XRP has gained nearly 6% in the past week, trimming some of last month’s weakness. It’s still down in the three-month band, but the token remains up over 400% year-on-year — showing that the larger uptrend hasn’t been broken.

Now, a small 7% move could be all it takes to unlock the next rally zone. The latest on-chain and chart signals suggest it might happen sooner than many expect.

Whales And The Short-Term Chart Hint At A Push Coming

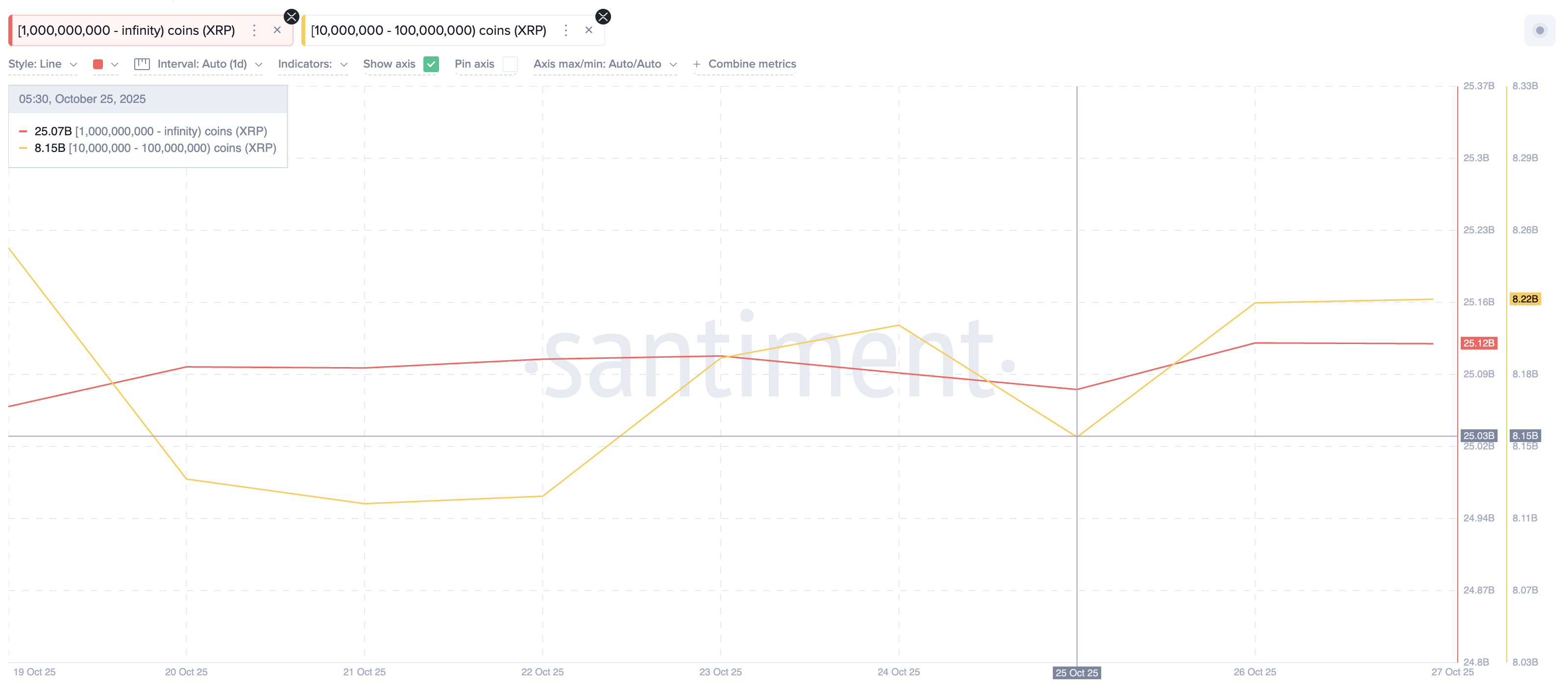

Big XRP holders are adding again. Since yesterday, wallets holding over 1 billion XRP have increased their stash from 25.07 billion to 25.12 billion, a 50 million addition.

Additionally, wallets holding 10 million–100 million XRP have added around 70 million coins, taking their total from 8.15 billion to 8.22 billion. In total, these wallets have added tokens worth $314 million.

That accumulation often happens when large players expect near-term momentum to pick up. The 4-hour chart supports this, showing improving short-term structure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The 20-period Exponential Moving Average (EMA), which tracks recent price momentum, has already crossed above the 50-period EMA and is now approaching the 100-period EMA. That would form another golden crossover.

If the faster EMA moves above the longer one, it typically means buying strength is growing and traders are starting to position for a breakout.

Together, the steady whale inflows and strengthening short-term chart set the stage for a test of XRP price’s most important resistance. We will reveal that in the next sections.

Cost-Basis Heatmap Shows Where The Price Battle Lies

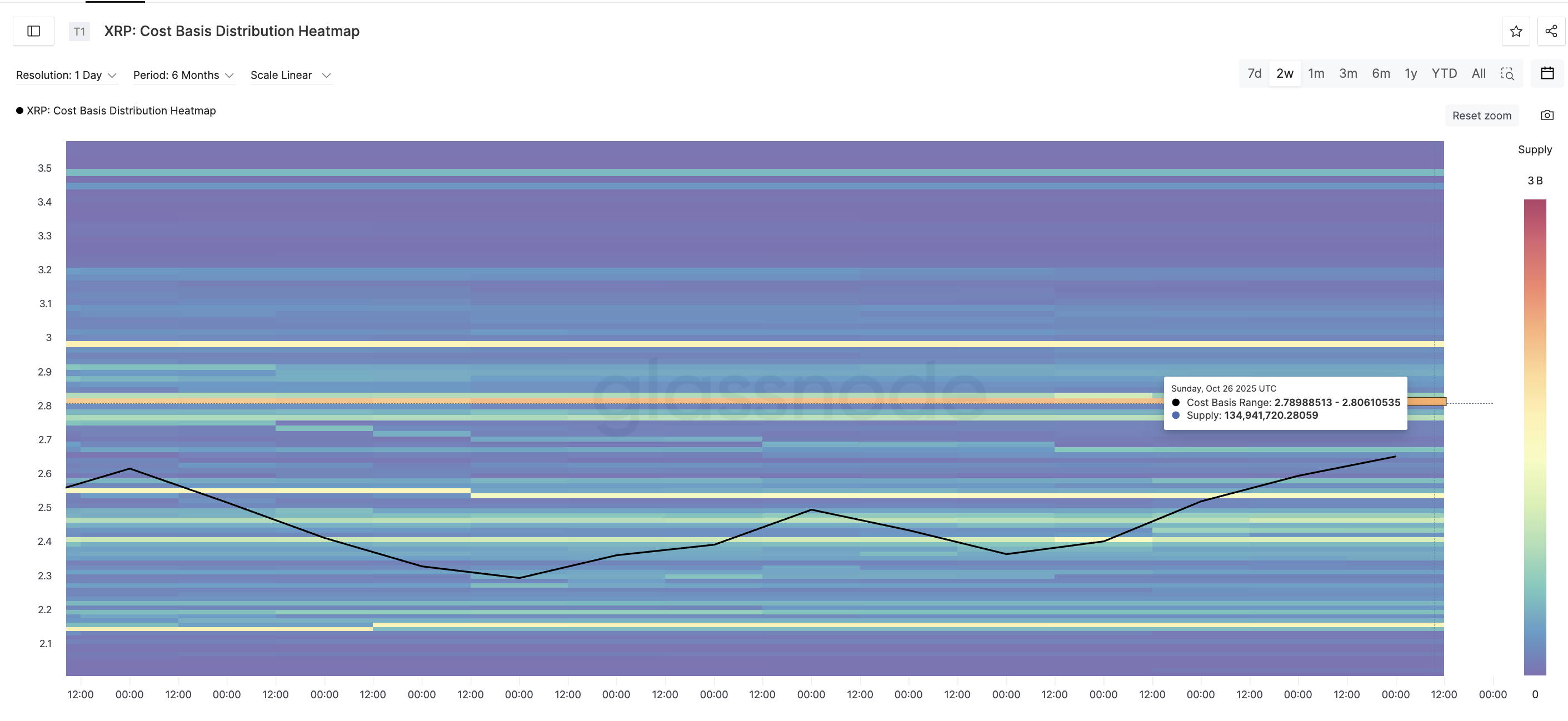

Before looking at the price chart, the cost-basis heatmap helps us understand where most holders are sitting on potential profits or losses, and where they might sell.

Data from Glassnode shows that the heaviest supply cluster is between $2.78 and $2.80. This zone is where roughly 135 million XRP were last acquired.

This is the zone where traders who bought earlier may try to sell and lock in profits. Breaking above it means absorbing that supply, which often triggers follow-up buying.

That $2.78–$2.80 zone aligns almost perfectly with the next chart-based breakout level we’ll look at next.

What the XRP Price Chart Shows

On the daily chart, XRP continues to trade inside a falling wedge. This pattern usually signals a bullish reversal once the upper boundary is breached. That boundary lies near $2.81, the same level marked by the heatmap’s dense supply band.

A daily close above $2.81 would confirm the breakout and validate the technical and on-chain signals. Once broken, price targets appear at $3.37 and $3.66.

If XRP fails to break above $2.81 and instead slips below $2.59, it could delay the next move higher. Losing $2.43 could even bring $2.27 back into the mix, invalidating the near-term bullishness.

But for now, the combination of whale buildup, positive short-term EMA signals, and a concentrated resistance zone just 7% (6.98% to be exact) away makes the setup hard to ignore.