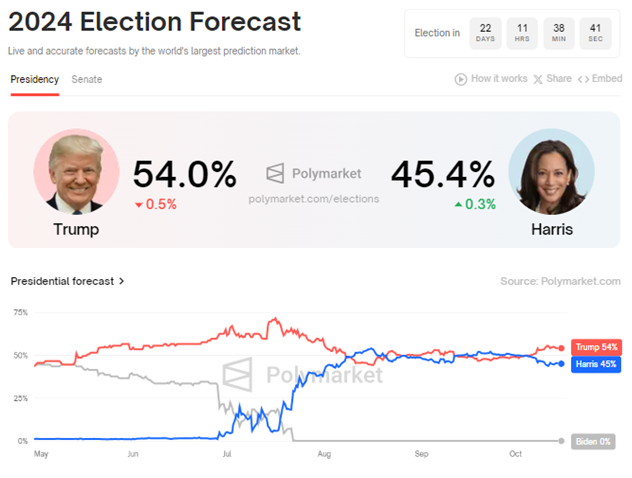

Donald Trump continues to extend his lead on Polymarket against Kamala Harris, as the two presidential aspirants have only three weeks to the US elections.

With crypto presenting as a political imperative in the ongoing US presidential campaigns, Donald Trump’s decentralized finance (DeFi) venture, World Liberty Financial, prepares for its WLFI token debut on Tuesday.

Donald Trump Leads Polymarket as WLFI Token Launch Approaches

Polymarket data indicates that Donald Trump is leading with 54% support, compared to Kamala Harris’s 45.4%, with only 22 days remaining before the US elections. Trump is also ahead in key swing states, including Arizona, Georgia, Pennsylvania, Michigan, and Wisconsin.

Trump’s edge over Kamala Harris comes from his pro-crypto stance, evidenced by, among other things, his DeFi venture, World Liberty Financial. The project’s token launch is due on Tuesday, October 15.

“World Liberty Financial token sale goes live on Tuesday morning, October 15th! This is YOUR chance to help shape the future of finance. Be there on Monday, October 14th at 8 AM EST for an Exclusive Spaces to learn more. Join the whitelist today and be ready for Tuesday,” Trump’s official account noted.

The post reiterated the protocol’s announcement about the WLFI token launch and upcoming sale. With 63% of the WLFI token supply allocated for the public sale, World Liberty Financial is aiming to raise $300 million. The project’s roadmap values the protocol at $1.5 billion.

Read more: Tokenomics Explained: The Economics of Cryptocurrency Tokens.

WLFI tokens will be non-transferable for the first year following their launch. Even if the community votes to remove this restriction, any changes would only take effect after the initial year. Despite the lockup, token holders will still have a voice in the governance of the network, which is a key use case for the WLFI token.

World Liberty Financial Gets Second Chance to Woo Crypto Investors

Ahead of the listing, World Liberty Financial will hold a session on X spaces on Monday, October 14, at 12:00 PM UTC. It will feature the WLFI team, advisors, and supporters. The session will provide World Liberty Financial with a second chance to convince the crypto community after they failed to make a positive impression during the DeFi venture’s launch.

Despite its ambitious mission, the debut left crypto investors doubtful about the project’s viability and business model. Other concerns included how WLFI would operate and its target customer base. How its decentralized lending protocol, which is expected to run on Aave, would generate revenue also remains unclear.

Further disappointment came from the announcement of exclusivity. Specifically, the WLFI token would only be available to investors who meet a certain wealth threshold. This left the broader audience that may have been interested in participating feeling excluded.

Crypto investors are keen to see whether the concerns surrounding the WLFI token will be addressed before its launch on Tuesday. Notably, Donald Trump could become the first US president to launch a cryptocurrency, pending the outcome of the November elections.

Read more: How To Fund Innovation: A Guide to Web3 Grants.

Meanwhile, Mark Uyeda, one of the commissioners in the five-member US Securities and Exchange Commission (SEC), commented on Trump’s DeFi venture. He said World Liberty Financial Will not be exempt from tight US regulations.

“I would tell them to hire good lawyers because they will have to navigate the same confusing and opaque process that every other entrepreneur in the space has faced because the Commission has not offered clear guidance. Godspeed to them,” Fox Business correspondent Eleanor Terrett reported, citing Uyeda.