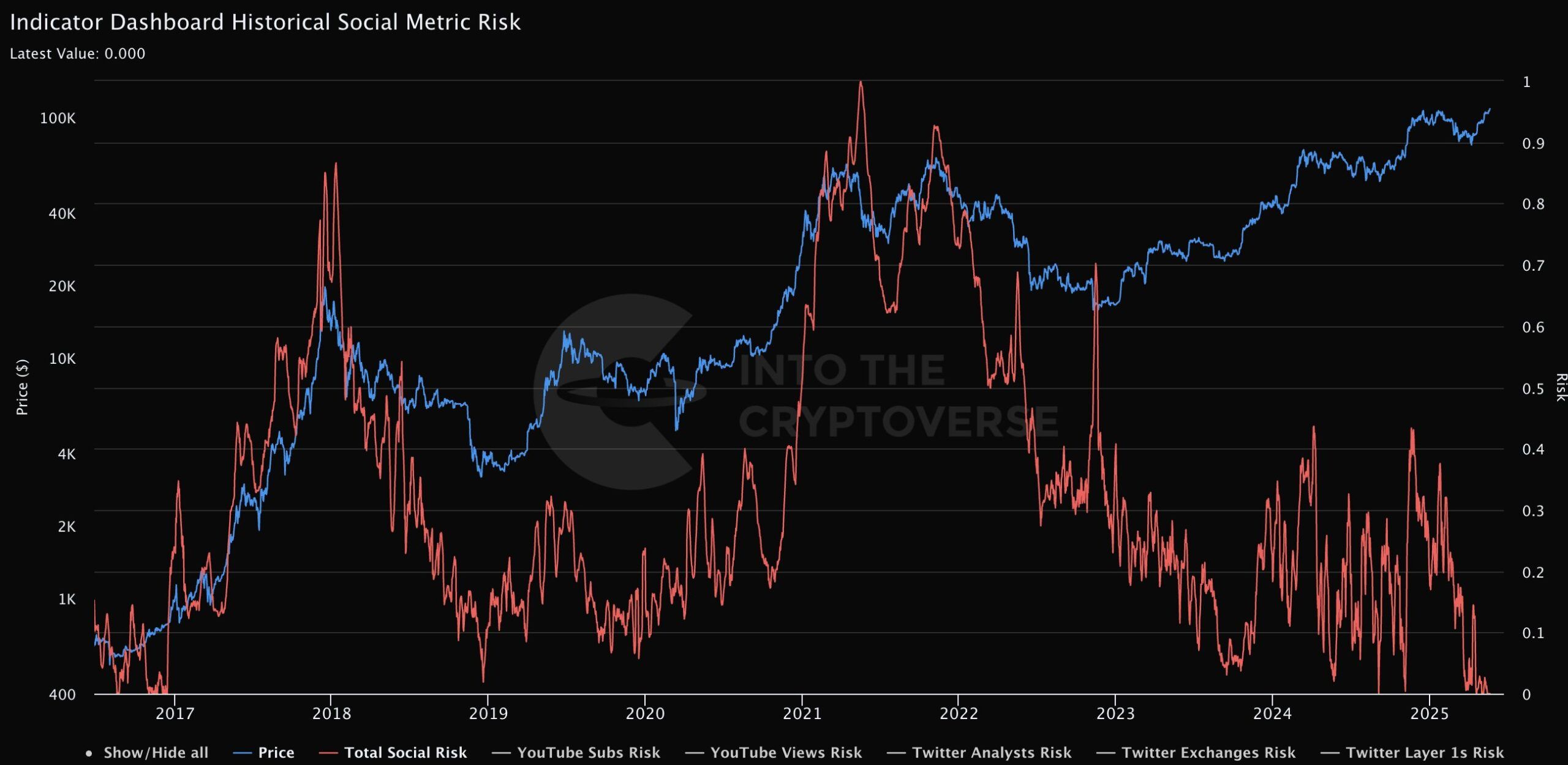

#3. Retail Investors Are Absent, Social Metrics at Record Lows

Another major difference in this cycle is the absence of retail investors.

In previous bull markets, each Bitcoin peak was accompanied by a surge in public interest. This was reflected in high social engagement metrics. But this time, social metrics related to Bitcoin are at historic lows.

Specifically, Google searches for “Bitcoin” in May 2025 have barely increased compared to past peak periods. This suggests that retail investors have yet to enter the market in large numbers.

In addition, CryptoQuant data shows that the number of wallet addresses categorized as “shrimp” (holding less than 1 BTC) has dropped to its lowest level since 2021.

This lack of retail activity could be a positive sign. It suggests that the current rally isn’t driven by FOMO (Fear of Missing Out), a common catalyst for bubbles and crashes. Instead, organic demand from long-term investors appears to play a key role.

All these factors indicate a more mature market with potential for sustainable growth.

Can Bitcoin reach $120,000, as many analysts predict? Only time will tell. But for now, this is a cycle worth watching closely.