Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee, because despite summer doldrums and persistent doubts, one of Wall Street’s most seasoned voices insists the rally is far from finished, and his outlook could ripple beyond equities into crypto.

Crypto News of the Day: WisdomTree’s Siegel Hints at TradFi Market Upside — Will Crypto Follow?

The US stock market rally is far from over, according to Jeremy Siegel, chief economist at WisdomTree. Speaking in a recent interview, Siegel argued that equities still have room to climb, dismissing fears that the market’s summer surge is about to fizzle.

“I think this bull market is certainly still intact,” Siegel said in an interview with a TradFi media.

Siegel noted that corporate earnings revisions remain positive and market breadth continues to strengthen.

While he does not expect a meteoric rise, he believes a 5–10% upside over the next six months is well within reach. Monetary policy is at the core of his optimism.

Siegel has consistently called for lower short-term interest rates. He argued that the Federal Reserve’s benchmark rate should be at least 100 basis points (bps) below the 10-year Treasury yield.

In his view, the Fed funds rate belongs in the “low threes,” a level he believes the economy is drifting toward.

That trajectory, he says, would be “a great comfort to investors,” especially as small-cap stocks, represented by the Russell index, have shown strong sensitivity to easing expectations.

He added that the powerful gains seen across both growth and value equities last week highlight that this rally is broad-based, not tentative.

One point of contention for investors has been thin summer trading volumes. However, Siegel brushed aside concerns, noting that low activity in late August is typical as traders “head to the beach.”

In his view, holding gains through seasonally weak periods, such as late August and early September, is historically a bullish signal for the remainder of the year.

Still, Siegel acknowledged risks. Chief among them is the Federal Reserve itself. If Fed Chair Jerome Powell fails to follow through on expectations of rate cuts, Siegel warned that “it puts an end to the rally.”

The upcoming Personal Consumption Expenditures (PCE) report is also a key watch. It features among the US economic signals this week. This data point could confirm that inflation pressures are cooling.

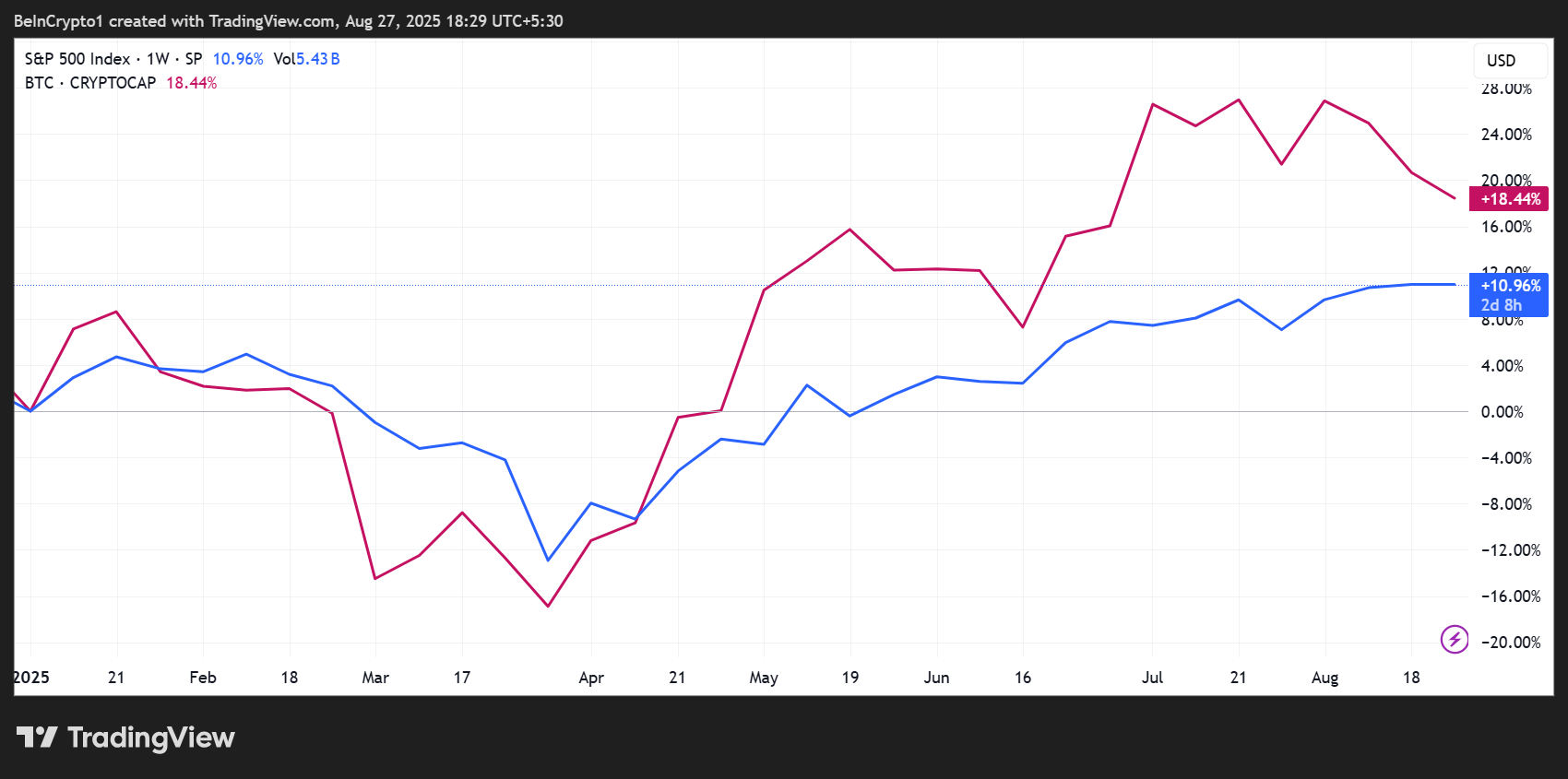

Siegel’s perspective is relevant to crypto markets. Bitcoin and Ethereum, among other digital assets, have often mirrored Wall Street’s risk appetite, with looser monetary policy historically fueling capital inflows into equities and crypto.

If Siegel’s outlook proves correct, interest rates fall, and the bull market extends, the conditions could also underpin a renewed crypto uptrend.

“…a potential Fed interest rate cut opens up retail capital, adding to the fiery demand for ETH,” Kevin Rusher, founder of RWA borrowing and lending ecosystem RAAC, told BeInCrypto.

As institutions increasingly treat Bitcoin as a risk-on asset, the health of Wall Street remains tightly bound to digital finance.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Fly to Malaysia for KYC? MEXC responds to the White Whale’s $3 million allegations.

- XRP Futures ETF became the fastest CME contract to hit $1 billion in open interest.

- $5,000 Ethereum price narrative resurfaces as big players rotate out of Bitcoin.

- Bitcoin price fights off 10-day sell streak—Are buyers gaining control?

- Three scenarios for CRO in 2026 after the Trump media deal.

- HYPE hits $50 all-time high as Hyperliquid targets breakout to $73.

- XRP is trapped in sideways action, but bullish signs are starting to emerge.

- JPMorgan’s $500 million bet fuels 130% surge for NMR.

Crypto Equities Pre-Market Overview

| Company | At the Close of August 26 | Pre-Market Overview |

| Strategy (MSTR) | $351.36 | $351.12 (-0.068%) |

| Coinbase Global (COIN) | $308.48 | $308.21 (-0.088%) |

| Galaxy Digital Holdings (GLXY) | $24.72 | $24.77 (+0.20%) |

| MARA Holdings (MARA) | $15.84 | $15.81 (-0.19%) |

| Riot Platforms (RIOT) | $13.69 | $13.65 (-0.29%) |

| Core Scientific (CORZ) | $14.04 | $14.08 (+0.28%) |