XRP price has struggled to gain momentum in recent weeks, failing to register any meaningful increase for over a month and a half.

The lack of upward movement has left investors growing impatient. As a result, many have started to cash out their holdings, adding to the pressure on the cryptocurrency.

Crucial XRP Investors Move to Book Profits

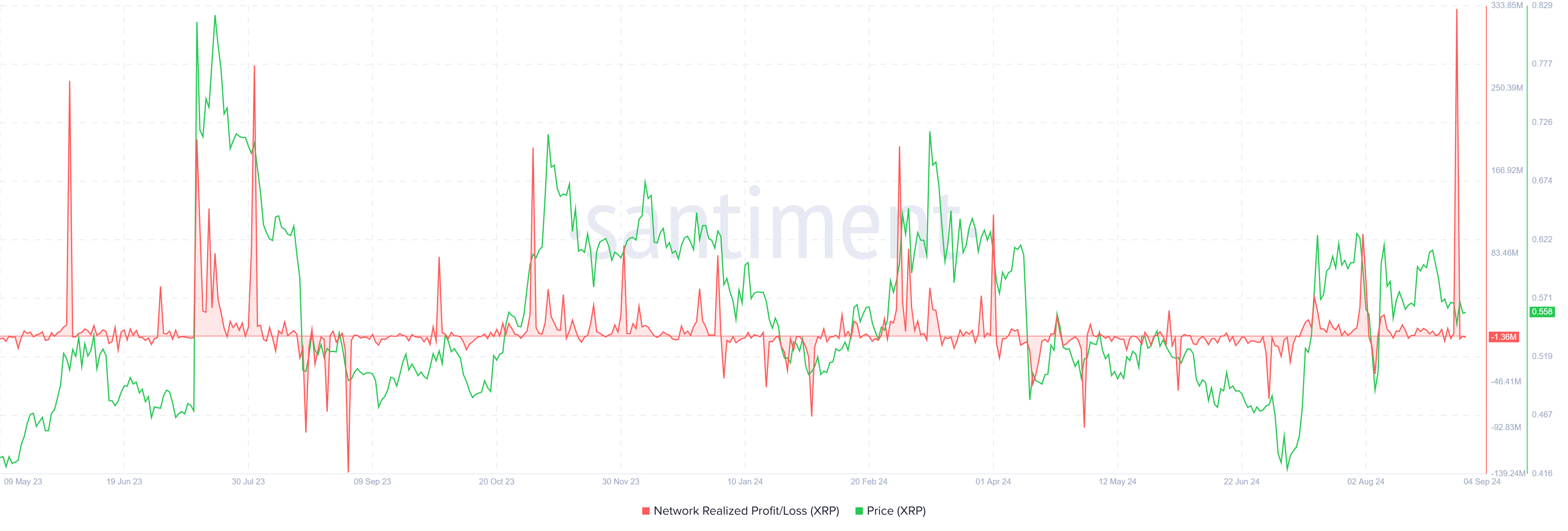

XRP price is largely driven by a surge in realized profits, which have hit a 13-month high. This indicates that a large number of investors are taking profits, likely because they no longer believe in short-term price growth.

Adding to this, Brian Quinlivan, Lead Analyst at Santiment, shared insights in an interview with BeInCrypto.

“XRP saw a huge amount of realized profit taking at the beginning of September, which came at a time when traders appeared to be “giving up”. It wouldn’t be surprising to see a healthy mid-term bounce directly after this spike took place,” Quinlivan told BeInCrypto.

The wave of selling could create downward pressure on XRP, pushing the price closer to the $0.50 mark or even lower if the trend continues. This spike is also a sign of declining confidence among investors.

Read more: XRP ETF Explained: What It Is and How It Works

Interestingly, this is no ordinary profit-taking. The age consumed metric—a measure of the movement of long-term holders’ assets—has experienced its largest spike since December 2022. This indicator shows that long-term investors are now moving their holdings, typically a sign that these holders are losing patience.

A spike in the age-consumed metric usually precedes a period of volatility as long-term investors reenter the market. This could signal a significant shift in market momentum, with more experienced holders losing confidence in XRP’s short-term recovery. Since these investors are the backbone of an asset, their actions could drive XRP’s price to decline further.

XRP Price Prediction: A Drop Ahead

XRP price is currently trading at $0.550, which is already below the 38.2% Fibonacci retracement level at $0.553. If the price fails to reclaim this critical level as support, it could fall further, testing the 23.6% Fibonacci line next. The $0.499 retracement level often serves as the “bear market support floor.”

Historically, the $0.499 level has acted as a strong support line for XRP. It is likely that if XRP reaches this price, the decline will halt as buyers look to accumulate at $0.499.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

On the other hand, XRP has not shown significant declines in the past 72 hours, which indicates that a steep drop could be avoided. If the cryptocurrency manages to reclaim $0.553 as a support level, it could invalidate the current bearish outlook. In this scenario, XRP may have a shot at rebounding to $0.60, offering a potential bullish reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.