Zcash (ZEC) price has been one of the strongest performers among privacy coins, gaining nearly 470% over the past three months. The token is now trading near $250 after a brief pullback, cooling off from its recent surge but still holding most of its gains.

At first glance, the pause (even one since yesterday might seem like fading momentum. But the signals suggest something different. Whales are taking a step back, retail conviction remains strong, and technical patterns continue to hint that the broader uptrend is far from over.

Whales Ease Off, But Retail Traders Ride The Conviction

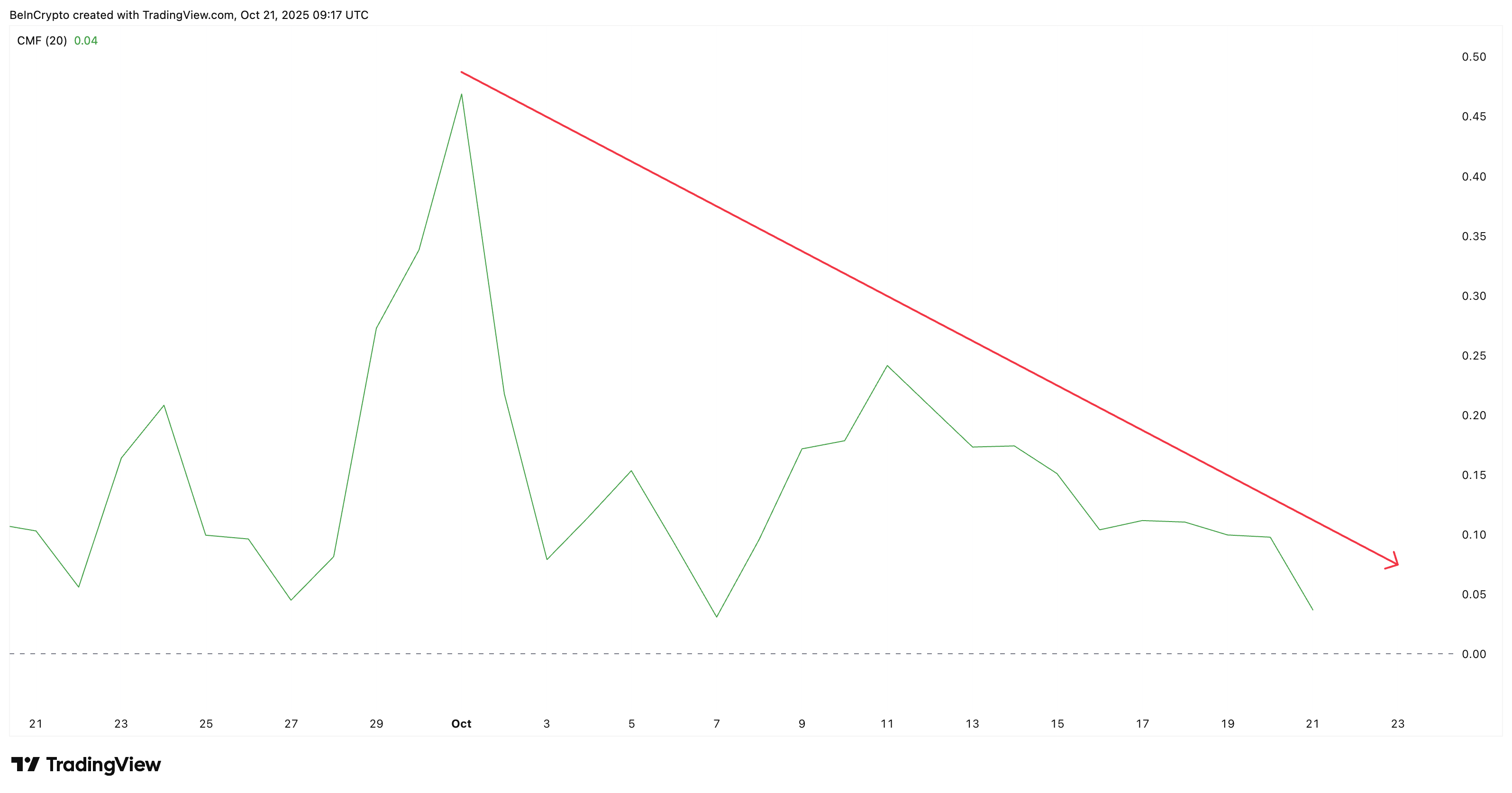

Large investors have started to slow their buying. The Chaikin Money Flow (CMF) — which measures large-money inflows — has dropped sharply from over 0.45 at the start of October to around 0.04 now. This indicates whales have begun taking profits after driving ZEC’s earlier rally.

Still, this is not entirely bearish. Even when CMF dropped earlier this month, ZEC’s price kept climbing. The token’s rally is no longer fully dependent on whale activity — retail traders are filling in the gap.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Over the past 24 hours, ZEC’s net flow flipped from +$18.14 million to –$4.06 million, a 122% swing toward outflows. That means more tokens are leaving exchanges, suggesting that holders are buying more.

Smaller traders appear to be accumulating while large holders reduce exposure — a pattern that often helps sustain rallies. Adding to that conviction, Zcash’s shielded pool recently surpassed 4.5 million ZEC, locking nearly 27.5% of its total supply.

This surge in shielded holdings shows that more users are moving coins into long-term private storage rather than trading them, tightening market supply and reinforcing confidence in Zcash’s privacy technology.

ZEC Price Structure Still Shows Strength Beneath The Surface

ZEC’s price action shows that this pullback is likely a pause, not a breakdown. The structure remains healthy, and multiple signals suggest the uptrend is holding.

While the full breakout projection of the flag setup points to an ambitious 547% potential move based on the pole’s height, that Zcash price target remains far-fetched for now. Nearer levels like $284, $314, and $441 look more realistic as upcoming resistance zones.

The Relative Strength Index (RSI) — which measures the strength and speed of price changes — highlights that shift clearly. A few days earlier, around October 16, a hidden bullish divergence appeared, where the RSI made lower lows while the price made higher lows. The result was a short-term rally that pushed ZEC up before this latest pullback.

Now, a similar divergence is forming again. The price has continued making higher lows while RSI dips slightly — a setup that often hints at trend continuation. If the pattern repeats, ZEC could soon resume its climb toward $284 and $314, the next resistance levels.

However, if the price drops below $247 and then $209, it could signal temporary weakness. A move under $187 would break the bullish structure and expose the ZEC price to a deeper correction.