The supply of wrapped or tokenized Bitcoin has stalled as the demand for decentralized finance cools amid a market-wide retreat.

One consequence of the onset of a bear market and plunge in cryptocurrency prices is a decreased demand for decentralized finance. This has a knock-on effect on the supply of tokenized Bitcoin which has stagnated recently.

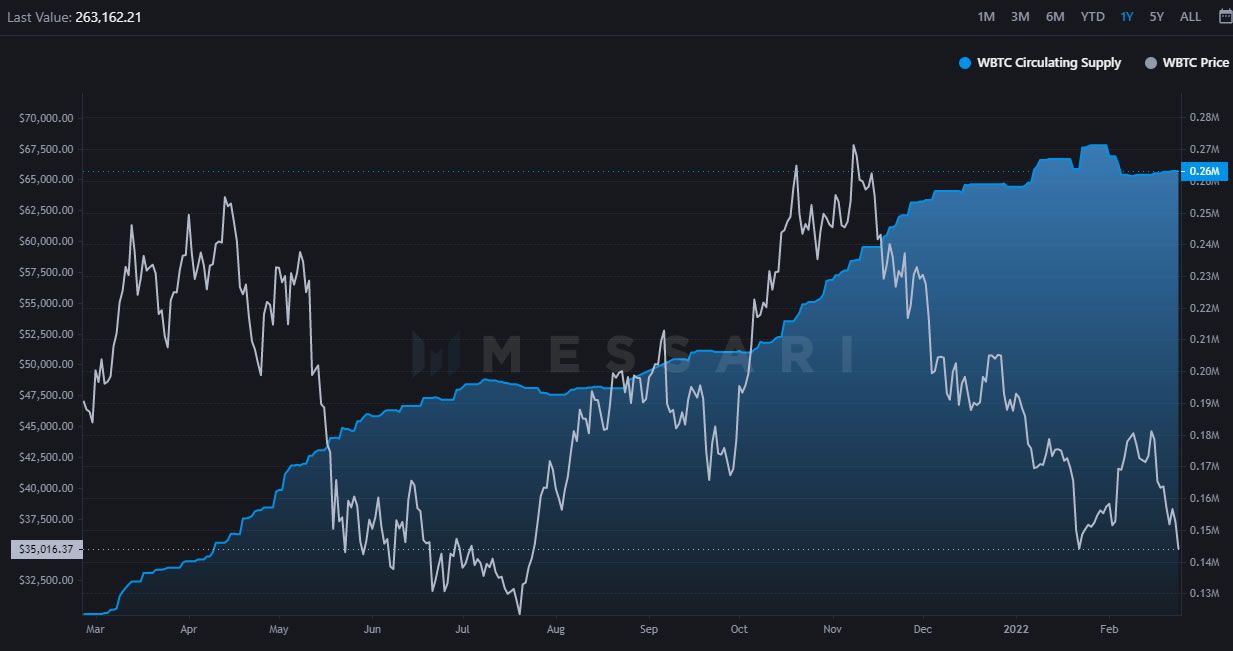

Wrapped Bitcoin (wBTC) enables Bitcoin holders to dabble in Ethereum-based DeFi without selling or converting their assets. Meaning, bitcoins are tokenized as an ERC-20 asset on the Ethereum network. Over the past couple of years, the supply of wBTC has surged along with the demand for DeFi. Additionally, during the past 12 months, the supply has increased by 113%.

WBTC beginning to fall

However, that trend is starting to show signs of reversal as the supply has stalled over the past couple of months. According to Messari, wBTC supply has plateaued since December after spiking to an all-time high of 271,257 BTC in January.

The current supply of wBTC is 263,162 coins worth around $9.2 billion at current prices. It is down 3% since that peak and appears to be entering a period of decline. Data from Coin Metrics shows a similar pattern.

In comparison to wrapped Ethereum (wETH), there are currently 7.49 million tokens worth an estimated $17.4 billion according to Etherscan.

DeFi TVL tumbles

The total value locked in DeFi has also taken a downturn as crypto markets continue to decline. Different analytics platforms have different methods of TVL measurement, but the trend is the same on all of them.

Currently, DeFiLlama is reporting a TVL of $183 billion, which is down 28% from its all-time high of $255 billion on December 1. Nonetheless, the TVL in DeFi has grown at a steady rate over the past 12 months, increasing by 252% since the same time last year.

DappRadar has a slightly lower TVL figure of $99 billion but reports a larger decline of 45% from a $182 billion all-time high on Nov 10.

The fall in TVL is more likely to be directly connected to the asset price dump over the past couple of months rather than investors pulling out of DeFi en masse. Crypto markets have now retreated by 47% from their total market cap all-time high of just over $3 trillion in November.