XPL FUD has recently become the center of attention as the token’s price dropped more than 46% from its all-time high (ATH) in just a few days.

The causes stem from rumors, ICO profit-taking pressure, and volatile market sentiment. The key question now is whether this is merely a short-term correction or a sign of a prolonged downtrend.

Plasma FUD Spreading Amid Information Distortion

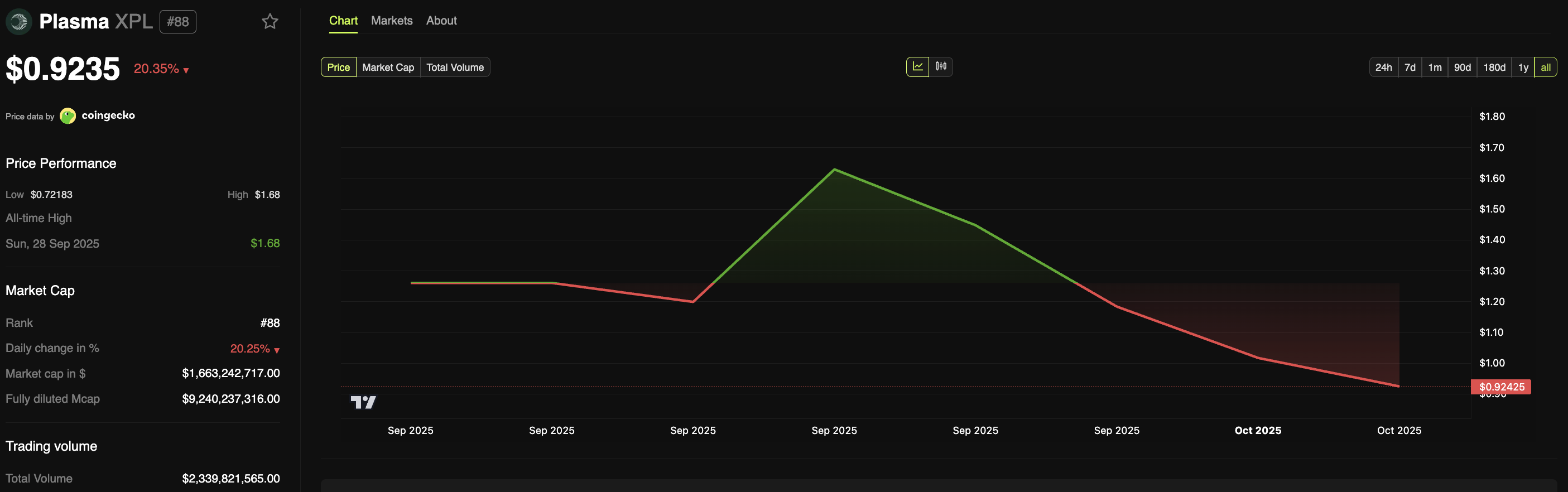

Data from BeInCrypto shows that Plasma’s XPL price is trading around $0.9235, down 46% from its ATH three days ago.

The sharp decline of XPL originated from claims that Plasma “was developed by the same team as Blast,” a highly controversial project. Since its launch in late 2023, Blast has faced numerous incidents, including hacks, rug pulls, network outages, a lack of transparency in development, and heated debates over token distribution and airdrops.

As a result, XPL’s price fell from $1.7 to $0.9 before recovering to current levels. However, some analysts have affirmed that this was merely baseless, even organized FUD, spread to create artificial selling pressure. This highlights an important reality: the crypto market is driven by supply and demand and highly vulnerable to manipulation through one-sided information.

“After deep research and my personal connections in Bitfinex it was confirmed that this is just organized FUD with zero evidence,” one X user commented.

Aside from FUD about the team, another reason is the unlocking of ICO tokens. Many early investors had gained 20x – 30x profits in just a few months, leading them to take profits. This caused a sudden surge in market supply, contributing to the price decline.

According to crypto trader Alex Kruger’s observations, abnormal funding rates combined with large spot selling volumes indicate that the drop was mostly due to “spot dumping” rather than a short squeeze. This is characteristic of a market undergoing correction after a hot rally, not necessarily due to a fundamental change.

“Expect a strong move up as soon as indiscriminate spot selling subsides, whenever that may be,” an analyst noted.

Technical Perspective: Clear Signals from the Charts

It seems that the FUD-related information around XPL significantly impacted investor sentiment.

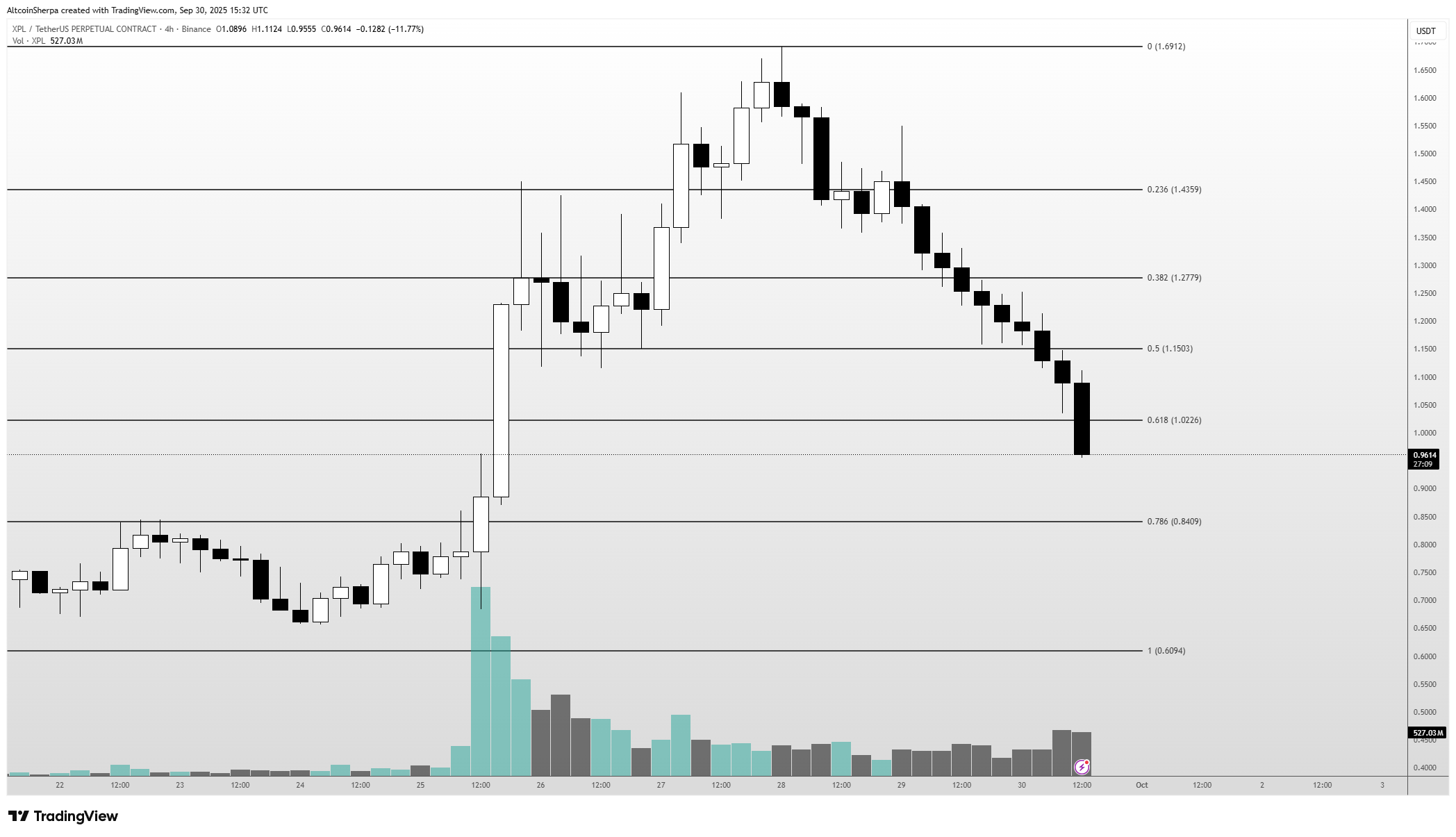

On the 1-hour chart, XPL displayed the typical pattern of a newly launched token: a rapid pump followed by a sharp dump. The ~$1.11 zone is a crucial support level to regain short-term momentum.

During the 4-hour timeframe, the market witnessed a streak of consecutive red candles, which precisely described a severe sell-off or “vicious selling.” Some analyses suggest that XPL has lost its 4H trend and even broken down past the consolidation zone, weakening its bullish structure without showing any recovery attempts.

XPL FUD has played a major role in fueling this pessimistic sentiment.

The big question now: Is this a local bottom or the beginning of a longer-term downtrend? From a strategic standpoint, this is more likely a short-term bottom — the price could rebound once ICO selling pressure cools off.

XPL still has strong recovery potential if selling supply decreases and the community overcomes its fear of XPL FUD. However, if left unaddressed, XPL FUD may continue to erode confidence.