The Ethereum (ETH) price has fallen considerably since Sept. 11 but it has reached a confluence of support levels which could initiate a rebound.

After numerous delays, the Ethereum merge finally went live on Sept. 15, transforming the network to a proof-of-stake consensus. Now, previous Ethereum miners have flocked to Ethereum Classic, greatly increasing its hash rate in the process.

Additionally, it massively reduced the electricity consumption of Ethereum, in turn making it a sustainable cryptocurrency. This is expected to have long-term positive effects on the price for several reasons, one of them being that it is now more acceptable for eco-friendly investors.

However, the ETH price has been falling since the merge and has actually underperformed Bitcoin (BTC). Below, we will look at several reasons why this might have occurred.

A potential bottom

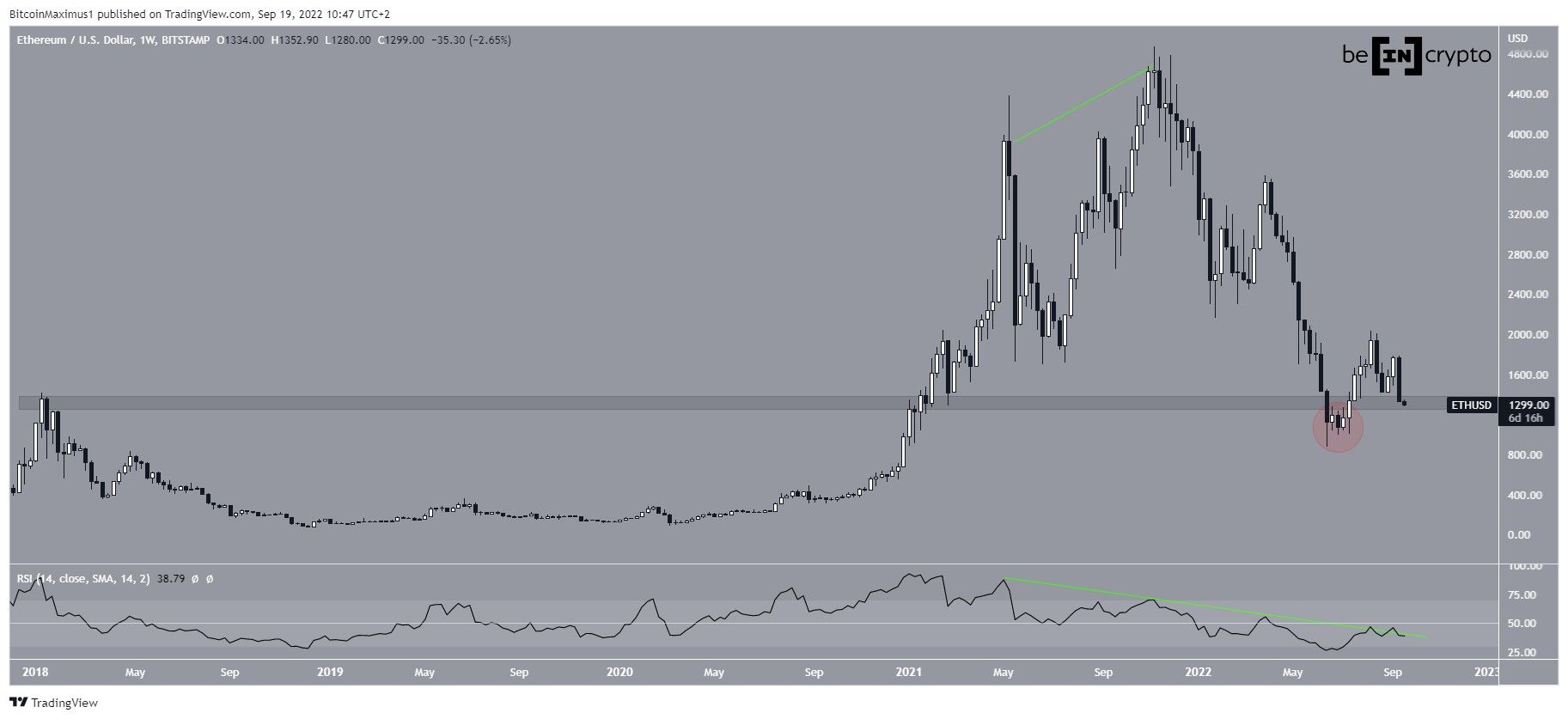

ETH has been falling since reaching an all-time high price of $4,868 in November 2021. The downward trend has led to a long-term low of $880 in June 2022. This seemingly caused a breakdown from the $1,300 horizontal support area (red circle).

However, the price rebounded shortly after and reclaimed the $1,300 area in the process. It could now potentially validate it as support.

Despite this, the bullish reversal is not yet confirmed. The reason for this is that the RSI has not yet broken out from its bearish divergence trendline (green line). Until that occurs and then the indicator moves above 50, the long-term trend cannot be considered bullish.

The daily chart supports the possibility that ETH will rebound soon. There is a multitude of support confluences between $1,180 and $1,300.

This support range is created by:

- $1,250 horizontal support level

- Support line of a descending parallel channel

- Ascending support line (white)

- 1:1 length of waves A and C

Therefore, it is very likely that the price will bounce once it reaches this level. A potential breakdown from the zone would instead suggest that a new yearly low will be reached.

ETH/BTC retraces

ETH/BTC has also been falling since Sept. 7. At the time, it had just completed a five-wave upward move.

Since then, it is likely correcting inside an A-B-C corrective structure. Currently, ETH has bounced at the 0.5 Fib retracement support level at ₿0.067, possibly indicating that wave A is complete.

Therefore, it is possible that the b wave will move back towards ₿0.08 prior to another drop that would complete the entire correction.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.