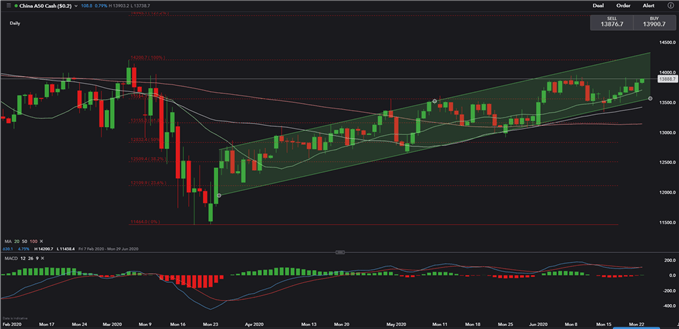

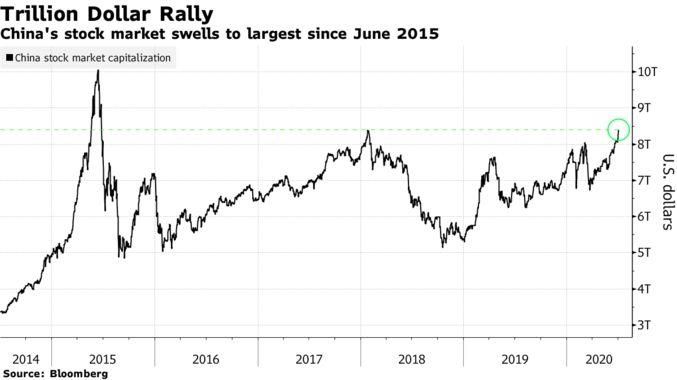

Monday saw the most significant one-day jump in the Shanghai Composite in five years. It closed up 5.7%, the most since the last bull market of 2015.

Leading the charge are Chinese financial stocks, which were amongst the best performers on the trading floors in Hong Kong and Shanghai.

Why Are Asian Stocks Hot Now?

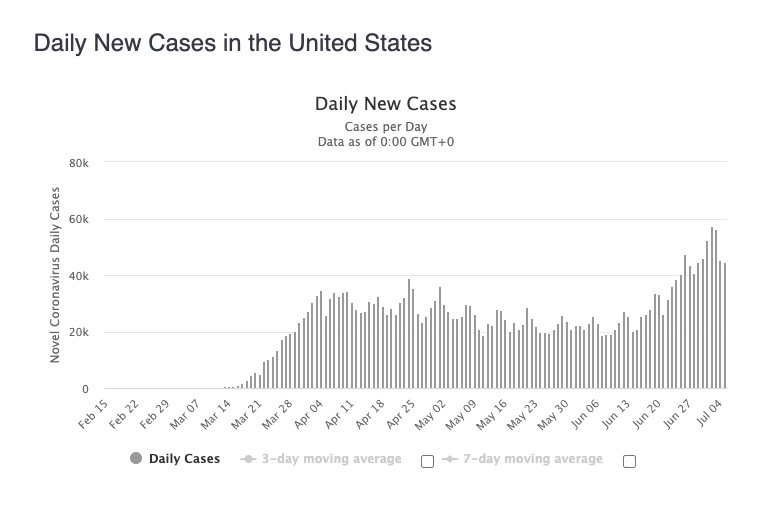

Multiple factors explain the positive sentiment towards Asian stocks and Chinese ones in particular. The main drivers stem from the effects of the COVID-19 pandemic and the lockdown that followed. These incidents shook the trust of global investors in sectors considered stable until now, like tourism, airlines, and main street retailers. Take a look at service and tourism-oriented economies, like Spain or Italy. They will likely be worse hit by the economic effects of the three-month lockdown than with the virus itself. Investors appear to be shifting their focus towards more production-oriented countries. Also, countries that managed the pandemic sooner will likely recover faster from the devastating effects of lockdown. These countries will be in a better position after the Global Reset of 2020.

“We see a number of catalysts that could drive Asia ex-Japan (AeJ) equities’ outperformance over U.S. equities in the near term,”The firm added:

“Better COVID-19 trends and mobility data in economies/markets that dominate the AeJ index should translate into faster economic recovery vs the U.S.”

China: The New Financial Center of the World

One of the declared objectives of the Chinese government is to grow the size of its financial industry. A more ambitious one is to make Shanghai the epicenter of Asian trade. The ultimate goal, however, is to overcome New York between 2040 – 2050. There’s a long way to go still, but Chinese regulators are slowly moving forward. The first step is opening up the stock market to a hungry group of global investors who are desperate to find good returns in a low-growth environment. Recently, regulators in Beijing loosened rules on margin financing, enabling investors to punt with borrowed funds.

“We expect regulators to continue to boost stock market activity and try to guide even more funding from banks and insurers into the stock market… The signal from the regulators is clear: They are pushing for the development of margin trading and short selling business in China.”Another characteristic to bear in mind is that 99% of all investors in Chinese stock markets are Chinese individuals. This can be interpreted as a sign of strength as it protects domestic markets from negative foreign sentiment. On the other hand, analysts raise flags about the validity of this bull push.

Money Printer Goes Brrrr

“investors were rushing back to stocks.”The state-owned China Securities Journal published on Monday an article asserting that:

“cultivating a healthy bull market is important for creating new opportunities… and in the post-COVID-19 world, the economy needs a healthy bull market more than ever.”

The Geopolitical Factor

Some of the big winners of the recent surge in Chinese stocks were Shanghai Composite defense stocks. They are rising sharply as tensions escalate between the United States and China in the South China Sea. Over the last few days, two U.S. Navy aircraft carriers arrived in the region for the first time in over six years. This is not just a display of military might from Washington. It’s a serious attempt at pushing back against China’s territorial claims in much of the contested region. China also conducted navy drills, drawing criticism from the Pentagon and various South China Sea neighboring states. The increased geopolitical risk, along with worldwide central bank stimulus, have kept sovereign bond yields low. The U.S. 10-year yield is holding at 0.67% at the time of writing, well off the June top of 0.959%.The Case for crypto

Covid-19 uncertainty, Chinese financial strength, and the geopolitical risk are shifting the global balance of power to the Pacific. And trillions of investment dollars with it. The European Union and America are facing a severe scenario that will likely continue along the path of money printing and larger debt buildups. This will deepen the depreciation of their currencies. We see this unfolding right now with the Lebanese pound, which recently fell below one Satoshi. Chinese investors remember what happened the last time their government led them to a stock market bubble. They will likely be savvier this time and look to ride the bull and protect their gains before the party is over. Only time will tell, but in both cases, cryptocurrency’s use case as a decentralized money, far from the reach of central banks and governments, remains strong. Bitcoin and other major cryptocurrencies, like those projects involved with staking and decentralized finance, are well-positioned to receive a big chunk of the wealth that’s been printed in the West and traded in the East.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Tony Toro

Tony has worked for several financial companies in London during the last seven years, gaining experience in traditional finances and trading. Passionate about direct democracy, digital rights and privacy, he has been involved with cryptocurrency since 2013.

Tony has worked for several financial companies in London during the last seven years, gaining experience in traditional finances and trading. Passionate about direct democracy, digital rights and privacy, he has been involved with cryptocurrency since 2013.

READ FULL BIO

Sponsored

Sponsored