World Liberty Financial (WLFI) trades near $0.21 at press time, down nearly 12% in the past 24 hours. From its launch peak of $0.33 on September 1, the WLFI price has now corrected by roughly 37%.

At first glance, this may appear to be a token under pressure. However, on-chain data and liquidation maps reveal a more nuanced story. Whales continue to add heavily, and while short bets dominate derivatives markets, the final liquidation clusters show a key level where WLFI could bounce back.

Whale Buying Stays, But Dip Buying Slows Down

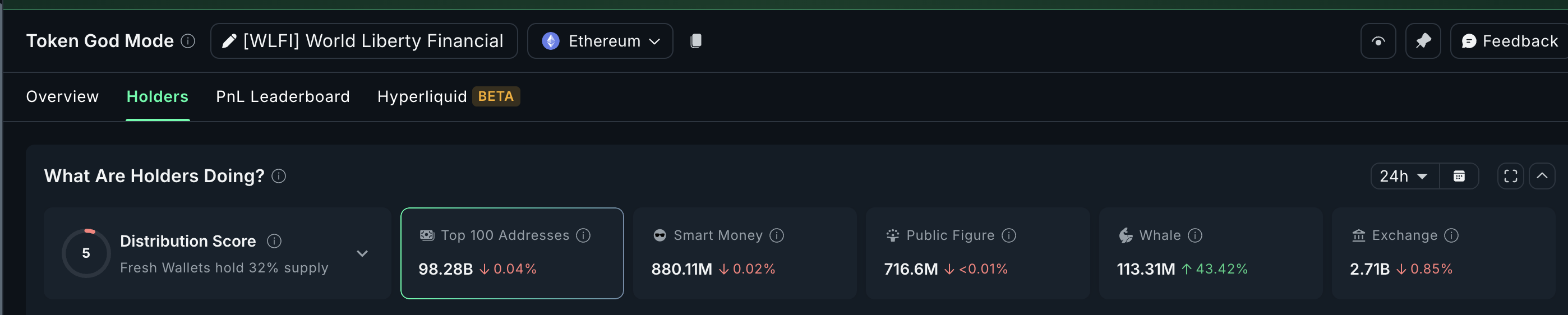

Even during WLFI’s sharp decline, whale wallets have expanded their holdings. Over the past 24 hours, whale balances jumped 43.42%, rising from 79.01 million WLFI to 113.31 million WLFI.

This means whales added about 34.30 million tokens, worth nearly $7.2 million at current WLFI prices.

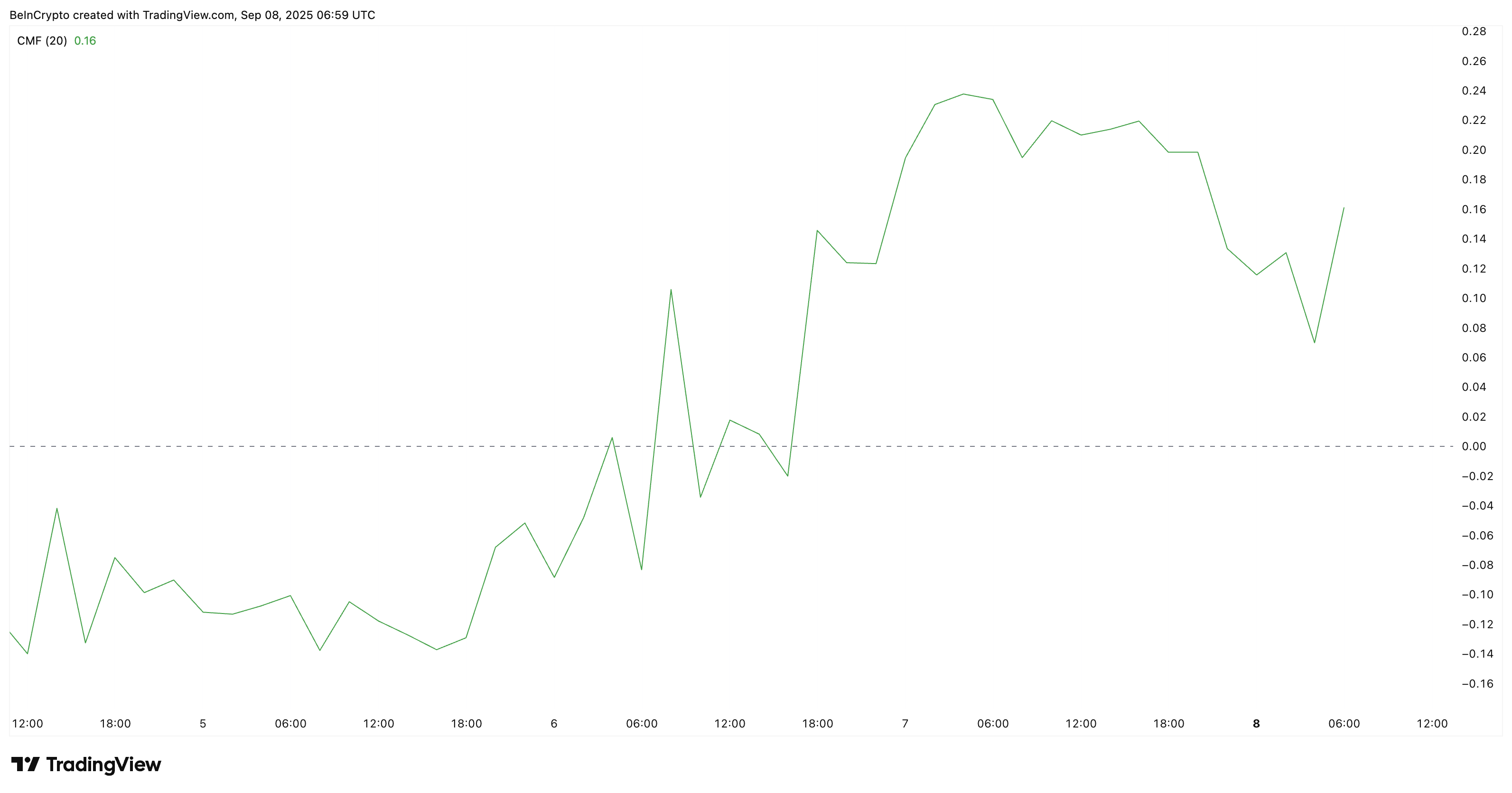

The buying explains why the Chaikin Money Flow (CMF) — a measure of whether money is broadly flowing in or out of a token — still reads strongly positive near +0.17.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In simple terms, as long as CMF is above zero, it shows that large investors are still sending money into WLFI.

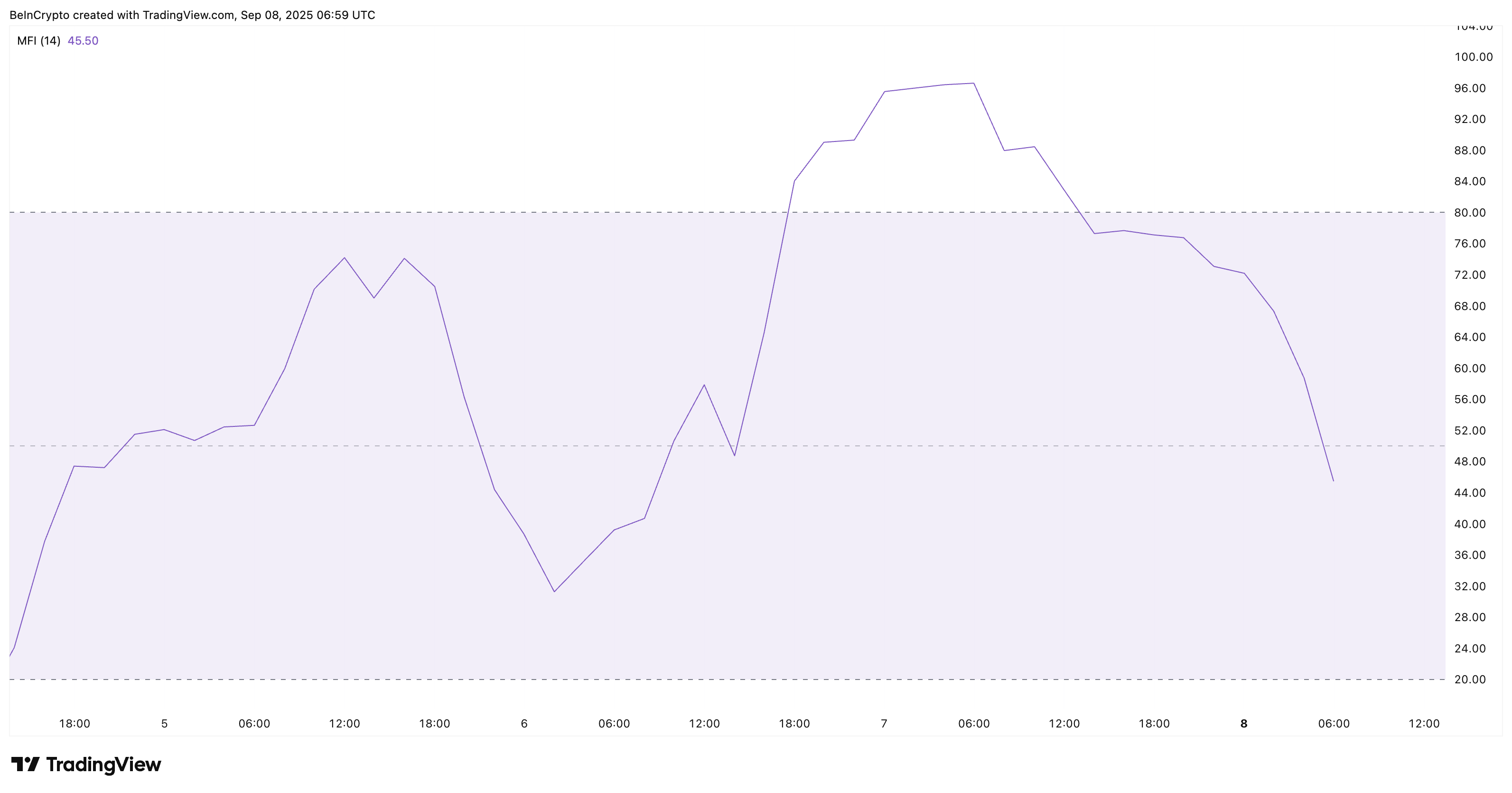

At the same time, the Money Flow Index (MFI) — which compares trading volume with price to show whether dips are being bought or sold — has been sliding lower on the 2-hour chart.

The drop signals that smaller traders are not buying dips. Instead, whales appear to be buying at almost any level, which keeps the broader inflows alive but reduces short-term rebound strength.

Liquidation Map Points To A Key Support

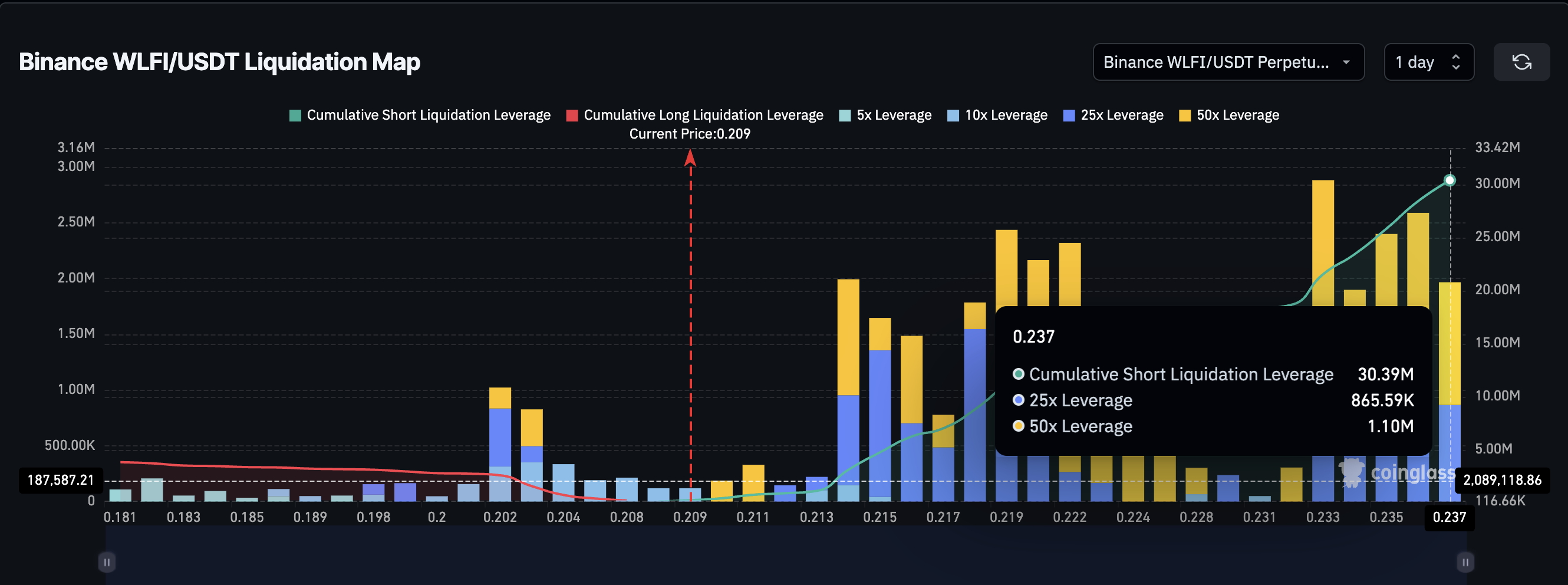

Most of the long positions have already been wiped out in the recent drop. Only about $4 million in long liquidations remain, while short positions stack up to more than $30 million. The imbalance means the market is leaning heavily short.

The last major liquidation cluster for longs is at $0.18, which now serves as a crucial support zone. This level is made more important because it aligns with support already visible on the price chart.

Together, these data points suggest that if WLFI drops to $0.18, buyers may step in strongly and spark a rebound. And that rebound might have strength considering the stacked short liquidations.

This sets the stage for how the WLFI price structure itself looks right now.

WLFI Price Action Holds The Rebound Zone

WLFI now trades just above $0.20, a level tested as short-term support, per the 2-hour chart. If the token holds this base, momentum from whale buying could lift it back toward $0.22, the next key resistance.

Crossing $0.22 might prime the WLFI price for $0.24 and beyond.

The alignment of the $0.18 liquidation cluster with chart-based support reinforces why this is seen as the rebound zone. If WLFI holds $0.20 and avoids breaking $0.18, the setup favors a bounce. But if it fails these levels, the bearish trend could extend further.