WLD, the token that powers Worldcoin, the crypto project co-founded by OpenAI CEO Sam Altman, is under increasing bearish pressure as traders bet against it.

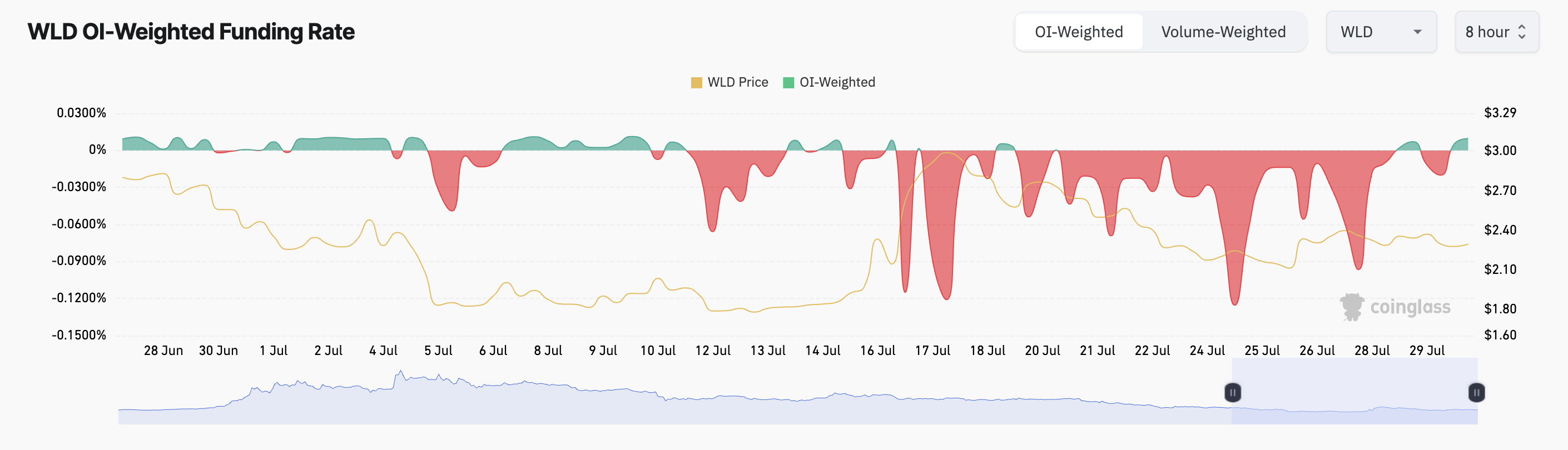

In the altcoin’s derivatives market, there has been a notable surge in the demand for short positions, evidenced by negative funding rates across major cryptocurrency exchanges.

Worldcoin Traders Hope For More Price Declines

According to Coinglass, WLD’s funding rate has been predominantly negative since July 11.

Funding rates are a mechanism used in perpetual futures contracts to ensure an asset’s contract price stays close to its spot price. When they are positive, it means more traders are buying the asset, expecting an increase than those buying and hoping for a decline.

Conversely, when an asset’s funding rate is negative, it indicates more traders are taking short positions. This suggests that more traders anticipate a decline in the asset’s price compared to those buying it, hoping to sell at a higher price.

The surge in demand for WLD short positions began after Tools for Humanity (TFH), the developer behind Worldcoin, announced its plans to release 2 million tokens daily from July 24. This reflects the lack of confidence in the token, as many traders have chosen to bet against it.

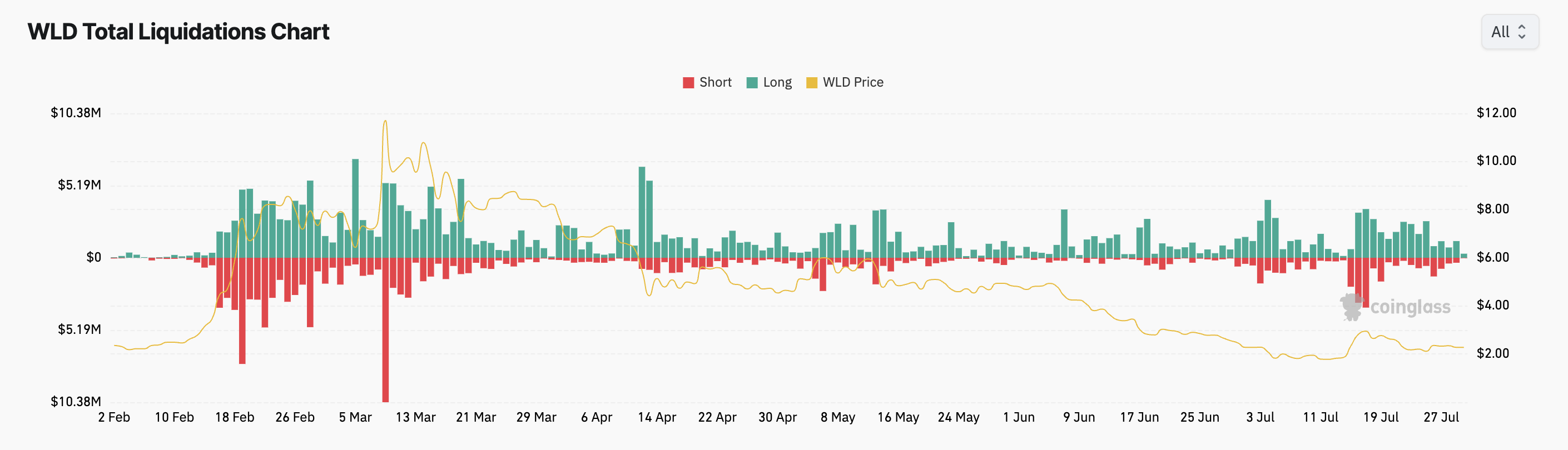

WLD’s selling pressure has spiked in the past few days, causing its price to drop. This has led to the liquidation of several long positions.

Read More: How to Buy Worldcoin (WLD) and Everything You Need to Know

Liquidations occur when an asset’s value moves against a trader’s position. When this happens, the trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations happen when the asset’s price falls beyond a certain level, forcing traders with open positions to bet on a price increase to exit the market.

According to Coinglass’ data, in the past seven days, WLD’s long liquidations have totaled approximately $11.46 million.

WLD Price Prediction: The Spot Market Is Not Any Different

Bearish sentiment is also present in WLD’s spot market. Readings from the altcoin’s Parabolic Stop and Reverse (SAR) indicator assessed on a daily chart confirm this. At press time, the dots of this indicator lie above WLD’s price.

An asset’s Parabolic SAR indicator identifies potential trend direction and price reversal points. When its dots are placed above an asset’s price, the market is in a downtrend. It indicates that the asset’s price is falling, and the decline will continue.

If WLD’s price continues to fall, it will trade below the $2 price level. Its next price target will be $1.80.

However, if market sentiment shifts from negative to positive, WLD’s price may rally past $3 to exchange hands at $4.20.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.