XRP has recently encountered significant resistance, struggling to break past the key $0.55 mark. Despite efforts to rebound, it has fallen below the crucial support level of $0.52, raising concerns over a straightforward recovery path.

The current momentum hints at potential difficulties for XRP’s return to higher levels, making a rise to $0.60 questionable.

XRP Needs Bulls

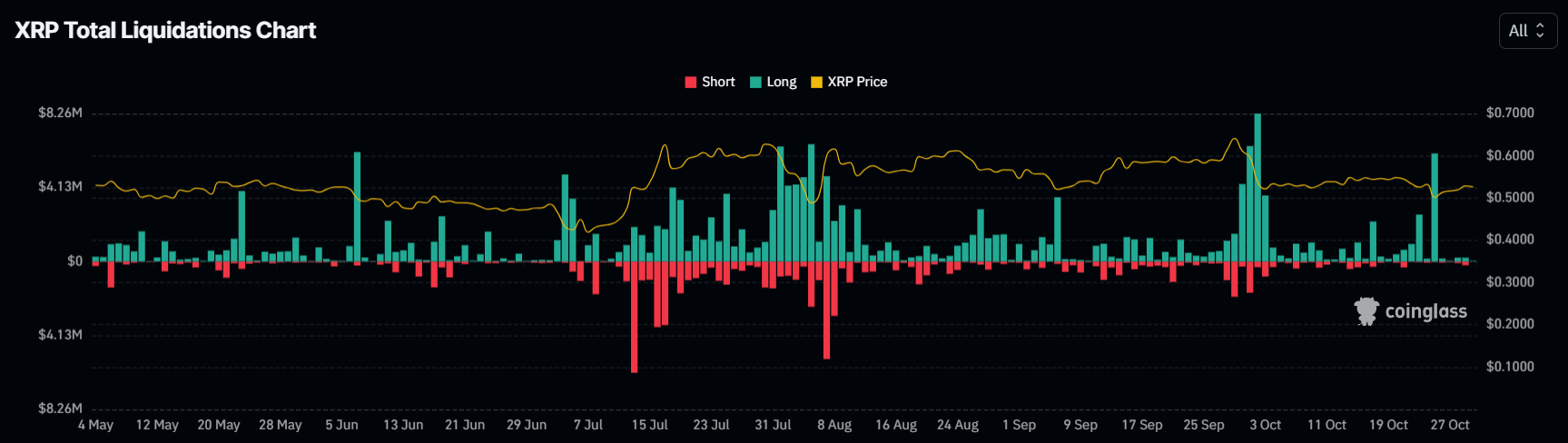

The sentiment around XRP is currently impacted by a high volume of liquidations dominated by long contract holders. These long liquidations reflect uncertainty among traders who had initially anticipated a price increase.

However, XRP’s lack of growth and occasional sharp price declines have contributed to a wave of long liquidations, with investors scaling back their positions. This trend adds downward pressure on XRP and suggests that optimism among bulls may be waning.

As more long positions are liquidated, bullish sentiment may weaken, potentially deterring new buying activity. This shift in sentiment poses a risk to XRP’s ability to rally effectively.

Read more: XRP ETF Explained: What It Is and How It Works

XRP’s macro momentum reflects this sentiment shift, as seen in technical indicators like the Relative Strength Index (RSI). The RSI currently sits below the neutral line of 50.0, indicating a lack of bullish momentum.

Throughout October, XRP attempted multiple rallies but consistently failed to push the RSI into positive territory, highlighting a struggle to establish sustained upward momentum. This failure suggests fading enthusiasm for bullish gains, which could deter further upward movement.

XRP Price Prediction: Taking Back Support

XRP has shown a slight recovery in the past week, reaching $0.52, though it’s barely holding above the 38.2% Fibonacci Retracement level at this price. Reclaiming $0.52 as a solid support floor is essential for XRP to continue its upward trajectory. Without stability at this level, a recovery could be difficult to maintain.

If XRP successfully holds above $0.52, it could approach $0.55; however, it may struggle to breach this barrier due to a lack of strong bullish momentum. Historical trends suggest XRP is likely to consolidate below this level rather than surpass it, given its current market conditions.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

For XRP to negate this bearish-neutral outlook, it would need to break past the 50% Fibonacci Retracement line at $0.55 and aim for $0.59. Successfully crossing this line could push XRP toward the $0.60 mark, offering a more favorable outlook and signaling potential resilience in the face of recent challenges.