Ripple’s XRP surged to a three-year high of $1.26 on Nov. 16 but has since pulled back to $1.15, reflecting a 9% decline over the past two days.

The market is currently experiencing increased selling pressure, heightening concerns that the XRP token could soon dip below the critical $1 threshold.

Ripple Sees Surge in Selling Activity

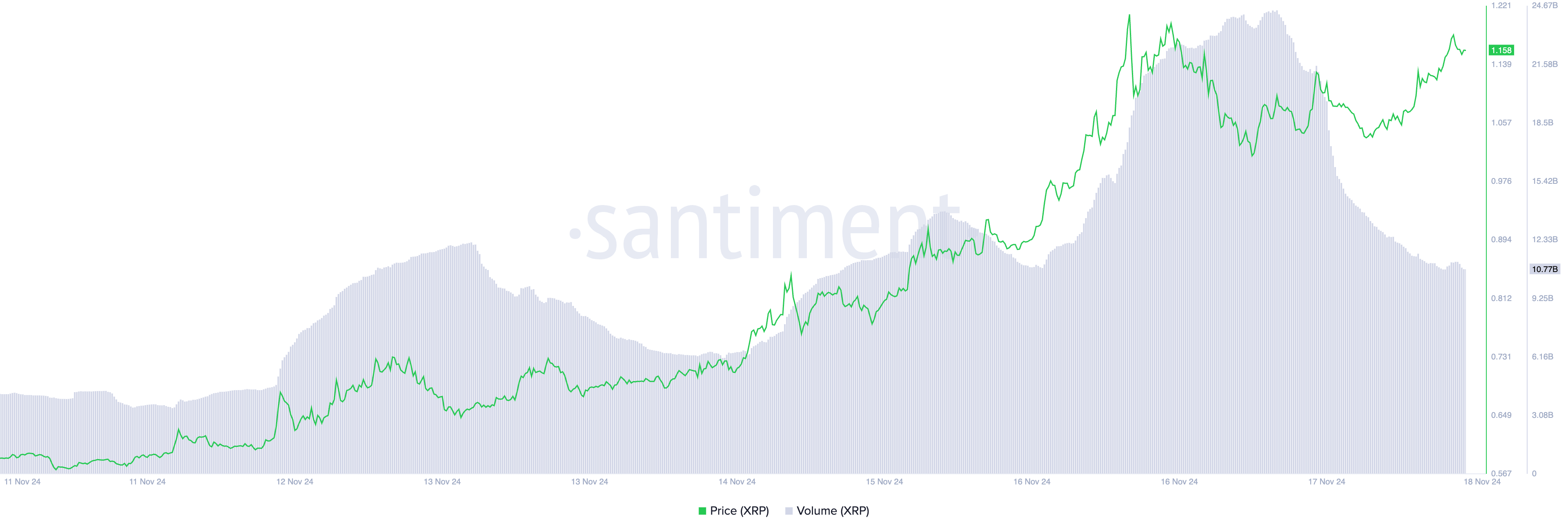

The divergence between XRP’s price and its trading volume over the past 24 hours is a notable indicator of the surge in selling pressure. The altcoin’s value has climbed 7% within this period, while its trading volume has plummeted by 55%.

When an asset’s price rises while trading volume declines, it signals waning market participation. Price increases are more sustainable when accompanied by higher trading volumes, which suggests higher market interest.

However, when the price increases with declining volume, the rally is losing momentum. It indicates that fewer participants are driving the price movement, potentially making it less reliable or more susceptible to reversals.

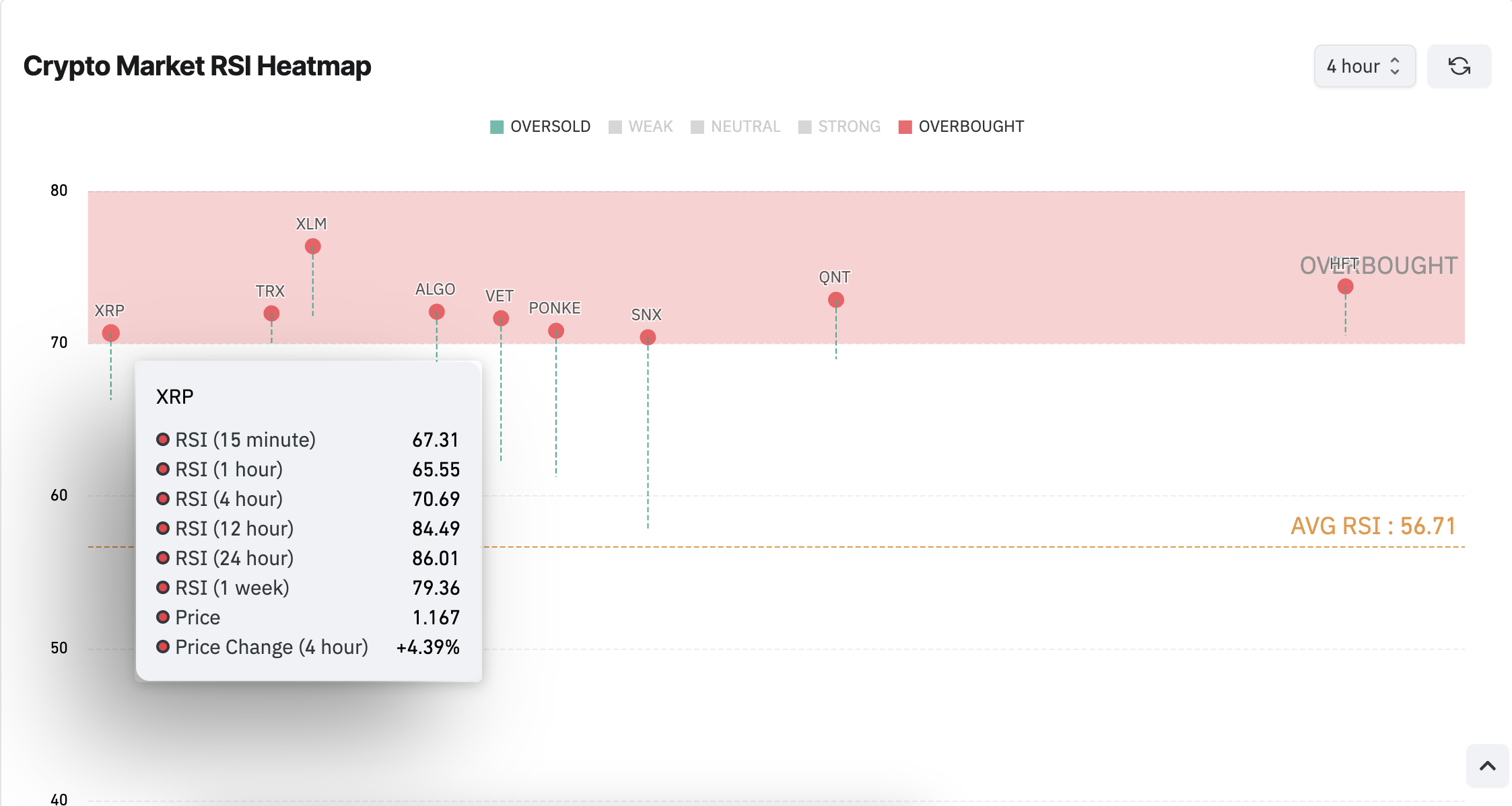

Additionally, a heatmap of XRP’s Relative Strength Index (RSI) indicates overbought conditions across four of six timeframes, hinting at continued price pullback in the meantime.

The RSI measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a decline. On the other hand, an RSI value below 30 indicates that the asset is overbought and may witness a rebound.

XRP’s overbought conditions across multiple timeframes point to a clear conclusion: the market is overheated. Signs of buyer exhaustion are emerging, raising the likelihood of a sustained decline in the XRP crypto price.

XRP Price Prediction: Sub $1 Price Level Imminent

Currently, XRP is trading at $1.15, maintaining support at $1.06. If selling pressure escalates, the altcoin may test this support level. A breach could see the price dip below the psychological $1 mark, potentially reaching $0.93. Continued selling could push XRP even lower, possibly targeting $0.82.

However, a resurgence in demand could propel XRP back to its three-year high of $1.26 and above, invalidating the bearish outlook outlined above.