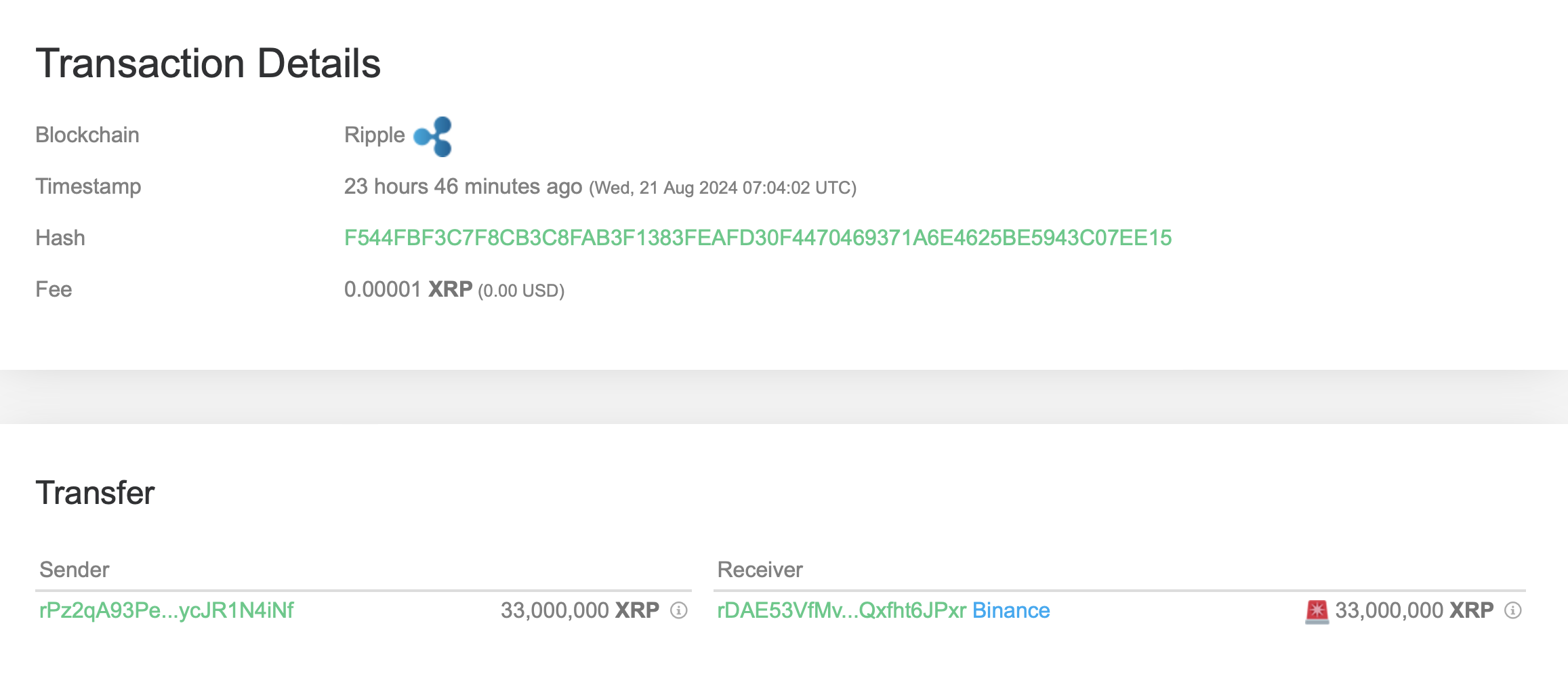

On Tuesday, a notable amount of Ripple (XRP) tokens was sent to Binance. However, while many traders expect this to be a sale, the deposit has failed to stir the market.

XRP’s price reaction has remained muted, with a 1% spike in the past 24 hours.

Ripple Unmoved, Targets New Price High

On Tuesday, 33 million XRP tokens worth approximately $20 million were sent to a Binance wallet. Large amounts of tokens sent to a cryptocurrency exchange would usually send the market into a frenzy due to the potential for a dump. However, XRP’s price has remained relatively stable.

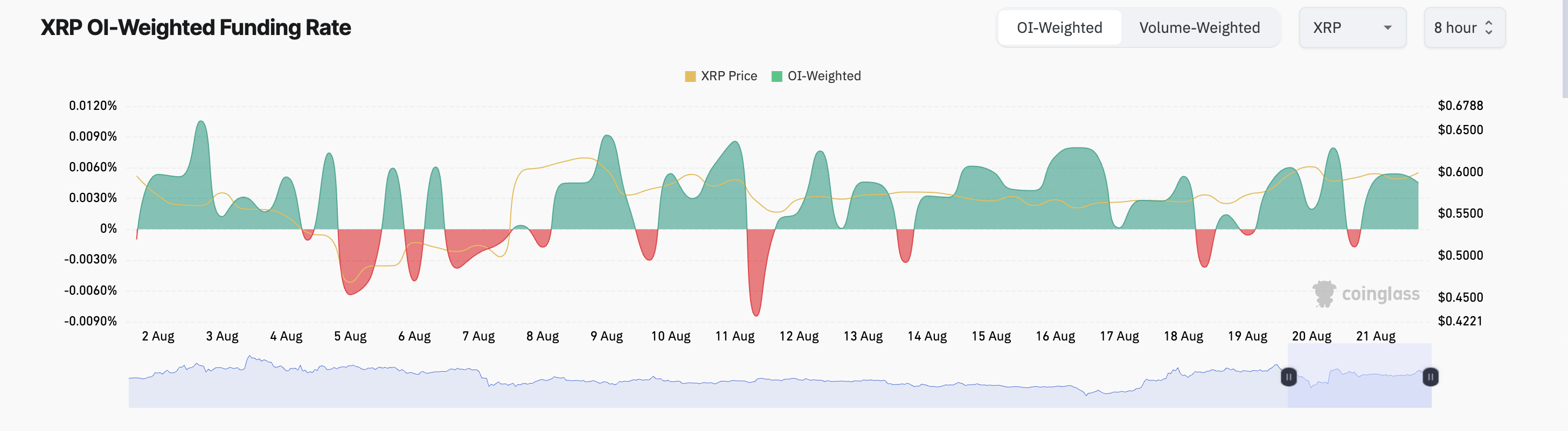

Currently, the altcoin is trading at $0.59, reflecting a 1% price increase in the past 24 hours. Notably, futures traders remain bullish, consistently favoring long positions, as indicated by the token’s positive funding rate on cryptocurrency exchanges. At present, the funding rate stands at 0.0045%.

Funding rates in perpetual futures contracts help maintain alignment between contract and spot prices. A positive funding rate signals that the contract price exceeds the spot price, prompting long-position traders to pay fees to those shorting. This dynamic suggests more traders are betting on an upward price movement than a decline.

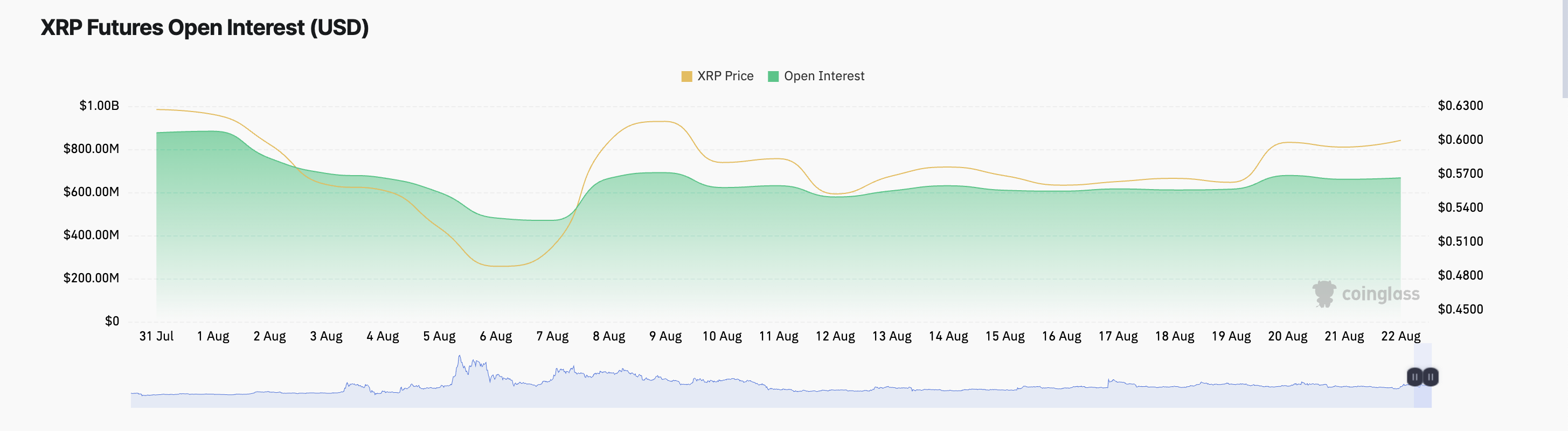

Moreover, XRP’s futures open interest has surged over the last 24 hours. According to Coinglass, the metric currently stands at $667 million.

Read more: XRP ETF Explained: What It Is and How It Works

XRP Open Interest. Source: Coinglass

An asset’s futures open interest tracks the amount of its futures contracts that have yet to be closed. When it rises, it means more traders are entering the market, bringing in new liquidity.

XRP Price Prediction: Demand for Token Remains High

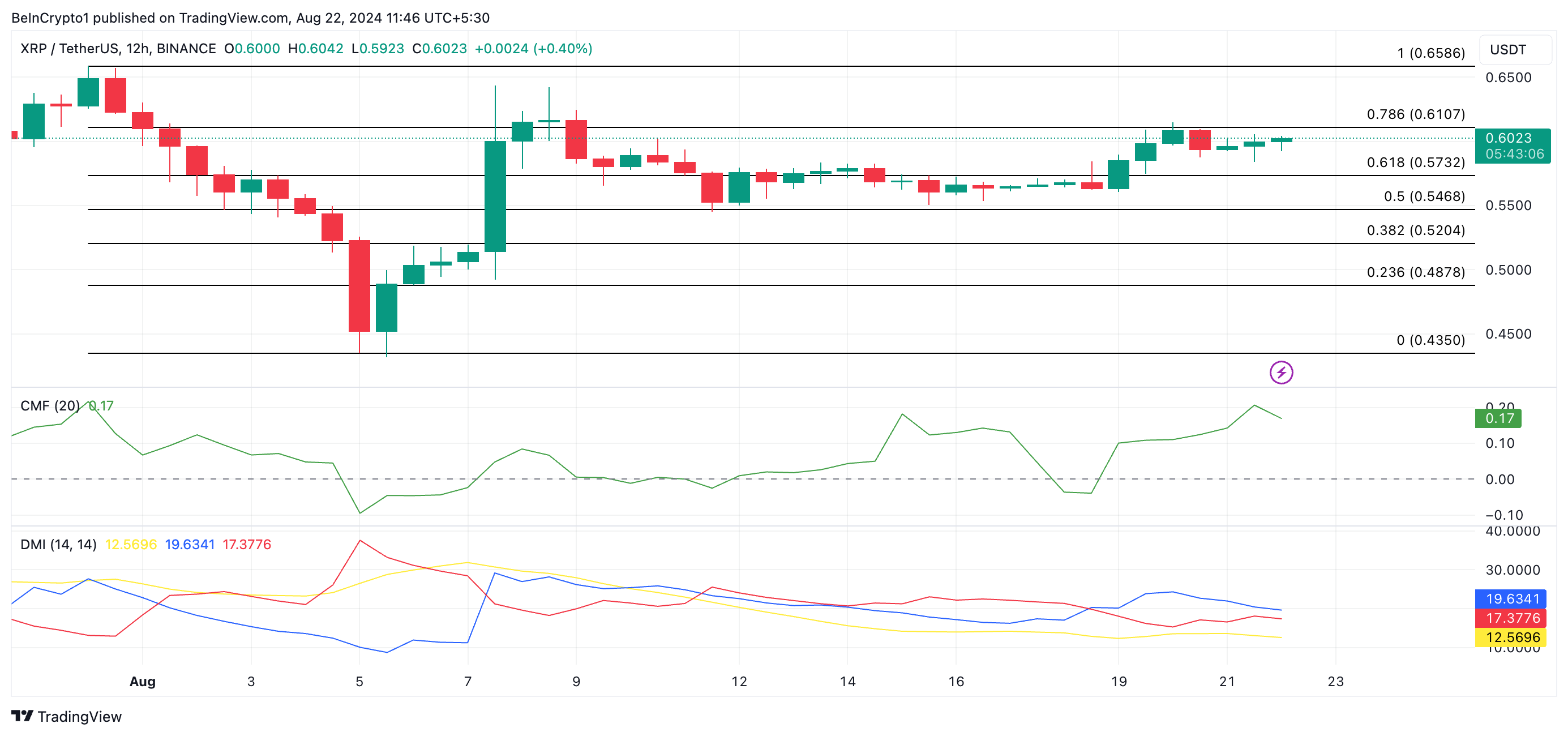

XRP has experienced a 5% increase in value over the past week, with technical indicators suggesting potential for further gains. A review of its 12-hour chart shows that the altcoin is positioned to extend this positive momentum.

Currently, the Directional Movement Index (DMI) highlights a bullish trend, with the positive directional indicator (+DI) above the negative directional indicator (-DI). This setup indicates a strengthening market uptrend driven by strong buying pressure.

Supporting this outlook, XRP’s Relative Strength Index (RSI) is trending upward at 58.15, reflecting increased demand. An RSI at this level suggests that buying pressure is significantly outweighing selling activity, signaling continued bullish sentiment in the market.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

If these bullish conditions remain present, XRP will continue its uptrend. Its price will climb to $0.61. However, any reversal in the current price will force its price down to $0.57, invalidating the bullish projections above.