XRP price has witnessed a 2% price surge and a 50% hike in trading volume over the past 24 hours. This follows Ripple’s announcement that it would file a cross-appeal in its ongoing legal battle with the US SEC.

XRP currently trades at $0.53, with on-chain data suggesting that the altcoin is poised to extend this rally.

Ripple Files Notice of Appeal

In a notice appeal filed to the United States Court of Appeals for the Second Circuit on October 10, Ripple Labs announced its intentions to challenge Judge Analisa Torres’ August 7 judgment, where the court levied a $125 million penalty against it for selling its XRP token without proper registration.

This cross-appeal comes after the SEC filed its notice of appeal earlier this month, aiming to overturn the court’s ruling that programmatic sales of XRP to retail investors did not violate securities laws.

Moreover, Ripple’s chief legal officer, Stuart Alderoty, said in a post on X that the appeal’s purpose is to ensure that “nothing’s left on the table.” According to Alderoty, Ripple is focused on reinforcing the argument that an “investment contract” cannot exist without essential rights and obligations specified in a formal contract.

“Last year, the SEC unsuccessfully tried to take an early appeal of the rulings that Ripple’s XRP sales on exchanges and Ripple’s other XRP distributions, like to employees and developers, weren’t securities. They’ll likely go after these again – and they will lose on both again,” Alderoty added.

XRP Traders Record More Profitable Transactions

XRP trades at $0.53, noting a 2% price surge over the past 24 hours and a 50% spike in trading volume. Optimism that the cross-appeal could be settled in Ripple’s favor has fueled this bullish reaction.

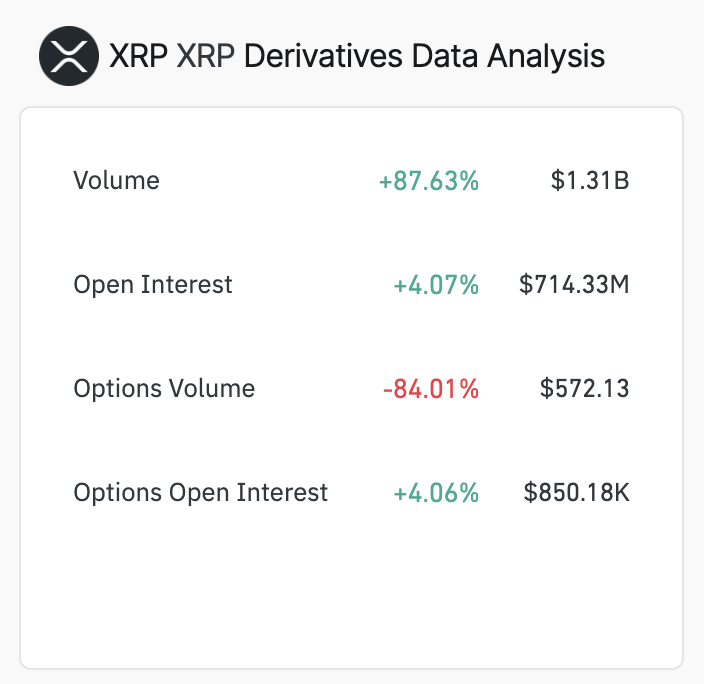

Also, BeinCrypto has noted a positive bias in the XRP derivatives market. According to Coinglass, trading volume in the XRP futures and options market has spiked 88% over the past 24 hours.

Read more: XRP ETF Explained: What It Is and How It Works

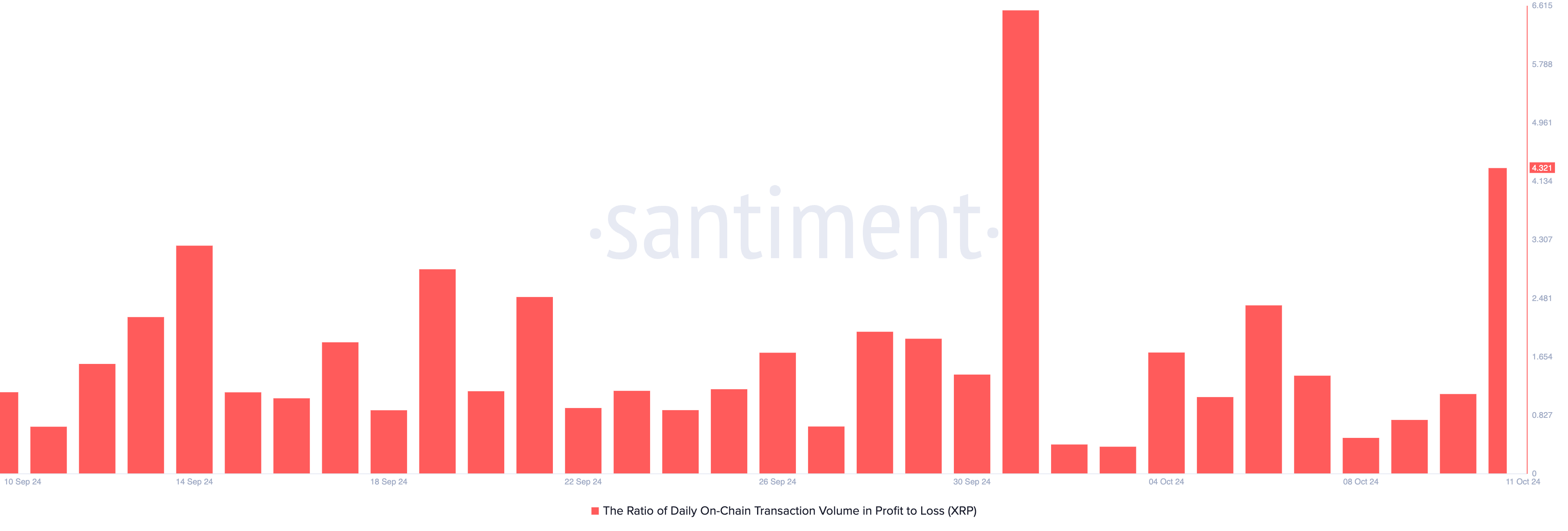

Furthermore, XRP’s 2% price hike has resulted in an uptick in the count of profitable transactions. On Friday, the ratio of XRP’s transaction volume in profit to loss stands at 4.32, its highest in ten days. This means that for every transaction that has ended in a loss, 4.32 transactions have returned a profit.

XRP Price Prediction: Token Eyes Multi-Month Eye

If the uptrend persists, XRP could be poised to hit $0.74 in the near term. To achieve this, it must break through the key resistance level at $0.66. A successful breakout and retest of this level would pave the way for XRP’s price to climb toward a high it last touched in March.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, if market sentiment turns bearish, XRP could lose its recent gains and fall back toward the support level at $0.46.