World Liberty Financial (WLFI) has slipped into deeper red. Trading at $0.187, the WLFI price has declined by almost 20% in the past 24 hours — a sharp move for an asset that was only launched days ago.

The charts and on-chain data both suggest one thing: sellers remain firmly in control of the coin. And there might be some more price weakness along the way.

Sell Pressure Floods Exchanges

Over the past day, more than $23 million in WLFI has moved to exchanges, amplifying sell pressure. That explains why the WLFI price cracked below $0.20 despite a brief bounce attempt.

Looking closer at the breakdown:

- Smart money balances fell nearly 2.8%, suggesting that even traders who bet on quick flips are exiting.

- Public figure addresses also dropped slightly, showing softer conviction from influencer-backed wallets.

- Whale balances ticked up marginally (+0.43%), but their impact was negligible compared to the flood of exchange inflows.

Even the top 100 addresses increased their holdings by 0.25%, taking their stash to 98.39 billion WLFI. But given the token’s distribution score of just 5 — with the largest holders controlling over 96% of supply — this is likely internal reshuffling or repositioning. The effect hasn’t shown up on exchanges, which is why the uptick isn’t considered a bullish signal for WLFI price right now.

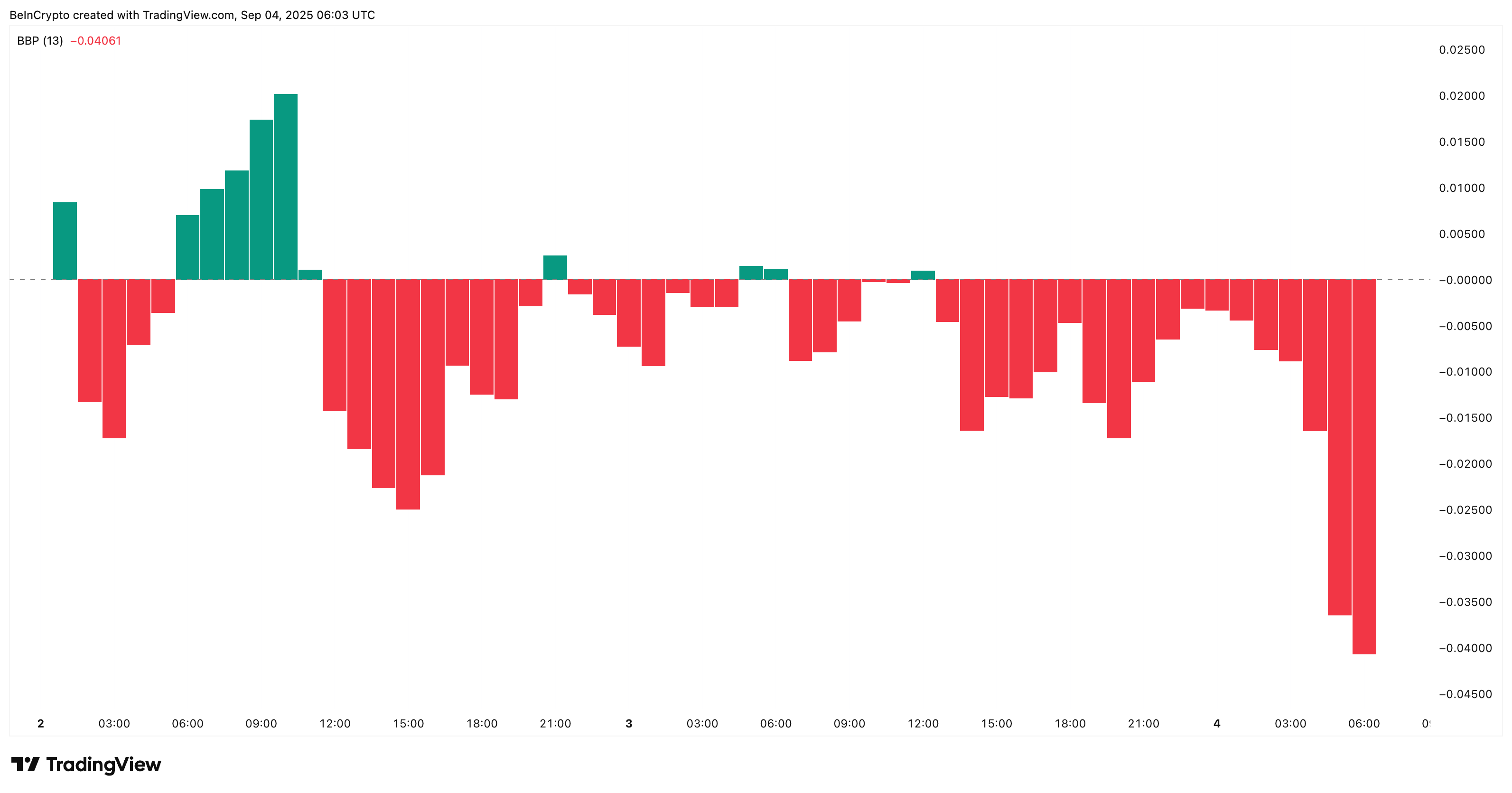

The Bull–Bear Power (BBP) indicator confirms the imbalance. BBP compares price extremes with a moving average to highlight whether bulls or bears control momentum. On the 1-hour chart — the most relevant timeframe given WLFI’s limited trading history — the histogram has been deep in red. In simple terms, bears are dictating the trend, and buyers have yet to mount any sustainable defense.

Until that changes, the WLFI price action seems to be headed south.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

WLFI Price and SAR Still Say “Down”

The technicals are equally grim. The Parabolic SAR (Stop and Reverse), a trend-following indicator that flips above or below the WLFI price to signal direction, has stayed firmly above the candles since September 2.

On that day, WLFI briefly traded above the SAR line and sparked a quick rally, but it quickly lost momentum. Since then, WLFI price has remained capped beneath SAR, a strong sign that the downtrend is still intact.

Unless WLFI price reclaims higher levels, the indicator suggests that traders will keep selling into every minor bounce. From the latest swing high near $0.23, the critical level to hold now is $0.18. A breakdown below it would confirm a bearish extension and open the door to fresh lows.

On the flip side, reclaiming $0.20 is the first sign of strength, with $0.21 as the next checkpoint for any recovery attempt.

For now, WLFI price looks fragile. With exchanges still seeing heavy inflows and Smart Money trimming positions, the bears remain firmly in control of the short-term outlook.