A large number of Bitcoin futures options contracts are due for expiry today, but will they have a significant impact on the markets?

Derivatives traders have switched back to Bitcoin options following a month or so, favoring Ethereum contracts. As a result, 29,000 BTC options are about to expire this week.

SponsoredBitcoin Options Expiring

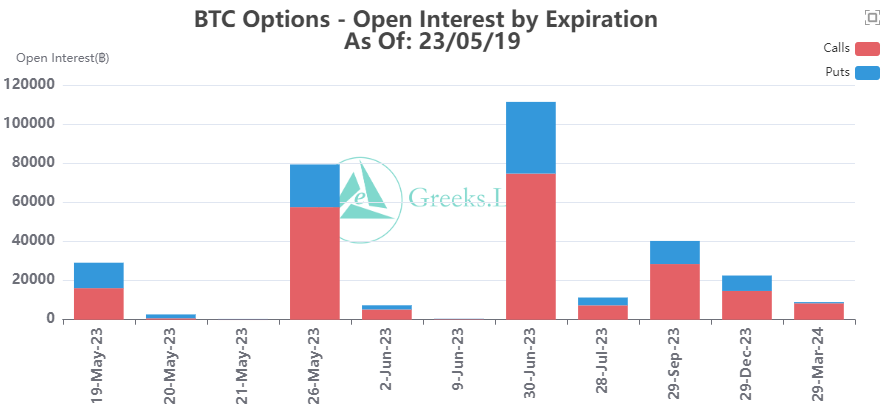

These contracts have a notional value of $780 million and a max pain point of $27,500, as reported by GreeksLive on May 19.

Bitcoin options are derivatives contracts that allow traders to speculate on the price of BTC without holding the asset.

Furthermore, they allow derivatives traders to buy or sell Bitcoin contracts at a specific price, the strike price, at a certain date of expiry. Additionally, they are more flexible than futures which have fixed expiry dates.

The max pain value is the price with the most open contracts. It is also the price at which the most losses will be made upon contract expiry.

Moreover, the put/call ratio for this batch of Bitcoin options is 0.81.

The put/call ratio is calculated by dividing the number of traded put (short) contracts by the number of call (long) contracts. A value below 1 is considered bullish, as more traders are buying long contracts than shorts.

Furthermore, Deribit is reporting a total open interest of 308,044. This refers to the total number of open contracts that have yet to expire.

There are also around 169,000 Ethereum options about to expire. These have a notional value of $310 million and a max pain point of $1,800. The put/call ratio for ETH contracts is 0.96, which is more neutral than the BTC ratio.

GreeksLive commented on the overall outlook:

“Overall total positions data were relatively stable, but the proportion of put positions began to increase, and bearish traders are gradually gaining ground after a sustained sideways move.”

BTC Price Outlook

Bitcoin prices have retreated 2% on the day, falling to $26,800 at the time of writing. The asset has been consolidating for the past couple of weeks since a fall from its 2023 high of $31,000.

Ethereum was holding around the $1,800 level at the time of writing.

Markets are still sideways, with support holding at current levels. However, if support is lost, BTC could fall to $24,000, as some on-chain analysts have predicted.