XRP’s strong correlation with Bitcoin (BTC) might be limiting its performance, as the token has remained relatively muted over the past two months, despite several events that would typically trigger positive price movements.

For instance, in July, reports revealed that Donald Trump raised over $4 million in campaign donations through digital tokens, including XRP, yet this news did not impact XRP’s price. Additionally, the altcoin showed no reaction when 33 million tokens were transferred to a Binance wallet on August 22. Most recently, after Ripple announced plans to introduce smart contracts to the XRP Ledger (XRPL), XRP’s price dropped by 3%.

Ripple’s Ties with Bitcoin Spells Trouble

Ripple’s announcement of plans to introduce smart contracts to the XRP Ledger (XRPL) should ideally have sparked a positive price reaction for XRP. However, the altcoin’s strong correlation with Bitcoin (BTC), with a correlation coefficient of 0.72, has resulted in a muted response. This figure reflects a reasonably strong positive relationship between the two assets.

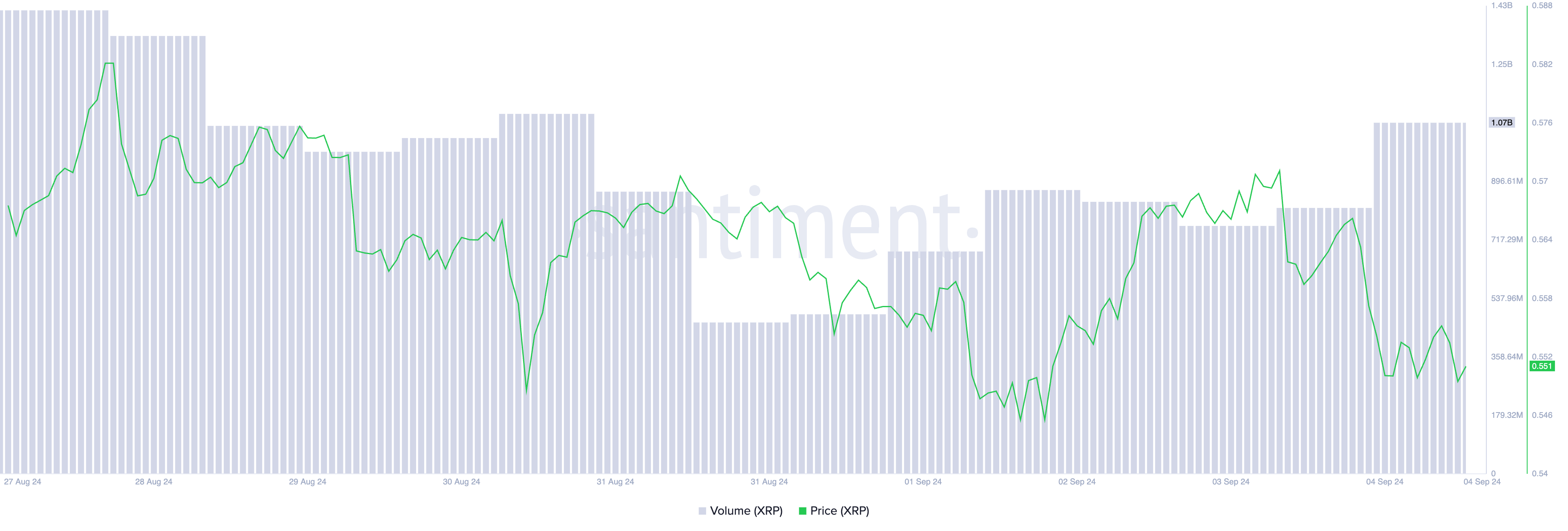

In the past 24 hours, Bitcoin’s price has dropped by 4%, and XRP followed with a 3% decline. Despite this drop, XRP’s trading volume surged by 39%, creating a negative divergence. Such divergence typically indicates increasing selling pressure, suggesting XRP could face further decline.

Read more: XRP ETF Explained: What It Is and How It Works

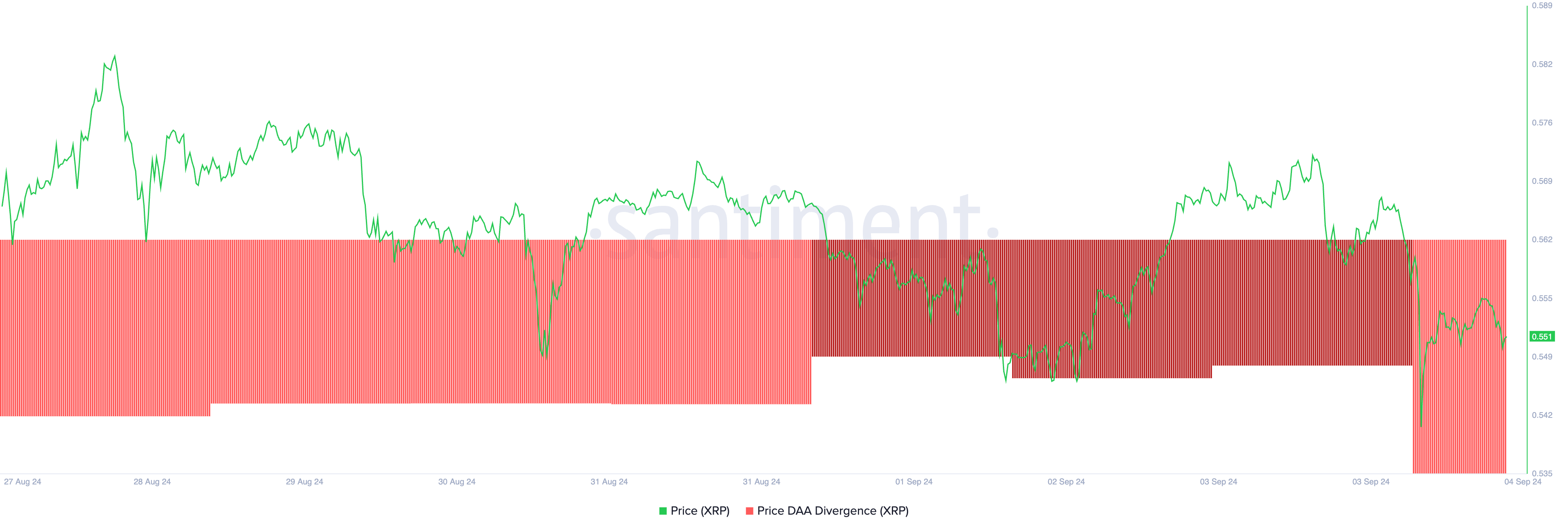

XRP’s negative price-to-daily active address divergence further confirms the increase in selling activity. This metric tracks the asset’s price movements and compares them with changes in the number of daily active addresses.

As of this writing, XRP’s price-to-daily active address divergence stands at -63.81, signaling reduced participation in buying, selling, or holding XRP, which could contribute to continued price pressure.

XRP Price Prediction: Brace For More Devaluation

At press time, XRP is trading at $0.55, and its 12-hour chart suggests further decline. The token’s MACD line (blue) sits below its signal line (orange) and the zero line, indicating a strong bearish trend. This setup signals a continued downtrend unless a reversal occurs, prompting traders to either avoid the market or consider short positions.

Additionally, XRP’s bull-bear power, measured by the Elder-Ray Index, reveals that sellers dominate the market. As of now, the index stands at -0.035, having remained negative since August 26, indicating bear power is in control.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

If bears continue to overpower bulls, XRP’s price could drop to $0.52. Should this level fail to hold, a further decline to $0.46 may follow. However, if market sentiment shifts to bullish, XRP could rise to $0.56.