The XRP price trades near $2.20, flat on the day and up about 1.5% in the past week. On the surface, the trend still looks steady compared to the broader market.

But when you dig deeper into holder behavior, one group is quietly shifting from supportive to risky.

Short-Term Holders Stay Positive, But Long-Term Holders Turn Risky

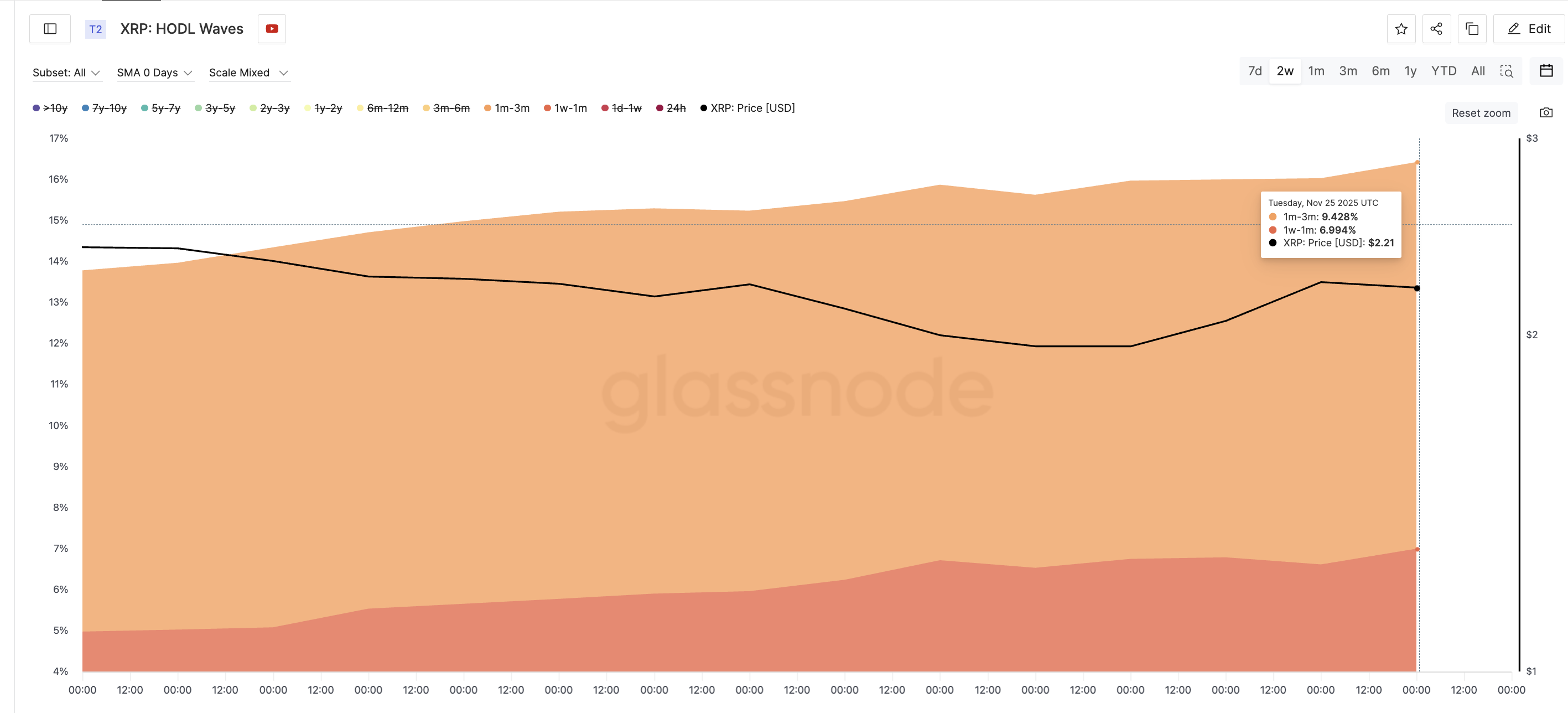

HODL Waves track how much supply sits in different holding-time bands. They show that short-term XRP holders are still steady. The one-to-three-month band has increased the stash from 8.80% to 9.48% since November 11. The one-week-to-one-month band also increased from 4.97% to 6.99%.

These groups usually sell fast when pressure hits, yet they have been accumulating instead.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

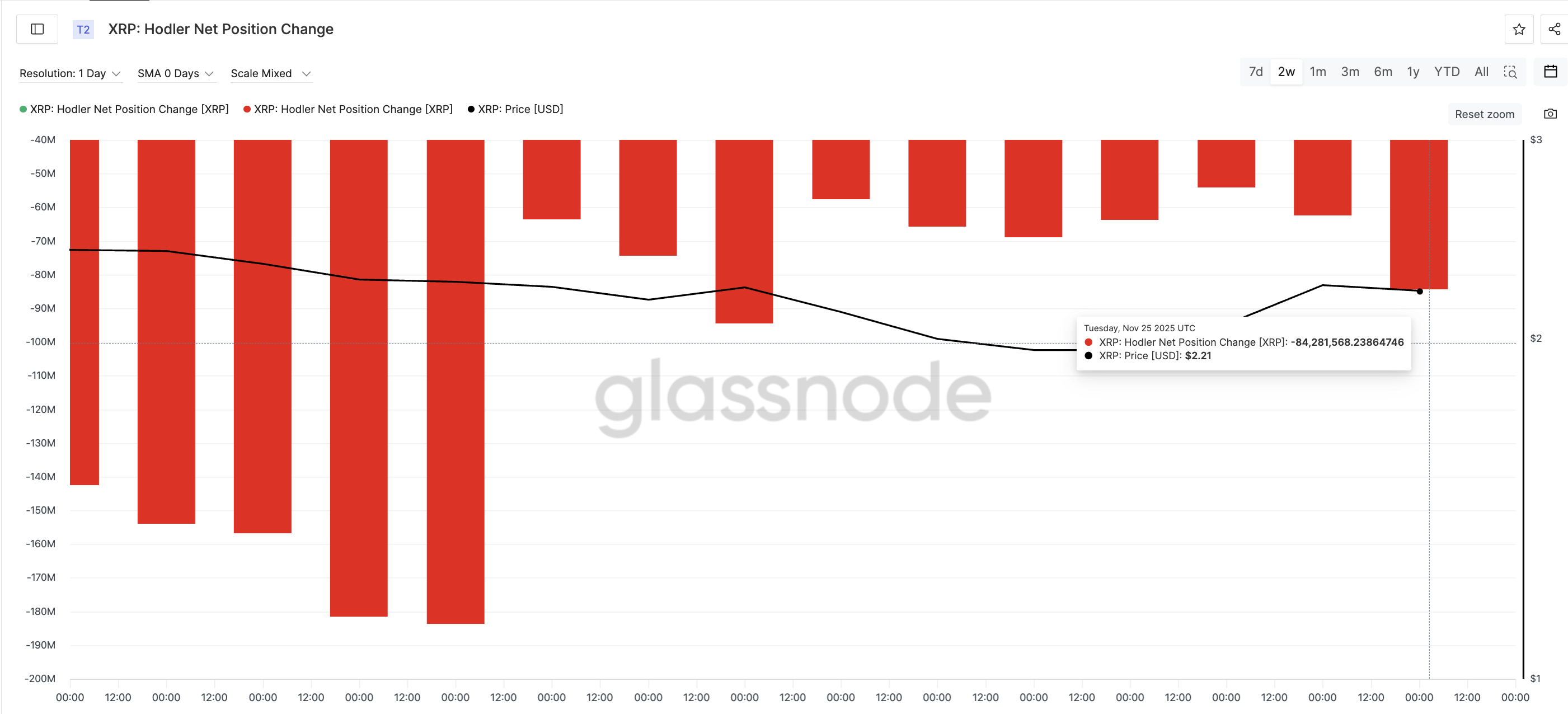

The pressure point sits with long-term holders. Hodler Net Position Change measures whether long-term holder wallets, on net, gain or lose coins.

On November 23, long-term holders were selling around 54 million XRP. By November 25, that number increased to 84 million XRP, a jump of about 56%.

This is not a random spike. A similar rise in selling happened between November 16 and 18, which was followed by a sharp drop in XRP from $2.22 to $1.96, almost 12%.

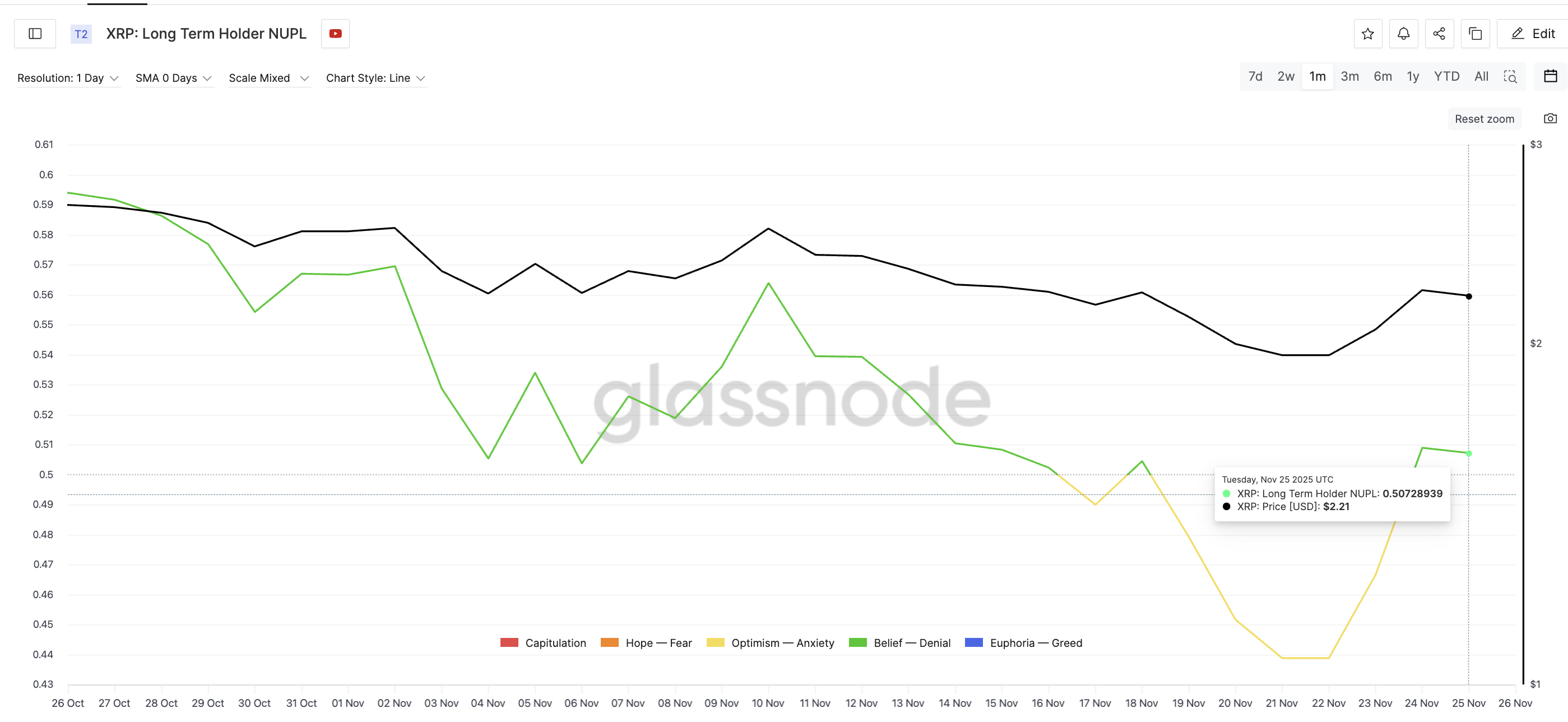

NUPL (Net Unrealized Profit/Loss) shows why. NUPL tracks how much profit or loss holders hold on paper. Long-term holder NUPL is near 0.50, which falls into the “belief–denial” region that often shows local tops. The last time NUPL hit this area on November 18, XRP corrected soon after.

So the incentive to take profit is real, and long-term holders are acting on it — this is the red flag. A sign that the XRP price is losing conviction among HODLers.

XRP Price Holds Key Levels For Now, But Breakout Confirmation Is Needed?

XRP trades between familiar levels. The first support sits at $2.06. If long-term holder selling increases and price loses this level, XRP could revisit $1.81, a recent local bottom.

To stay in its green zone, XRP needs a clean close above $2.24, flipping the short-term trend upward. That would open the path toward $2.58 and $2.69, but only if big money supports the breakout.

This is where CMF (Chaikin Money Flow) comes in. CMF measures money flowing in from large wallets. It has moved slightly above zero, indicating some inflow, but it still sits below a descending trendline. Until CMF breaks that trendline, inflows are not strong enough to fully offset long-term holder selling.

For now, XRP price still holds its green (week-on-week), but long-term holders — backed by high NUPL and rising outflows — remain the slow-forming red flag that traders should watch closely.