Between October 1 and 3, Ripple’s (XRP) price fell from $0.64 to $0.52. But since then, the token has climbed back to $0.54, suggesting that XRP could break above the hurdles on the upside.

However, with momentum waning and technical indicators showing weakness, XRP’s path to $0.65 now appears uncertain. Unless the token can reverse this bearish pattern and reclaim key support levels, the odds of a sustained rally continue to diminish.

Sellers Block Ripple’s Uptrend

On October 5, the 20 Exponential Moving Average (EMA) — in blue, on the XRP’s daily chart slid below the 50 EMA (yellow). The position, known as the death cross, is a bearish pattern that typically signals prolonged downward pressure

Before this, XRP overcame several hurdles to reach $0.65, setting its sights on $0.70. However, that upward attempt has been cut short. Given its current position, sellers could strongly resist any price increases, much like they did between late May and early July.

During that period, XRP’s value declined sharply from $0.54 to $0.42. This suggests that, unless there is a significant shift in buying pressure, XRP’s price may face challenges in reclaiming higher levels.

Read more: XRP ETF Explained: What It Is and How It Works

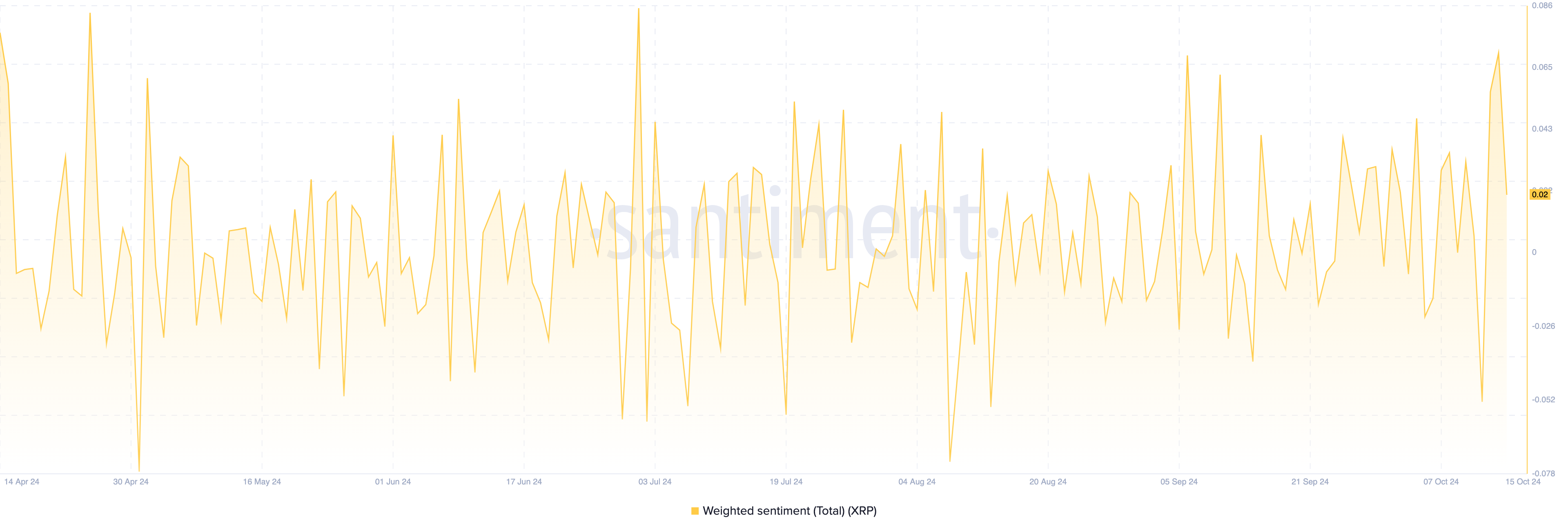

Additionally, XRP’s Weighted Sentiment has dropped significantly, reflecting a shift in the community’s perception of the token. Weighted Sentiment measures the overall tone of discussions about a cryptocurrency.

When it is positive, it means most comments about the token are optimistic. Conversely, a negative Weighted Sentiment indicates a rise in pessimistic discussions, which could paradoxically be bullish for the token.

As shown below, XRP’s Weighted Sentiment has declined from 0.07 to 0.02, aligning with this more pessimistic outlook. This drop may suggest that despite the negative tone, there is potential for a reversal, as overly negative sentiment can sometimes be a contrarian indicator signaling a bullish turn.

XRP Price Prediction: $0.65 Run Is No Longer Viable

Looking at the daily chart, XRP could face resistance at $0.55. This is where the 50% Fibonacci retracement level stood. The Fibonacci retracement indicator shows price levels with strong support or resistance.

Currently, XRP’s trading volume has decreased, which, combined with a stalling price, suggests a limited chance of further upward movement. A declining volume typically signals weakening momentum, and if this trend continues, XRP’s price could drop to $0.48 in the near term.

Without a significant increase in buying pressure, the chances of sustaining an uptrend appear slim.

Read more: How to Buy XRP and Everything You Need To Know

Alternatively, if bulls defend XRP from falling below $0.52, this prediction could be invalidated. Should that happen, XRP’s price might climb to $0.61.