XRP has experienced an impressive 424% rise in the past four weeks, bringing it closer to its all-time high (ATH) of $3.31. This sharp increase has drawn significant attention, signaling potential for further gains.

However, as XRP nears its ATH, several bearish factors are emerging, making its path to new highs more uncertain.

XRP Is Facing Challenges

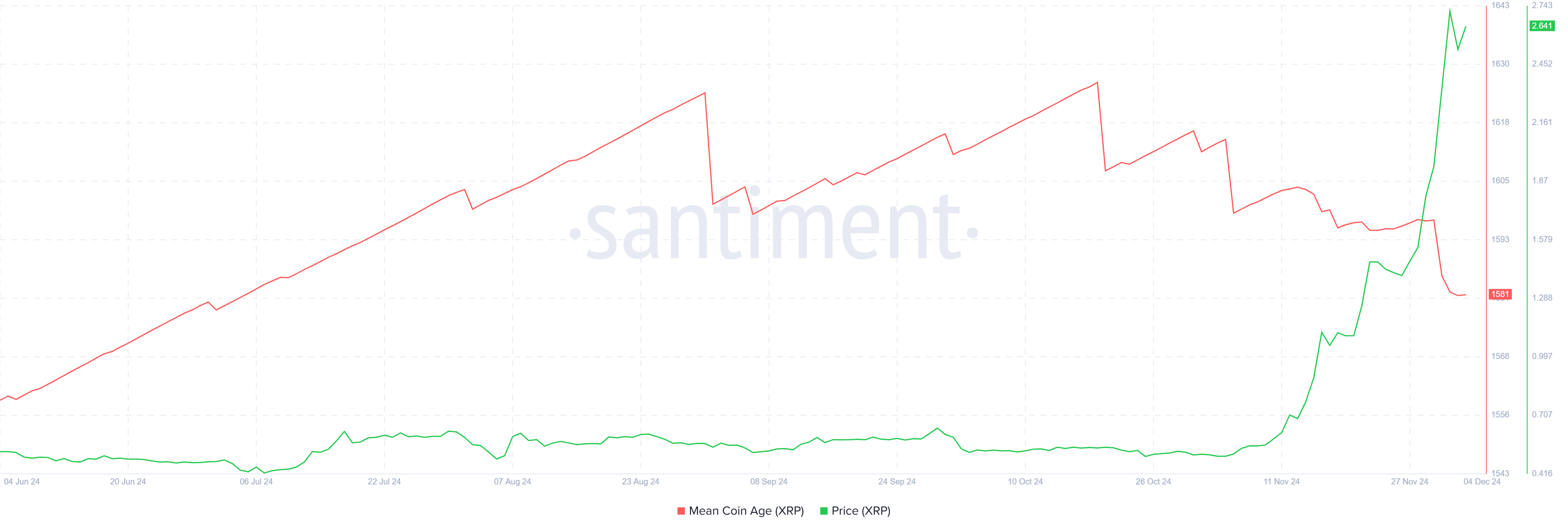

XRP’s market sentiment has shown some concerning signs, particularly with the Mean Coin Age indicator, which has been consistently declining. When the Mean Coin Age decreases, it typically suggests that investors are moving their holdings around rather than holding them long-term. This lack of conviction is often seen as a bearish sign, as it indicates that investors may be preparing to exit their positions.

An increasing Mean Coin Age generally signals strong HODLing behavior, showing that investors have faith in the asset’s future growth. However, the current trend in XRP suggests a shift in sentiment, with more investors trading rather than holding. If this trend continues, it could signal that XRP is nearing a price peak as more market participants look to take profits.

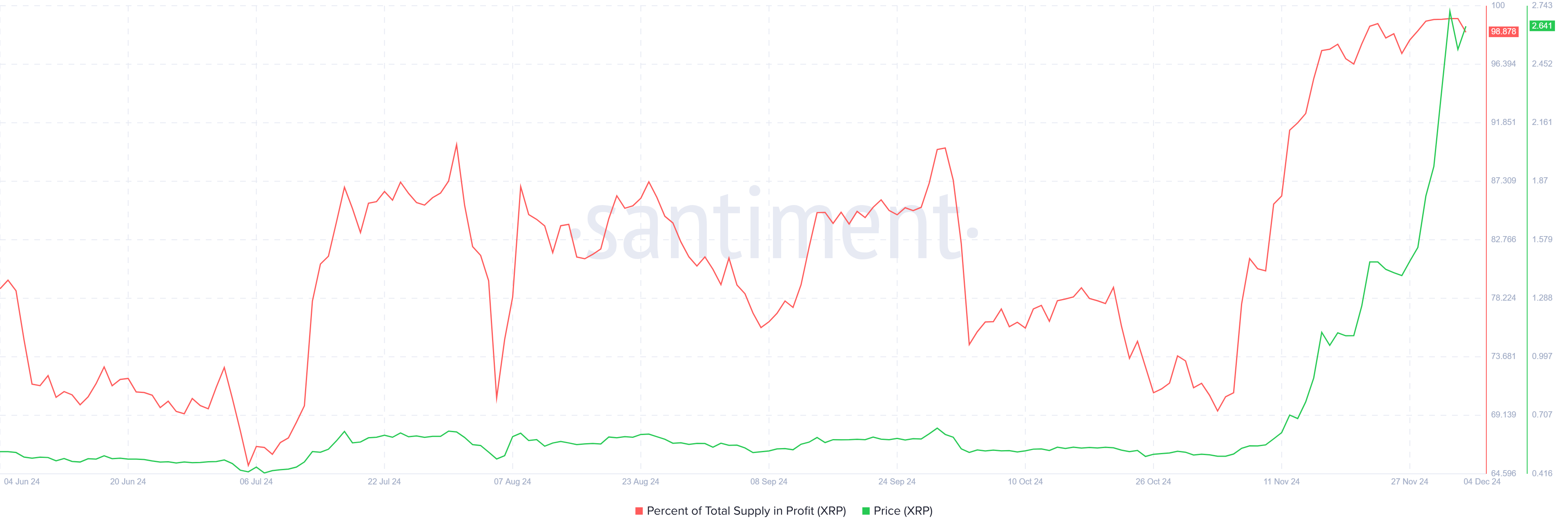

XRP’s macro momentum, while positive, is starting to show signs of saturation. The total supply of XRP in profit is currently over 98%, which traditionally suggests the market is nearing its top.

When over 95% of the supply is in profit, it is often seen as a signal that the market may be close to exhausting its upward momentum. Historically, such high levels of profit saturation have led to market tops, where the price begins to trend downward after extended growth.

The high percentage of XRP supply in profit indicates that many holders are in a profitable position, which could eventually lead to a wave of profit-taking. This selling pressure, combined with bearish market sentiment, suggests that the uptrend may be reaching its saturation point.

XRP Price Prediction: Aiming For ATH

XRP’s price is just over 25% away from reaching a new all-time high above $3.31. The recent surge in price has created optimism for further growth, but the path to ATH may not be straightforward. Resistance at key levels may slow XRP’s ascent, and traders are watching for signs of a breakout or reversal.

If bearish factors continue to mount, such as declining Mean Coin Age and profit-taking from investors, XRP may struggle to break through its ATH. In this case, the altcoin could face a pullback, testing the support level at $2.00 and potentially reversing its recent gains.

However, if the bullish momentum continues, XRP could potentially surpass its ATH and form a new price ceiling. The critical support level to watch is around $2.00, which could act as a buffer against any sudden price drops. As long as XRP holds above this level, a new ATH remains within reach.