The price of Ripple’s XRP is attempting to regain the midline of a long-term pattern. Its success or failure in doing so could have massive implications regarding the future price.

While the short-term readings suggest that the increase is expected to continue, the long-term outlook is still undetermined, slightly leaning on a bearish future price forecast.

There is positive news regarding the Securities and Exchange Commission (SEC) vs Ripple case. Pro-Ripple lawyer John Deaton uncovered old SEC internal emails that suggest that XRP cannot be classified as a security since it does not pass the Howey test.

Ripple Price Attempts to Regain Crucial Support Level

Since June 2022, the price of XRP has been trading within an ascending parallel channel. This pattern involves the price bouncing between the resistance and support lines numerous times before eventually breaking down.

Consequently, the ascending parallel channel is considered a bearish pattern.

As anticipated, on March 29, the price was rejected by the resistance of the channel. This triggered the ongoing downward movement. Subsequently, the price dropped below the $0.53 horizontal resistance, resulting in a lower high on April 14.

Afterward, the breakdown below the channel’s midline suggested that the trend is bearish. So, an eventual breakdown from the channel is likely.

However, the price action since the breakdown has been conflicting since the XRP price regained its footing and is attempting to move above the channel’s midline again.

Additionally, the Relative Strength Index (RSI), which is used by traders as a momentum indicator to gauge if a market is overbought or oversold and to determine whether to buy or sell an asset, provides mixed readings.

When the RSI reading is above 50 and the trend is upward, it suggests that bulls still have an advantage. Conversely, when the reading is below 50, the opposite holds true.

While the RSI previously fell below 50 and below an ascending trendline (green), it has now moved above them both.

XRP Price Prediction: Does Wave Count Predict Bounce?

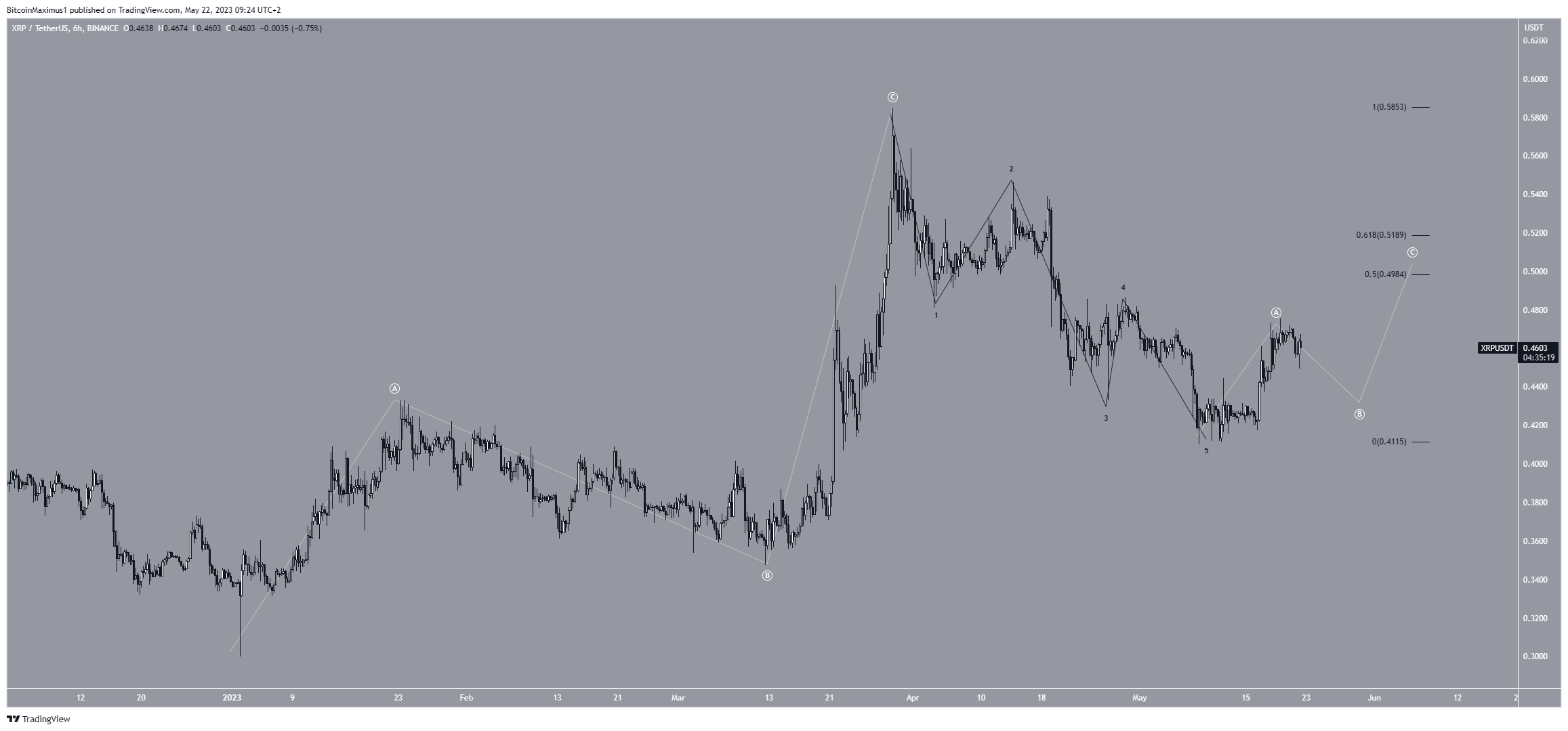

The short-term four-hour time frame technical analysis suggests that the ongoing bounce is just a relief rally, after which another drop will follow. So, it gives a bearish XRP price forecast.

The main reason is the wave count, which supports the decrease. By studying recurring long-term price patterns and investor psychology, technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction.

The wave count shows that the XRP price has completed a five-wave decrease (black). This means that the trend is bearish. Moreover, the decrease followed an A-B-C upward movement, further supporting this possibility.

So, it is likely that the current increase is just a corrective rally.

If so, the most likely target for the top of the increase is at $0.50-$0.52, created by the 0.5-0.618 Fib retracement resistance level.

Despite this bullish short-term XRP price prediction, a fall below the beginning of wave A at $0.41 will mean that even the short-term trend is bearish. In that case, an immediate decrease to the channel’s support line at $0.37 will be expected.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.