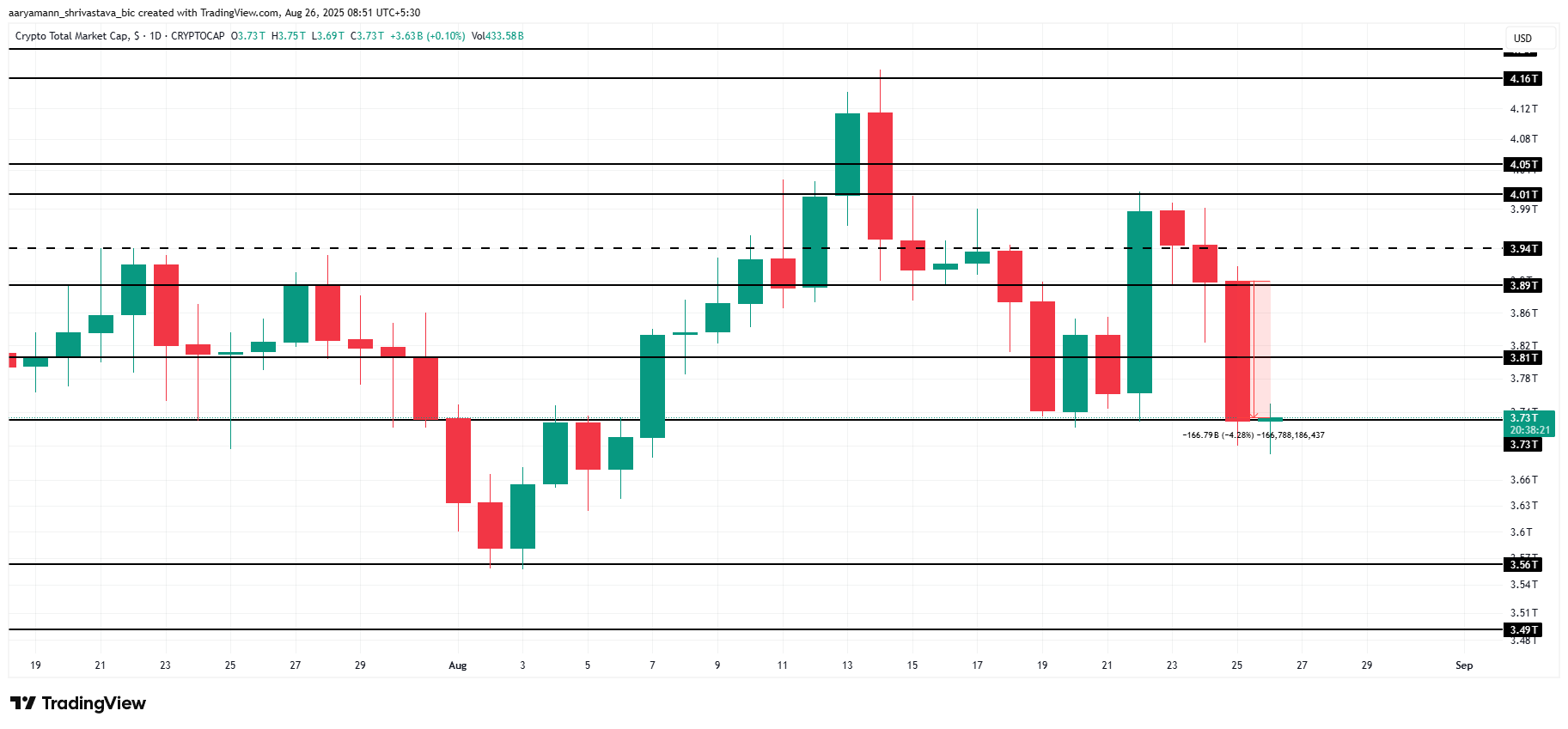

The total crypto market cap (TOTAL) faced the brunt of bearish investors as over $166 billion was erased from the market. Bitcoin (BTC) led the decline as it fell below the $110,000 support, marking a month and a half low. Fartcoin (FARTCOIN) led the altcoins’ drop with a 17% decline, which led to a 4-month low.

In the news today:-

- B Strategy plans to launch a U.S.-listed company as a $1 billion corporate BNB treasury and investment vehicle, backed by YZi Labs. Unlike yield-focused treasuries, it will fund core tech development, grants, and community initiatives to strengthen the BNB ecosystem.

- Sharps Technology stock surged 96% Monday after unveiling a $400 million plan to build a Solana-based digital asset treasury. The rally was fueled by a $50 million SOL token deal with the Solana Foundation via a PIPE transaction.

The Crypto Market Records Losses

The total crypto market cap dropped $166 billion in 24 hours, triggering $818 million in long liquidations and shaking investor sentiment. TOTAL now sits at $3.73 trillion, a critical level that signals heightened volatility.

Despite the recent downturn, TOTAL remains above the $3.73 trillion support zone, giving bulls a chance to regain control. The market could push toward $3.81 trillion if low prices attract fresh capital. A rebound would suggest that investors still see strong value in major cryptocurrencies at current levels.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If bearish momentum persists, TOTAL may slide to $3.56 trillion, intensifying losses and eroding confidence across the market. A breakdown below this threshold could extend declines, forcing investors to reevaluate risk exposure.

Bitcoin Falls Below Major Support

Bitcoin price fell 3.2% in the last 24 hours, slipping below $110,000 for the first time in a month. The crypto king now trades at $109,826, reflecting increased selling pressure.

BTC is approaching the $108,000 support level, a historically strong bounce point that has previously halted declines. The support zone could stabilize current prices if buyers step in with renewed confidence.

If conditions improve, Bitcoin could reclaim $110,000 as a vital support level, paving the way for further gains. Such recovery would boost investor confidence, opening a path toward $112,500.

Fartcoin Marks a 4-Month Low

FARTCOIN price dropped 17% in the past 24 hours, falling to $0.78. This marks a four-month low for the altcoin after losing the $0.80 support level. The decline reflects strong selling pressure, pushing the cryptocurrency below a key threshold that had previously maintained stability for several consecutive trading sessions.

FARTCOIN is approaching the $0.73 support level, which previously served as a rebound point in April. A move higher from this zone could enable the altcoin to reclaim $0.80 as support. Price recovery beyond this threshold may create conditions for a short-term rally, with $0.87 emerging as the next resistance.

If FARTCOIN fails to hold $0.73, the altcoin could extend its decline to $0.67, setting a new multi-month low. The drop would increase investor losses and confirm continued downward pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.