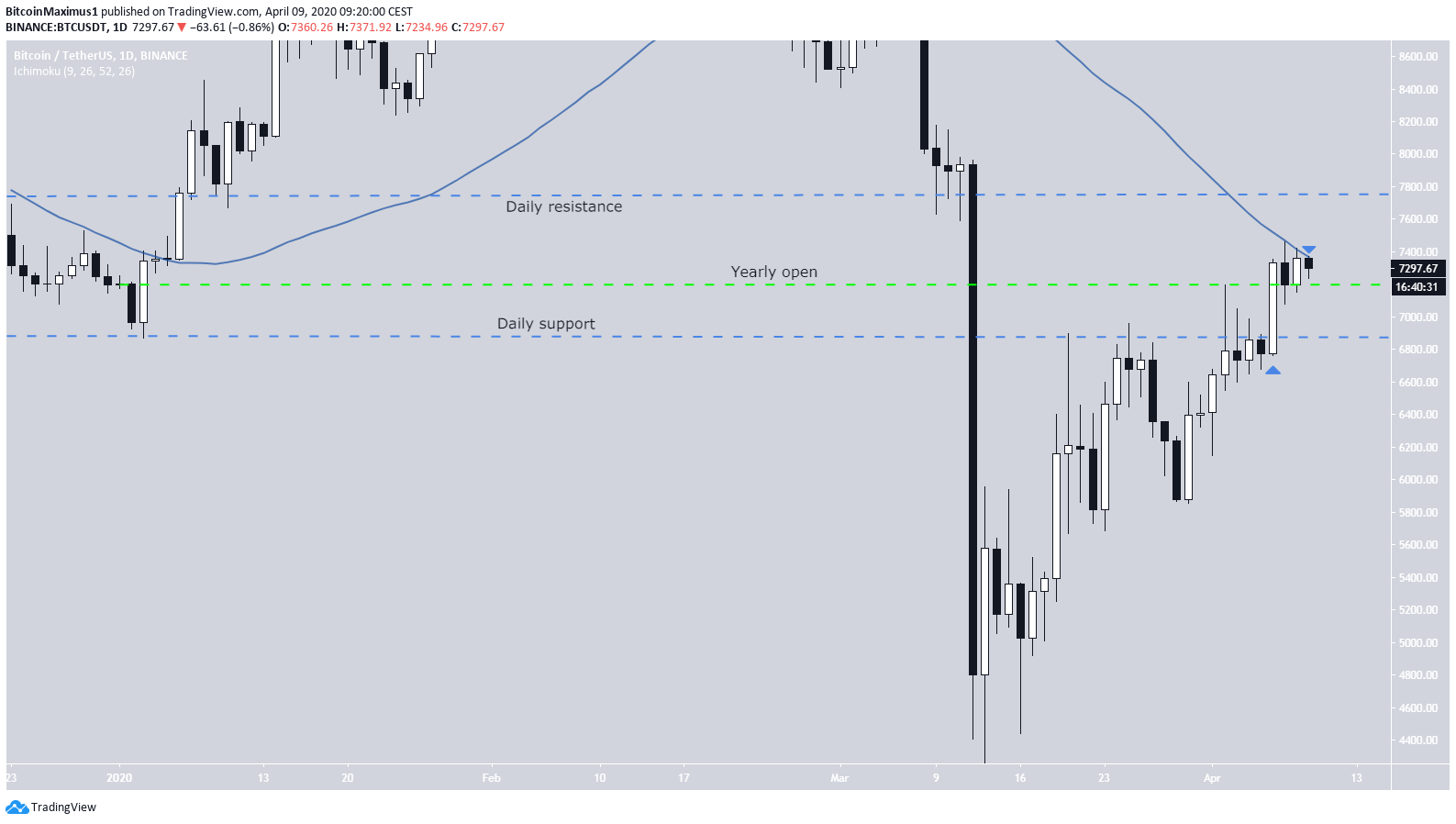

On April 6, the Bitcoin price created a bullish engulfing candlestick and moved above several important resistance levels, including the yearly open. The rally has stalled, however, since reaching the 50-day moving average (MA).

Bitcoin Daily Levels

The BTC price has increased significantly since reaching a low on March 13, creating at least four higher-lows. This is a sign indicating that the price is in a bullish trend. Looking at the daily chart, we can see that BTC created a bullish engulfing candlestick on April 6 and moved above the main resistance level at $6,850. The increase has been continuing and the price has also moved above the yearly open. However, the rally stopped once the price reached the 50-day MA, which it has yet to flip as support. If it is successful in doing so, the next resistance level up is found at $7,750.

Short-Term Perspective

In the short-term, the price is following an ascending support line and has been doing so since March 30. However, it also seems to have created a short-term symmetrical triangle, which is considered a neutral pattern. Since it is occurring while the price is in an upward trend, a breakout from this pattern is expected. Even if the price breaks down, it would be very likely if it found support at $7,100, a confluence of both a significant support level and the ascending support line. Therefore, a breakdown from the short-term triangle would not necessarily mean that the upward trend has ended.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored