Is XRP overvalued? This is one question that the broader market has asked since the altcoin began its explosive in November.

While some have hoped that the XRP price rally will subside, a significant correction has not happened. But, according to this on-chain analysis, the token might soon be overpriced when compared to the overall market condition.

The Ripple Token Faces Huge Risk

About one month ago, XRP’s price broke the $1 mark for the first time in a long while. Some market observers believed it to be a fakeout. However, that sentiment turned out to be false, as it now trades at $2.36.

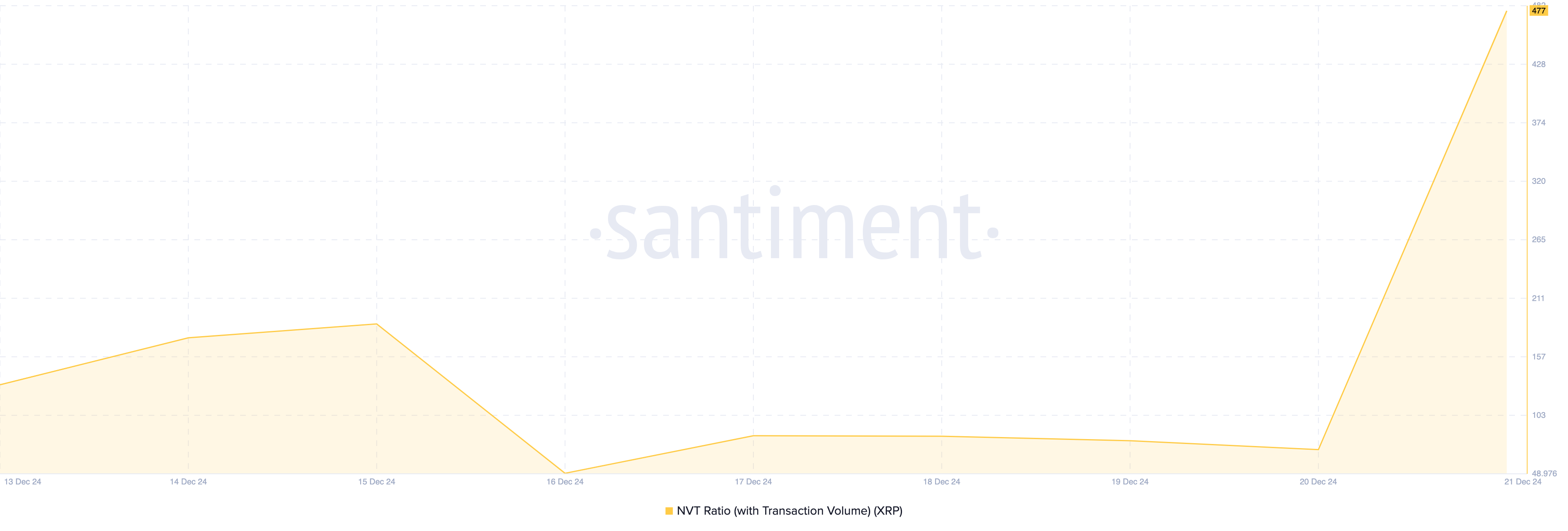

Despite several predictions coming out that the token’s value might rally toward the $5 mark, some on-chain indicators suggest that it could be challenging. One indicator that aligns with the thesis is the Network Value to Transaction (NVT) ratio.

The NVT ratio measures the growth of an asset’s market cap relative to the transaction growth. When the ratio drops, it means that transactions on the network are growing faster than the market cap, which is bullish and indicates that the price is undervalued.

On the other hand, a spike in the NVT ratio suggests that the market cap is growing at a faster pace which draws it to a more overvalued area. According to Santiment (as shown above), XRP’s NVT ratio has jumped to a high reading of 477.

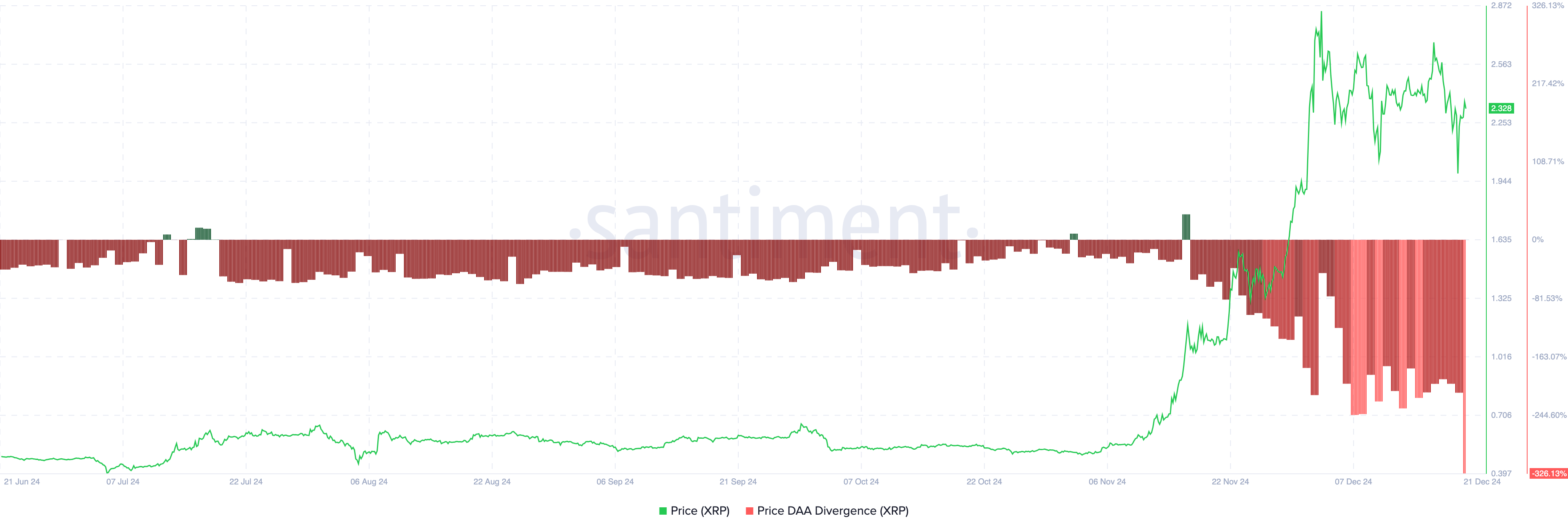

Another indicator with such sentiment is the price- Daily Active Addresses (DAA) divergence. The price DAA measures the level of price growth compared to user engagement. When the metric increases, it means that user engagement is backing the price action, which is bullish.

However, as of this writing, the price of DAA divergence has dropped by 326.13%, suggesting that the number of XRP wallets interacting with the token has decreased. If this trend continues, then the XRP price might slide lower than $2.

XRP Price Prediction: Momentum Stays Bearish

On the 4-hour chart, the XRP price attempted to hit $2.40. However, the altcoin faced resistance at $2.35, which has pulled the price back to $2.31. A look at the Moving Average Convergence Divergence (MACD) shows that the 12- and 26-period Exponential Moving Averages are down to the negative region.

This drop indicates bearish momentum around the token. Should the momentum continue to decline, then the XRP price might fall to $2.05.

So, is XRP overvalued? This analysis suggests it could be. In a strongly bearish scenario, the token might drop to $1.90. Conversely, increased buying pressure could drive XRP up to $2.73.