On Sunday, Ripple unlocked 1 billion XRP tokens in three phases, releasing 500 million, 200 million, and 300 million XRP, totaling over $560 million at current market prices.

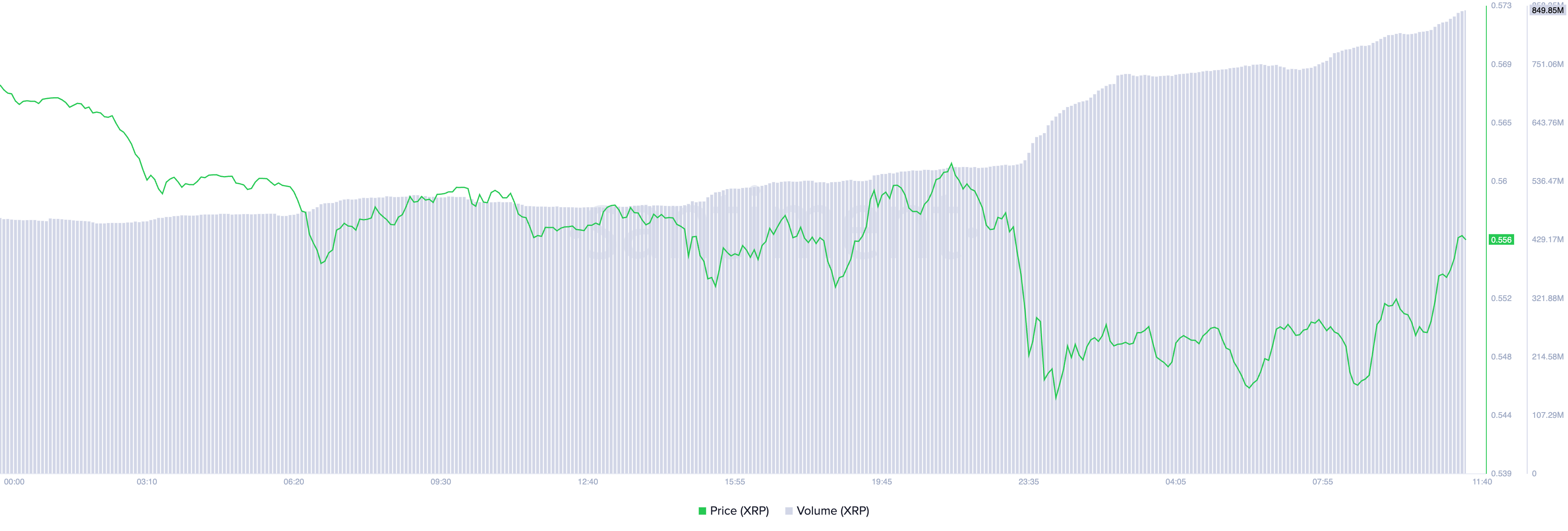

XRP, currently trading at $0.54, has seen a 1% decline in the past 24 hours. However, the 78% surge in trading volume during this period suggests potential market volatility or upcoming challenges.

Ripple is Not Ready for Any Short-Term Rally

XRP’s trading volume has reached $851 million over the past 24 hours, with a negative divergence forming as its price drops while volume spikes. This divergence indicates increasing selling pressure and suggests the asset’s price may continue to decline.

Typically, when trading volume rises as the price falls, it signals that more traders are actively selling, reinforcing the bearish trend.

Supporting this, XRP’s Relative Strength Index (RSI) is in a downtrend and currently sits below the neutral 50 mark at 45.23. This suggests that market participants are favoring selling over buying, adding to the bearish sentiment.

Read more: XRP ETF Explained: What It Is and How It Works

XRP Price Prediction: The Bears Have Overpowered the Bulls

XRP’s 12-hour chart supports the bearish outlook. The Parabolic Stop and Reverse (SAR) indicator shows its dots above the current price, signaling a potential ongoing decline. This indicator typically suggests that the asset’s price may continue to fall.

Additionally, XRP’s Aroon Down Line at 92.86% signals that this downtrend is strong. The Aroon indicator also identifies an asset’s trend strength and potential reversal points. When the Down Line is close to 100, the downtrend is strong, and the most recent low was reached relatively recently.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

If the trends continues, XRP could drop 5% to $0.52. Failing to find buying support at that level could push the price further down to $0.46. However, if demand increases, XRP could rise to $0.56.