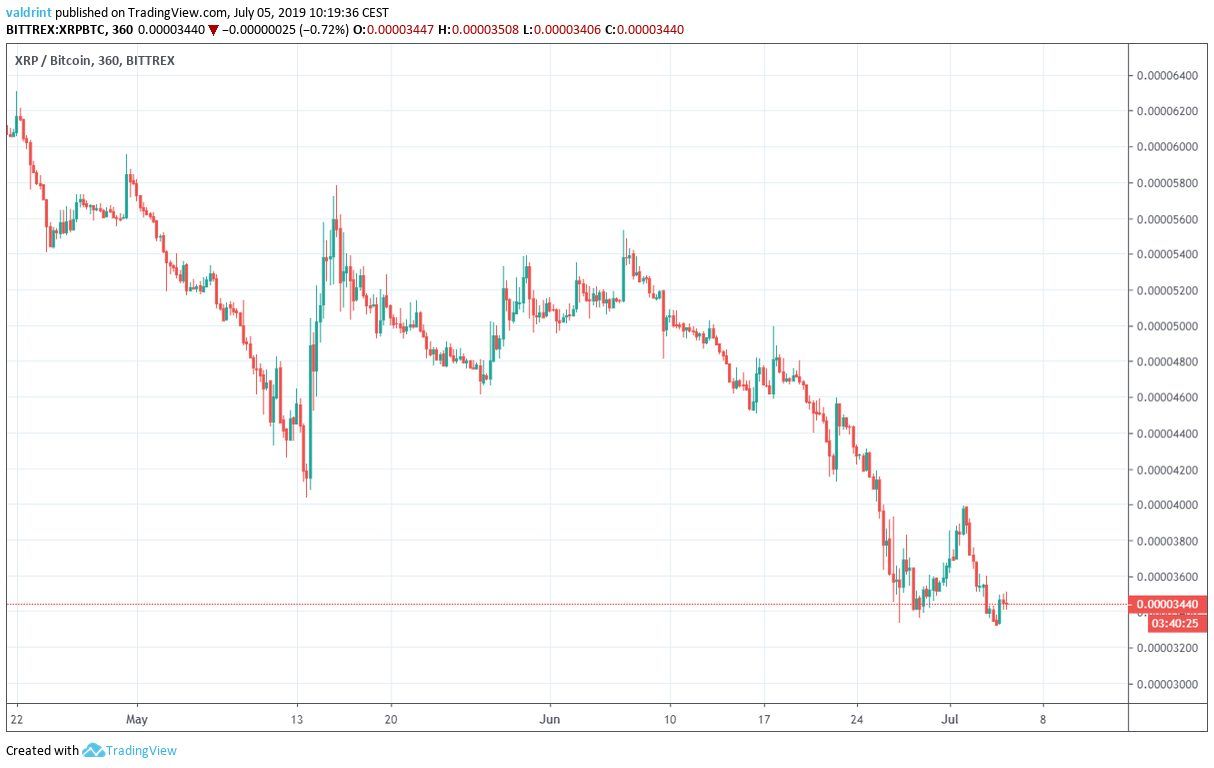

On Apr 30, 2019, the XRP price reached a high of 5956 satoshis. Since then, it has been decreasing, creating several lower lows.

For our previous analysis, click here.

If you would like to trade XRP safely and securely on our partner exchange, follow this link to get all set up on XCOEX.

XRP Price: Trends and Highlights for July 5

- XRP/BTC is trading inside a descending channel.

- There is bullish divergence developing both in the short and the long-term.

- The short-term moving averages have made a bullish cross.

- There is resistance near 4000 satoshis.

XRP Price in a Descending Channel

Since reaching the aforementioned high on Apr 30, the price of XRP has been decreasing, trading inside the descending channel outlined below.

After touching the support line on June 30, the XRP price began an upward move. However, it was unsuccessful and the price again dropped to the line on July 4.

This was the third time the support line was touched, confirming it as a valid trendline.

The resistance line is currently near 4800 satoshis.

Will the XRP price soon begin another upward move?

Possible Bounce?

We stated above that the support line was touched on June 30 and July 4.

Since the line is descending, these were lower lows.

Sponsored SponsoredDuring this period, however, both the RSI and the MACD generated higher lows.

This is known as bullish divergence and often precedes price increases.

Furthermore, it is also present in long-term time-frames, albeit throughout a different period.

Both the RSI and the MACD have been generating divergence since the XRP price reached a low on May 13.

This divergence is more pronounced in the MACD.

The use of these momentum indicators makes it likely that the price will begin an upward move towards the resistance line of the channel.

SponsoredIn order to know when the move will begin, we will take a look at short-term moving averages (MA):

On July 5, the 10-hour MA crossed above the 20-hour one.

This is known as a bullish cross and often indicates that an uptrend has begun.

Since this is a very short-term cross, it can be considered insignificant in itself.

However, combined with our previous reading, it makes it likely that the bounce from the support line has already begun.

Reversal Areas

One potential resistance area is outlined below in case the XRP price begins an upward move.

The closest resistance area is found near 4000 satoshis.

Before the XRP price reached the resistance line, it is likely to meet resistance in this area.

Summary

The XRP price has been trading inside a descending channel since the beginning of May.

Throughout this period, both the RSI and the MACD have generated bullish divergence.

Recently, the short-term moving averages have also begun to do the same.

It is likely that the price will begin an upward move soon.

When do you think the XRP price will begin an upward move? Let us know in the comments below.

Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Images are courtesy of Shutterstock, TradingView.